“Let the good times roll” is probably something Nio (NYSE: NIO) investors are now telling themselves after shares rose 65% in the past month. The Chinese electric vehicle (EV) manufacturer has a lot to offer: it has just started deliveries of its Onvo L60; it received a cash injection from strategic investors; and now it just announced strong September deliveries and a quarterly record.

Strong deliveries

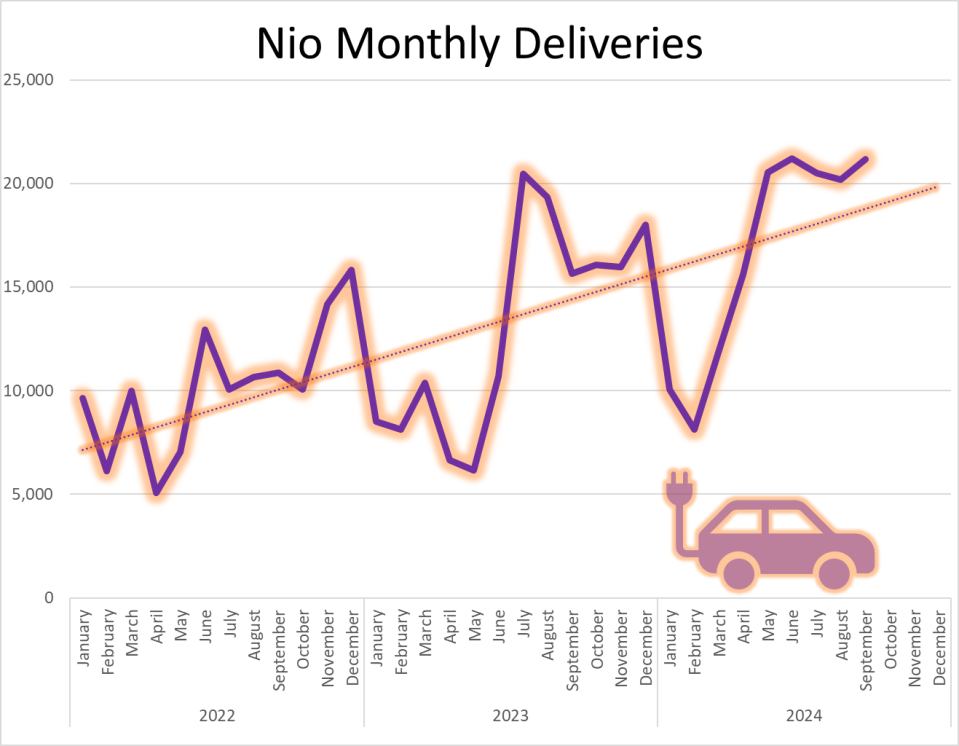

Nio has quietly tallied five straight months of shipments above 20,000. Nio delivered 21,181 vehicles in September, representing a 35% increase over the previous year’s deliveries. It also included the first-ever deliveries of the company’s lower-priced sub-brand, Onvo. Nio’s newly launched brand totaled 832 deliveries in September. For the third quarter of 2024, Nio delivered 61,855 vehicles, up 11.6% year over year and setting a new quarterly record for the company.

If you look at the chart above, you’ll see a trend of higher deliveries, but it’s also fair to say that Nio has turned a corner with over 20,000 deliveries in the last five months. It’s also true that Nio will likely kick sales into high gear as production of the Onvo L60 increases. Not only will the Onvo L60 increase delivery numbers in the future, but the company isn’t stopping with just one affordable sub-brand. There’s another brand on the way, expected to be unveiled in late 2024 and internally codenamed ‘Firefly’.

While the Chinese EV market is highly competitive, there is also a bigger piece of the pie that we can take a piece of. Recall that China’s EV market share in new passenger car sales exceeded 50% for the first time in July. That’s huge when you consider that the EV market share of new vehicle sales in the US is about 8%. Nio’s premium vehicles have caught on with Chinese consumers, but there’s enough market share that it can attack the lower end of the market with its more affordable Onvo and Firefly brands, and it should kick Nio’s deliveries and stock price into high gear.

Cash infusion

Nio’s strong shipments weren’t the only recent positive development. Nio recently announced a cash infusion from a strategic group of investors. More specifically, Nio China will receive 13.3 billion yuan, or about $1.9 billion, from parent company Nio and its group of investors including Hefei Jianheng New Energy Automobile Investment Fund Partnership, Anhui Provincial Emerging Industry Investment and CS Capital. More specifically, the collection of strategic investors will invest a total of 3.3 billion yuan, or roughly $471 million, in Nio China, while Nio has agreed to funnel 10 billion yuan, or about $1.43 billion, in cash to subscribe to the newly released Nio China. Chinese stocks.

What it all means

Let the good times roll. Nio is getting a cash injection at just the right time as it begins to really push its Onvo brand into the mainstream consumer market and prepares to unveil its next sub-brand: Firefly. Nio clearly has momentum on its side with five straight months of over 20,000 deliveries and record quarterly results. Shares of Nio may be up 65% in the past month, but the momentum should continue as new brands push sales to new records.

Should You Invest $1,000 in Nio Now?

Before you buy shares in Nio, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Good News Keeps Rolling for Nio Investors was originally published by The Motley Fool