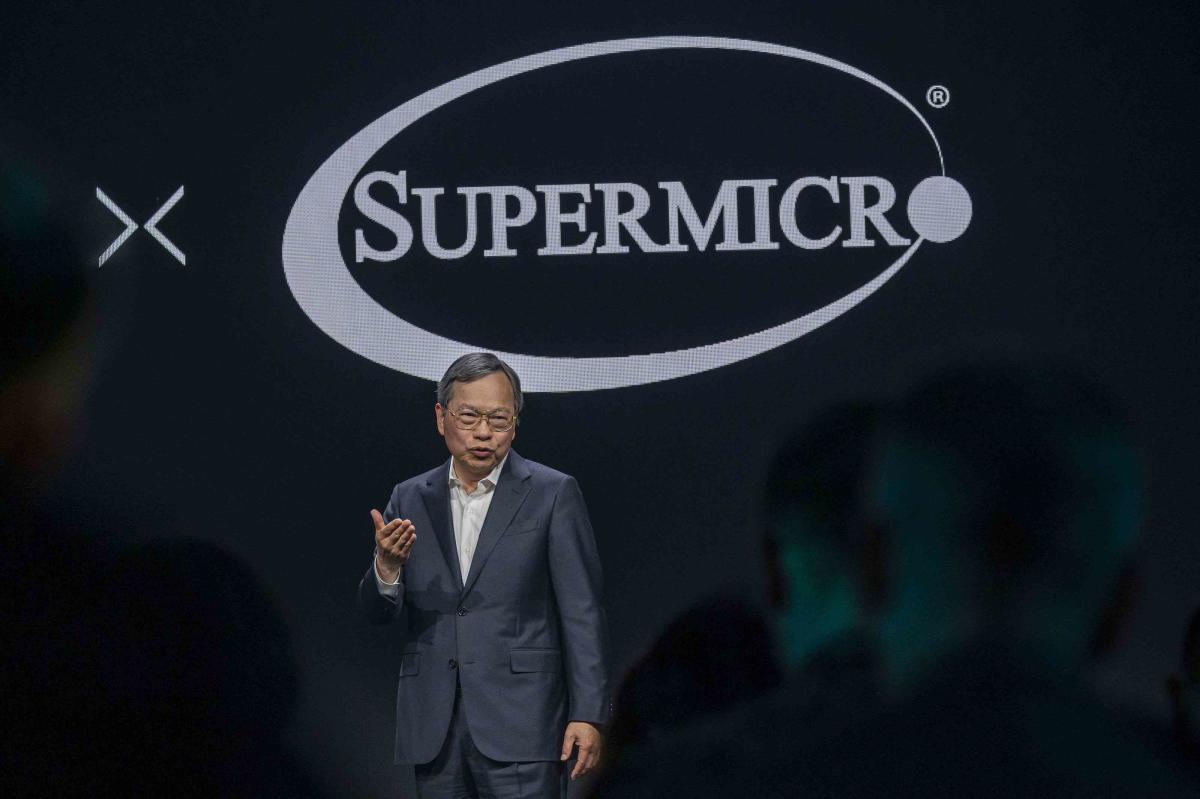

David Paul Morris/Bloomberg via Getty Images

Charles Liang, CEO of Super Micro Computer.

Key Points

-

Hindenburg Research accused Super Micro Computer of “accounting manipulation” in a report published Tuesday.

-

The well-known short-selling firm alleged, among other things, that Super Micro engaged in undisclosed related-party transactions and failed to comply with export controls.

-

Super Micro Computer makes server technology and hardware for data centers, making it a big winner in the AI boom.

Supermicrocomputer (SMCI) shares fell on Tuesday after short seller Hindenburg Research announced a short position in the artificial intelligence (AI) technology company.

The Hindenburg report accused Super Micro Computer of “accounting manipulation, collusion and sanctions evasion.” The shares, which fell sharply in premarket trading, recently fell nearly 3%.

The report, whose claims Investopedia has not independently verified, describes a three-month investigation by Hindenburg into Super Micro, which included interviews with former senior employees. It alleges major accounting deficiencies, including undisclosed related-party transactions and failure to comply with export controls. The company did not immediately respond to a request for comment.

Nvidia Partner Gains AI Boom

Super Micro Computer, which makes server technology and hardware used in data centers, has benefited greatly from the AI boom. As Nvidia (NVDA) partner Super Micro has shared some of the profits the AI darling of the market has made, and its hardware can be found in a number of Nvidia’s data center technologies, including that of Elon Musk’s AI company, xAI.

Shares of Super Micro have nearly doubled in 2024, though the price has fallen more than 50% from its March peak. The company reported fiscal fourth-quarter earnings earlier this month that missed analysts’ estimates and announced a 10-for-1 stock split.

Read the original article on Investopedia.