(Bloomberg) — The Federal Reserve’s frontline inflation gauge is poised to show some modest relief from persistent price pressures, confirming central bankers’ caution about the timing of rate cuts.

Most read from Bloomberg

Economists expect the price index of personal consumption expenditure minus food and energy – expected on Friday – to rise by 0.2% in April. That would mark the smallest progress so far this year on the measure, which provides a better snapshot of underlying inflation.

The overall PCE price index is likely to have risen 0.3% for a third month, according to the average projection in a Bloomberg survey. The increases this year are in stark contrast to relatively flat numbers in the final three months of 2023, underscoring the Fed’s uneven progress in its fight against inflation.

Fed Chairman Jerome Powell and his colleagues have stressed the need for more evidence that inflation is on a sustainable path to its 2% target before cutting rates, which have been at a 20-year high since July.

The PCE price measure is expected to rise 2.7% year-on-year, while the core measure is expected to reach 2.8% – both matching the previous month’s level.

Officials coalesced earlier this month around a desire to keep interest rates high for longer and “many” questioned whether the policy was restrictive enough to bring inflation back to their target, according to minutes of their latest meeting.

Read more: Minutes show officials back higher and longer rates

The latest inflation figures will be accompanied by personal spending and income figures. While demand grew at a solid pace in the first quarter, the data will provide information on spending on services, following previously reported flat retail sales in April.

What Bloomberg Economics says:

“The report is likely to provide some encouraging signals that the disinflation process has not yet come to a complete halt. With income growth slowing in a cooling labor market, consumers are gradually starting to crunch, which should provide continued disinflationary momentum for the rest of the year. But with catch-up price pressures on the horizon, inflation is likely to decline only very gradually this year.”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For a full analysis, click here

Other data for the week includes Thursday’s revised first-quarter gross domestic product. Economists predict that growth is likely to cool from the government’s initial estimate. The Fed will release its Beige Book summary of economic conditions across the country on Wednesday.

Among the U.S. central bankers who spoke during the shortened holiday week are John Williams, Lisa Cook, Neel Kashkari and Lorie Logan.

Looking north, Canada will release first-quarter gross domestic product data. Declining monthly momentum in March and weak domestic demand would likely keep the central bank in play for a rate cut in June.

Elsewhere, a likely recovery in eurozone inflation, Chinese industrial data and PMI figures, and price reports from Brazil will be among the highlights.

Click here for what happened last week and below is our summary of what will happen in the global economy.

Asia

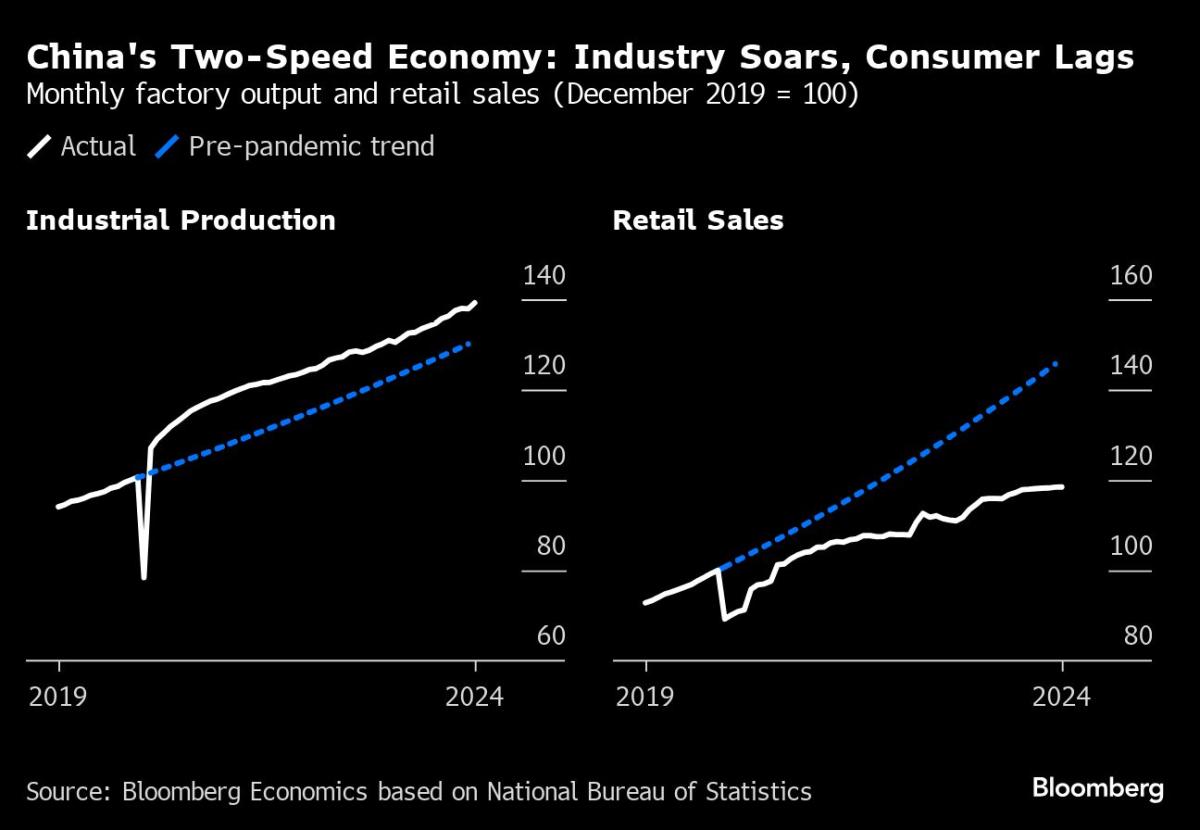

China’s manufacturing sector will be in the spotlight this coming week. Industrial data will show on Monday whether profits rebound in April, after a sharp decline in March dragged the first three-month profit pace to 4.3%.

Persistent producer price deflation and weak domestic demand could keep profitability under pressure. China will get its official manufacturing PMI data on Friday, with a focus on whether the indicator remains above the 50 threshold that separates contraction from expansion for a third month in May.

Also on Friday, Japan’s industrial output growth is seen to be slowing, while retail sales are pushing ahead in April.

Consumer inflation in Tokyo could pick up somewhat in May, portending gains for the national data.

Australian consumer price growth is expected to slow to 3.3%, still high enough to earn the Reserve Bank of Australia’s nod.

Vietnam also reports CPI data along with industrial production, retail sales and trade during the week.

In terms of central banking, Kazakhstan will set its policy rate on Friday.

Europe, Middle East, Africa

In the eurozone, inflation is likely to have accelerated to 2.5% in May, according to economists’ forecasts. An underlying indicator is expected not to weaken for the first time since July, at 2.7%.

In line with broader eurozone data, national releases starting Wednesday with Germany’s are expected to have moved in the wrong direction in three of the region’s four largest economies. Only Italy has slower price growth.

Such outcomes hamper progress towards the ECB’s 2% target, but officials’ consistent signals for a quarter-point rate cut on June 6 make it unlikely that one month of data will derail them. Still, some policymakers are arguing against any rush to ease further.

“It is increasingly likely that we will see the first rate cut in 13 days,” Bundesbank President Joachim Nagel, a policy hawk, said in an interview on Friday. “If there is a rate cut in June, we have to wait, and I think we have to wait until maybe September.”

Other eurozone reports include Germany’s Ifo business confidence index on Monday, the ECB survey of inflation expectations on Tuesday, and economic confidence on Thursday.

ECB officials scheduled to speak in the coming week include chief economist Philip Lane and the Dutch, French and Italian governors. A blackout period ahead of decision-making begins on Thursday.

The Bank of England has already gone silent and canceled all speeches and public statements by policymakers during the campaign before the UK general election on July 4.

Among other European central banks, a financial stability report from Sweden’s Riksbank on Wednesday and a speech in Seoul by Thomas Jordan, president of the Swiss National Bank, will be among the highlights.

Several monetary decisions are planned in the wider region:

-

Israel’s central bank is expected to keep its key interest rate steady at 4.5% on Monday, largely to contain war-related inflation pressures and provide support for the shekel. Governor Amir Yaron is wary of easing monetary policy and further widening the gap between borrowing costs in Israel and the US.

-

Ghana’s monetary authority will leave the key interest rate at 29% on Monday to overcome persistent inflation and support the floundering currency.

-

On Wednesday, Mozambique’s policymakers are poised to cut borrowing costs, with consumer price growth expected to remain in the single digits for the rest of the year.

-

And on Thursday – a day after elections in which the ruling African National Congress risks losing its majority – South African monetary officials are forecast to keep their policy rate at 8.25%, with inflation yet to return to midpoint of 4.5% of their target range.

Latin America

Brazil will report the mid-month consumer price index reading next week, along with the May reading of the broadest inflation measure.

The combination of Brazil’s tight labor market and a weaker currency are likely to limit the scope for further disinflation from current levels, with inflation already close to year-end consensus expectations.

The IPCA-15 price index fell below 4% last month, after jumping more than 5% in September – which came just two months after reaching 3.19%, below the central bank’s 2023 target .

Also in Brazil, the central bank will release its weekly survey of economists on Monday, whose inflation expectations and interest rate forecasts are rising again, along with national unemployment, total loans outstanding and budget balances.

Chile reports six separate indicators for April, with highlights being unemployment, retail sales, industrial production and copper production.

Mexico’s light program will be dominated by the central bank’s release of its quarterly inflation report, followed by a news conference led by Governor Victoria Rodriguez.

Banxico earlier this month raised its inflation forecasts for the third quarter of 2025, while Wednesday’s report will reveal the bank’s revised GDP forecasts.

Mexican labor market data for April will be released on Thursday. Early consensus calls for the unemployment rate to rise from a record low of 2.28% in March.

–With help from Robert Jameson, Piotr Skolimowski, Monique Vanek and Laura Dhillon Kane.

Most read from Bloomberg Businessweek

©2024 BloombergLP