Super microcomputer (NASDAQ: SMCI) Shares have been crushed today following a report that the company is under investigation by the Department of Justice (DoJ). The server specialist’s share price ended the day’s trading down 12.2%, having fallen as much as 18.6% earlier in the session.

The Wall Street Journal reported today that the DoJ is in the early stages of conducting an investigation into Supermicro. According to the report, the investigation is likely related to allegations of poor accounting practices made in a short-seller note published by Hindenburg Research in late August.

After today’s big sell-off, shares of Supermicro are now down 66% from the high they reached earlier this year. Despite the drop in valuation, the company is still on track to proceed with a 10-for-1 stock split, effective October 1.

Is Supermicro a buy ahead of the stock split?

Supermicro has faced intense bearish pressure lately, but it’s possible the negative sentiment surrounding the stock has become overblown. For starters, the DoJ has yet to announce any official investigation into the company. Even if an investigation were to take place, it would not necessarily mean that anything inappropriate actually took place.

The Justice Department has generally increased its scrutiny of big tech and financial companies recently, after filing antitrust lawsuits against companies including Apple, AlphabetAnd Visa. Supermicro is unlikely to face antitrust scrutiny, but the DoJ’s recent flurry of activity provides background context worth keeping in mind.

If a DoJ investigation into Supermicro is underway, Hindenburg’s claims that it had found evidence of new accounting violations by the tech company could have been a major catalyzing factor. But it’s important to keep in mind that Hindenburg is a short seller, and it benefits when the valuations of companies it has listed go downhill.

The lack of visibility on the company’s prospects means Super Micro Computer stock is not suitable for investors without an above-average risk tolerance. On the other hand, investors willing to embrace risk and uncertainty could ultimately earn big returns by viewing the recent sell-off as a buying opportunity.

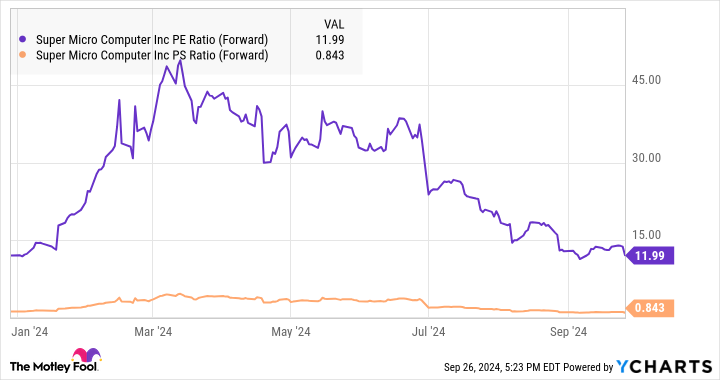

After today’s share price drop, Supermicro now trades at just 12 times this year’s expected earnings and less than 85% of expected revenue. Even with expectations that the company will see cyclical moderation, that’s a cheap-looking valuation for a company that has delivered stellar sales and earnings growth thanks to artificial intelligence (AI)-driven demand. If the technology specialist scores gains with liquid cooling technologies that help differentiate its high-performance rack servers, Supermicro stock could weather the recent controversies and come back.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy shares in Super Micro Computer, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Apple and Visa. The Motley Fool has a disclosure policy.

Supermicrocomputer Plummeted Today — Should You Buy AI Stock Before the Stock Split on October 1? was originally published by The Motley Fool