With the right insight and timing, an investor could have benefited immensely from the electric vehicle (EV) sector in recent years. For example, if you had invested € 1,000 Tesla (NASDAQ: TSLA) when the shares went public in June 2010, you would have more than $156,000 today. Nowadays many investors are looking for the next Tesla. If that’s your goal, take note of the two companies on this list.

Looking for the next Tesla? Here it is.

While many investors are looking for the next Tesla, it’s fair to mention that it’s still possible to invest in the original Tesla today. The company has a massive market value of $850 billion, but that shouldn’t stop you from jumping in.

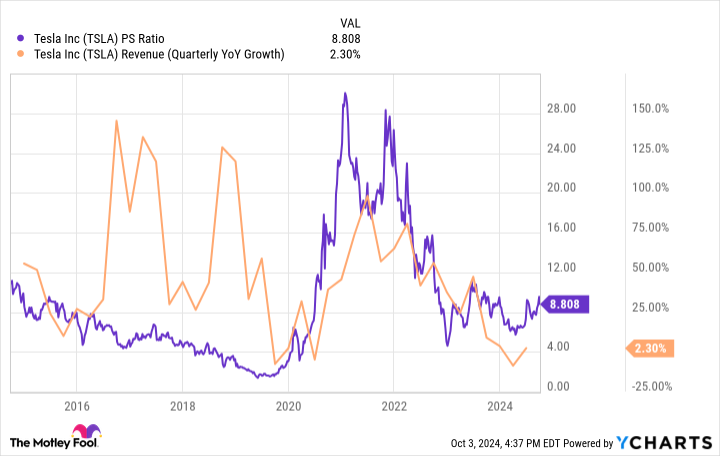

There are two reasons to believe the stock still has plenty of long-term upside potential. First, stocks are cheaper today than they have been in years. This is due to a huge dip in turnover growth. Earlier this year, Tesla actually experienced one reject in company-wide turnover. As a result, Tesla’s price-to-sales ratio has fallen from the mid-20s to below 10. Sure, that’s still expensive, but it’s a bargain relative to the company’s history.

However, a cheap valuation on paper is only attractive if you think the company is about to turn the corner. Please note the schedule below. Tesla has experienced massive declines in sales growth before, with valuation usually following suit. A major reason things turned around was an increase in electric vehicle sales, as well as the introduction of new models like the Model 3 and Model Y – both of which resulted in sales spikes that lasted for several years.

According to Bloomberg, electric vehicle deliveries have remained essentially flat since early 2023, and that’s unlikely to change anytime soon. But luckily Tesla has something else up its sleeve. “Tesla’s robotaxi event next week,” Bloomberg reports, “will see Musk lean even more heavily into the self-driving vehicle, artificial intelligence and robot narrative.”

Do I join Tesla’s robotaxi hype? Not yet. But Musk has dreamed big before. Sometimes he delivers results, and sometimes he doesn’t, but it’s often a smart move to back the horse with a winning track record. And despite the company’s recent missteps, Tesla is still the company to bet on if you’re bullish on EV stocks in general. But if you’re looking for the biggest upside potential, the next stock on this list is for you.

This EV stock has enormous growth potential

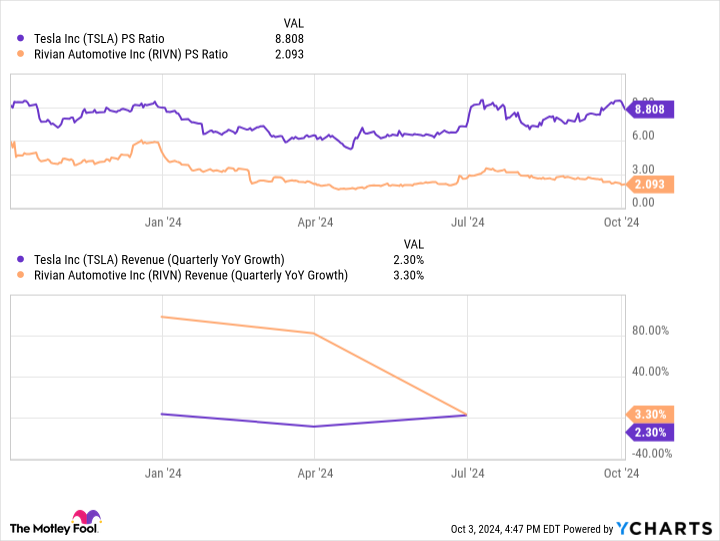

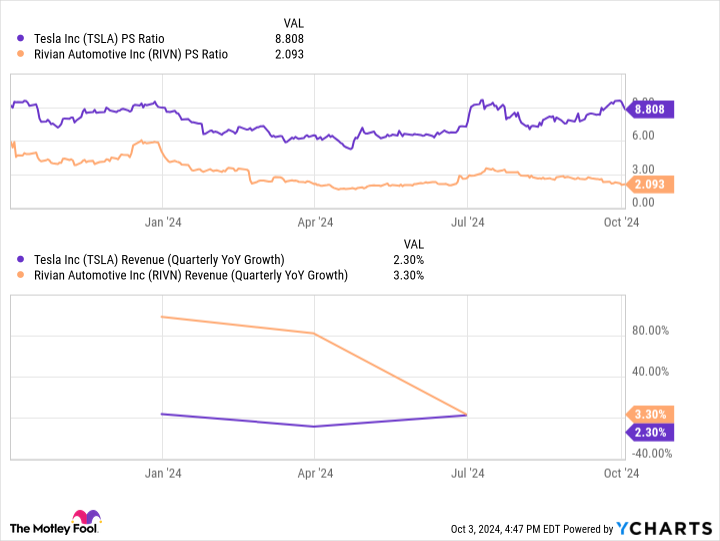

While Tesla is still a great stock to bet on for those bullish on the EV market, the shares are still expensive and the company’s biggest days of growth are likely behind it. Rivian automotive industry (NASDAQ: RIVN) is in the opposite situation. The biggest days of growth are many forward of it, and stocks aren’t as expensive as you might think.

Earlier this year, for example, Rivian posted year-over-year revenue growth rates of more than 80%. These growth numbers came at a time when Tesla’s revenue base was actually shrinking. And while Rivian’s growth rates have recently coincided with Tesla’s, most of that is due to industry pressure and the maturation of its models.

This year, electric vehicle sales forecasts have been repeatedly revised up across the industry, and Rivian’s two existing models, the R1T and R1S, have been on the market for several years. But that’s all about to change.

Earlier this year, Rivian announced three new models: the R2, R3 and R3X. They’re all expected to cost less than $50,000 – the magic price point that EV makers must sell below in order to sell to a mass audience. While electric vehicle sales have generally slowed this year, most long-term forecasts still predict massive growth in the coming years. According to a recent report from Bloomberg, sales of passenger EVs are expected to exceed 30 million by 2027. And this figure should grow further to 73 million per year by 2040.

Rivian’s new models are not expected to hit the market until 2026. That gives plenty of time for market conditions to improve, as most forecasts predict. And in the meantime, investors can lock in a market cap of just $11 billion. That results in a price-to-sales ratio (P/S) of just 2.1 for Rivian, versus Tesla’s premium P/S multiple of 8.8.

You’ll have to get comfortable with the volatility as Rivian tries to ramp up its production capabilities and bring new models to market for a consumer base still skeptical of electric vehicles. But if you really want to invest in the next Tesla, Rivian has all the features you’d want to see.

Should You Invest $1,000 in Tesla Now?

Before you buy shares in Tesla, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Tesla. The Motley Fool has a disclosure policy.

The Smartest Electric Vehicle (EV) Stocks You Can Buy Right Now with $1,000 was originally published by The Motley Fool