Buy Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) Stocks are rarely a bad idea.

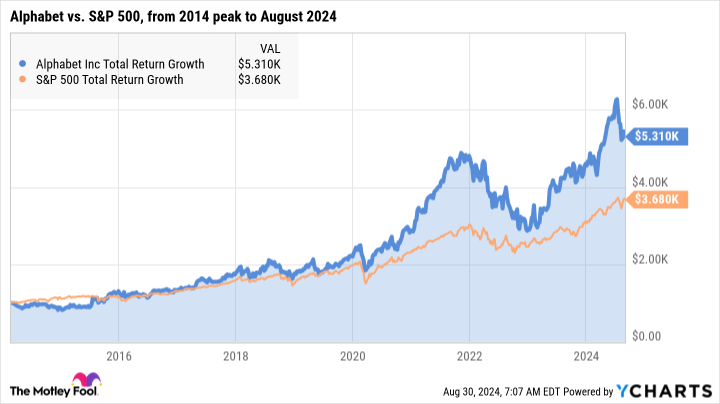

Imagine buying $1,000 worth of Alphabet stock on February 25, 2014. It turned out to be the worst day of the year to buy the tech giant’s stock. The day’s high of $30.50 per share post-split was followed by an 18% decline over the next 10 months. The bear bait mounted as European regulators considered breaking up the company, Android phone sales struggled, top executives left, and new product ideas like Google Glass and Waymo self-driving cars failed to catch on.

That’s fine. If you had stuck with that $1,000 investment through thick and thin, you would have had a market-beating $5,310 in your pocket about 10 years later.

Alphabet shares have fallen before, but have now risen sharply again

Of course, you would have done even better if you had invested in Alphabet on any other day that year, but the company overcame its problems and beat the broader market, even from its worst possible starting point in 2014. I expect future generations will say similar things about buying Alphabet stock in 2024: That investment should continue to beat the market for many years, if not decades, no matter how poorly you time your purchase.

Time to market is better than timing to market, you know. And this business is built to last a very long time.

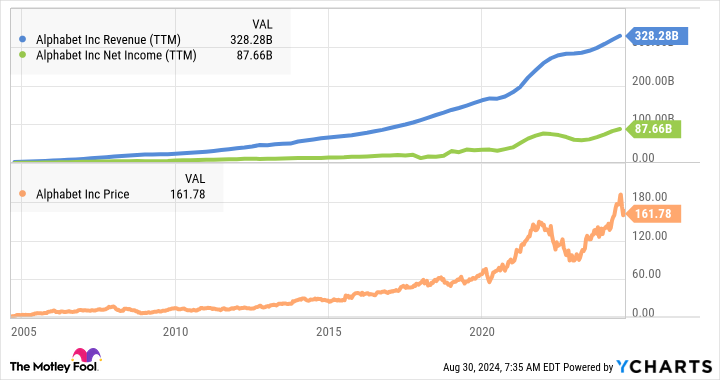

I can’t think of a single company more likely to deliver robust returns into 2040, 2050 and beyond than Alphabet. That horrible price drop in 2014 is barely visible on the chart now. And Alphabet’s bottom line just kept growing:

Alphabet stock is currently a bargain

Wait — it gets better. On top of Alphabet’s tank-like staying power, the stock just so happens to be unusually affordable.

After hitting a new high of $191.40 per share in July, shares of Alphabet have fallen 15% to around $162 per share. As of this writing, they are trading at 23.4 times trailing earnings with a price-to-earnings-growth (PEG) ratio of 1.1. These are the most affordable earnings-based valuation ratios among the “Magnificent Seven” of tech giants.

Additionally, Alphabet has played a leading role in the boom in artificial intelligence (AI). Google Cloud is a popular cloud computing platform where other companies can train and run their own AI platforms. The Google Gemini chatbot directly competes with OpenAI’s ChatGPT in the area of language understanding and generation. The company is poised to make the most of generative AI as a catalyst for long-term growth.

I could go on, but you get the idea. Alphabet stock was a great investment before the recent sell-off, and it’s an even better buy now. Market sell-offs can be your friend if you want to invest in a great company like Alphabet.

Should You Invest $1,000 in Alphabet Now?

Before you buy Alphabet stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The recent tech sell-off made this artificial intelligence (AI) stock an even better buy was originally published by The Motley Fool