Shares like Nvidia have gotten most of the attention over the past 18 months, but nothing goes up forever on Wall Street. Eventually, the stock’s big move is over and it’s time to find the next big winner.

That’s exactly what the three Motley Fool employees set out to do.

Palantir Technologies (NYSE: PLTR), To confirm (NASDAQ: AFRM)And Free Market (NASDAQ: MELI) emerged as top ideas. These companies have attractive growth potential, but are still early enough to make investors a lot of money in the coming years.

Consider buying and holding these three top emerging tech stocks for the next five years.

Palantir’s Excellent Year Continues

Jake Lerch (Palantir Technologies): There is one name that When I think of emerging technology stocks to buy and hold, Palantir Technologies immediately comes to mind.

First of all, Palantir is really firing on all cylinders. Recently, news broke that Palantir is joining the S&P 500. And while I’m personally excited because I predicted Palantir would join the benchmark index, it’s even better for the company, as the announcement sent Palantir’s stock up 14%. Palantir’s stock has now more than doubled this year so far, meaning that when Palantir officially joins the index on September 23, it will likely be the index’s second-best performing stock — behind only Nvidia.

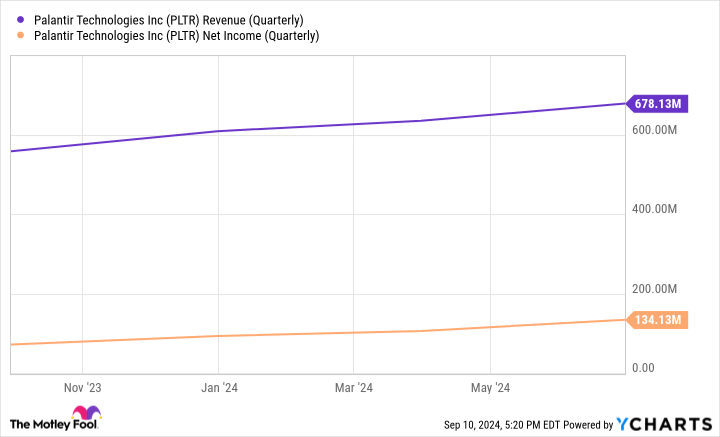

This exceptional stock performance is due to Palantir’s fantastic growth. In its most recent quarter (the three months ending June 30), the company reported $678 million in revenue, up 27% from a year earlier. It also reported $134 million in net income, which represents an 87% improvement year-over-year.

Likewise, Palantir’s customer base and free cash flow are growing. The company has more than 27 deals worth over $10 million as demand for AI platform continues to rise.

In short, a stellar 2024 has led to Palantir’s inclusion in the S&P 500, which could soon make this once-unknown stock a household name. However, there is still time for investors to acquire shares of Palantir. At the time of writing, Palantir’s share price has yet to reach its all-time high of $45, which it reached in 2021.

Given the company’s strong performance, investors may see 2024 as a good time to invest in Palantir stock.

Affirm’s ‘buy now, pay later’ Apple partnership could make shareholders big money

Justin Pope (affirmative): Buy now, pay later company Affirm stands out as a clear long-term winner. The company uses algorithms to lend money, one transaction at a time, and helps borrowers avoid accumulating balances. Affirm is so confident its customers will pay them back that it doesn’t charge late fees.

Such a consumer-friendly business model (the company makes money from interest and trading fees) has built a user base of 18.7 million. Users can shop directly through the Affirm app or use the Affirm Card, which is linked to their bank account and allows shoppers to split purchases into loans with a “buy now, pay later” option.

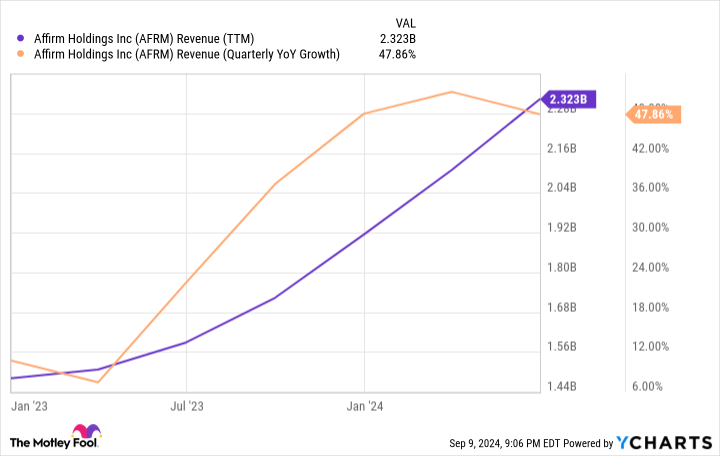

More than 300,000 merchants work with Affirm, including partnerships with major retailers such as Amazon And Shopping. This has helped Affirm accelerate its revenue growth to nearly 50% since the beginning of last year:

Now Affirm is taking it a step further. In June, Apple announced that it would discontinue its buy now, pay later product and instead use Affirm. Affirm will be integrated directly into Apple Pay, giving Affirm exposure to the estimated 153 million iOS users in the United States.

With the Apple deal fueling its already meteoric growth, Affirm should see leaps and bounds over the next five years. The stock is down 77% from its 2021 highs, but it’s hard to predict whether that will last; the company recently posted its first operating profit and should be making strides toward profitability in the coming years.

The strong growth and improving financials could force Wall Street to rethink the stock, making Affirm a rising star with great investment potential.

Those who missed out on Amazon may get a second chance with this stock

Will Healy (Free Market): Many investors missed Amazon’s growing e-commerce opportunity as the company transformed from an online bookseller into a technology conglomerate powered by e-commerce and the cloud.

But as Amazon grew, many investors missed the explosive growth of the e-commerce giant south of the border, MercadoLibre. MercadoLibre’s market stretches from Tijuana to Tierra del Fuego, and like Amazon, it started as an online retailer. But Latin America’s unique business challenges forced it to branch out.

Unlike the US, Latin America is a cash-based society, with hundreds of millions of consumers without bank accounts or credit cards. To solve this problem, it created Mercado Pago to develop digital financial tools that would make online shopping possible. The concept was so successful that MercadoLibre opened it up to customers and businesses that didn’t shop on the e-commerce site.

Also, fulfillment and shipping options are limited in Latin America. So the company created Mercado Envios to fulfill orders and ship products. In the process, it introduced same-day and next-day shipping in areas where it didn’t exist before.

With a market cap of around $100 billion, it’s a fraction of Amazon’s $1.9 trillion. Still, that smaller size facilitates faster growth, so much so that revenue for the first half of 2024 grew 39% annually to $9.4 billion.

In addition, by containing spending growth, the company managed to post a profit of $875 million in the first six months of 2024, an 89% increase in net profit compared to a year ago.

More and more investors have taken notice of the stock, which has seen it rise in value by more than 40% over the past 12 months and is now near record highs.

Despite this success, it is selling at a price-to-earnings ratio of 73. Still, thanks to its massive earnings growth, its PEG ratio is just under 0.9. That metric arguably makes MercadoLibre a fairly priced stock that investors should consider while it still has a relatively small market cap.

Should You Invest $1,000 in Palantir Technologies Now?

Before you buy shares in Palantir Technologies, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $729,857!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon, MercadoLibre, and Nvidia. Justin Pope has positions in Affirm. Will Healy has positions in MercadoLibre, Palantir Technologies, and Shopify. The Motley Fool has positions in and recommends Amazon, Apple, MercadoLibre, Nvidia, Palantir Technologies, and Shopify. The Motley Fool has a disclosure policy.

The Next Big Thing? 3 Emerging Tech Stocks to Buy and Hold for the Next 5 Years was originally published by The Motley Fool