The stock market is off to a red-hot start this year. The technology heavy Nasdaq Composite is up 11% so far in 2024, fueled by artificial intelligence (AI) hype. Moreover, the S&P500 is also up almost 11%, indicating an overall strong profile among broader market sectors.

The energy sector in particular has performed well so far this year Berkshire Hathaway CEO Warren Buffett has taken note. According to Berkshire’s latest 13F filing, Buffett only added to one existing position in the first quarter of 2024.

The Oracle of Omaha has acquired 4.3 million shares of the oil and gas conglomerate Western petroleum (NYSE:OXY). Should you follow Buffett’s example? Let’s find out.

A breakdown of Occidental Petroleum

The energy sector consists of many different types of companies. From nuclear energy, refining and pipelines, there are countless companies contributing to the overall energy landscape.

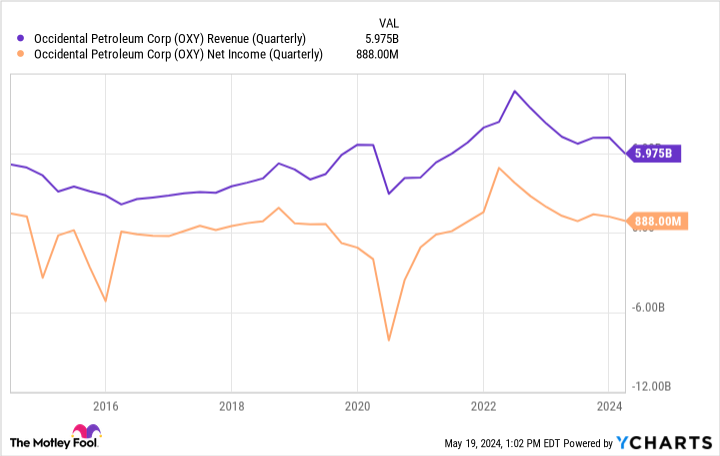

Occidental Petroleum operates primarily as an oil and natural gas exploration company. The chart below illustrates some key operating metrics for the company and provides a glimpse into its long-term performance.

The above financial trends illustrate the ebbs and flows in Occidental’s business. This is not entirely surprising. Oil and gas are commodities and can be subject to dramatic price volatility. For this reason, operating results can change significantly.

As shown in the chart above, Occidental Petroleum reported revenues of $5.9 billion in the first quarter of 2024. This represented a decline of 19% year over year. Moreover, net profit also fell from $1.3 billion in the first quarter of 2023 to $888 million this year.

Given the noticeable volatility in Occidental’s business, coupled with declining revenue and profitability, why would Buffett buy shares?

A new growth opportunity presents itself

Within the energy world, one of the most prominent emerging growth opportunities revolves around renewable and sustainable energy programs. While Occidental Petroleum is primarily in oil and gas, the company is pursuing a new opportunity: carbon management. Specifically, the company focuses on a carbon dioxide removal process called direct air capture.

During the company’s first-quarter earnings call, investors learned that Occidental’s first direct air capture plant is on track to become operational by the middle of next year. While this may sound like great news at first glance, keep in mind that these investments come with a heavy price tag. Occidental plans to spend up to $6.6 billion on capital expenditures (capex) in 2024, with nearly $600 million allocated to low-carbon businesses.

Still, diversification beyond traditional oil and gas exploration products should help pave the way for a new frontier at Occidental Petroleum. In addition, management expects the low-carbon business activities to “generate cash flow separate from oil and gas, price volatility, and further strengthen Oxy’s cash flow resilience.”

Should you buy Occidental Petroleum stock?

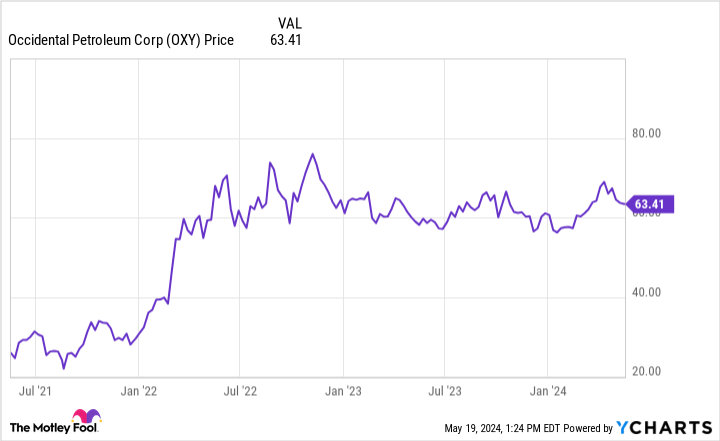

The chart below illustrates the movement of Occidental’s stock prices over the past three years. You may notice that shares soared in early 2022. This momentum happened after it was revealed that Buffett had a position in the company.

After the brief price surge, Occidental’s stock has actually remained somewhat subdued in recent years. There have indeed been some short-lived peaks and valleys, but overall the stock hasn’t moved too dramatically one way or another.

Occidental’s stock currently trades at a price-to-earnings (P/E) ratio of 16.7. By comparison, the S&P 500’s forward price-to-earnings ratio is 20.8.

The cyclical nature of the oil and gas industry can impact a company’s performance on both a quarterly and annual basis. The inconsistency of operating trends can certainly impact stock prices and in some ways this can make valuation multiples difficult to decipher as they can change relatively quickly.

That said, Occidental is currently trading at a discount to the broader market. While this isn’t necessarily an opportunity to buy the dip, I think investors with a long-term horizon might want to consider following Buffett’s lead.

Despite some volatility in its financial profile, Occidental remains highly profitable and free cash flow is positive. Furthermore, the company aggressively reinvests these excess profits back into the business to enter new, innovative markets. I think these characteristics are what Buffett cares about as they relate to his investment in Occident Petroleum.

I am optimistic that the company will strengthen its existing businesses through its low-carbon exploration activities and enter a new phase of growth that it can sustain in the long term.

Should You Invest $1,000 in Occidental Petroleum Now?

Consider the following before purchasing shares in Occidental Petroleum:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $581,764!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

The energy sector is off to a thrilling start in 2024. This stock is the only existing position that Warren Buffett contributed to during the first quarter. was originally published by The Motley Fool