What makes the ultimate growth stock? In addition to high growth rates, I would say it has to have long-term growth drivers, be on the cusp of profitability or already showing it, have some sort of hedging or resilience, and not be overvalued.

Sounds too good to be true? Check out Now Holdings (NYSE: NU). Now is a digital bank based in Brazil that offers a wide range of financial services in three Latin American countries and appeals to a broad customer base with its low rates, user-friendly platform and modern technology. It has all this and more.

High growth figures

Quarterly growth rates are incredibly high for Nu, as it adds customers quickly — and those customers are highly engaged. Nu added more than 5 million customers in the second quarter, surpassing 100 million for the first time, for a total of 104.5 million. Customers in its headquarters and key market Brazil are still joining at a healthy pace, despite more than half of the adult population — 56% — already using the platform, and engagement rates are also increasing, to 83.4% in the quarter.

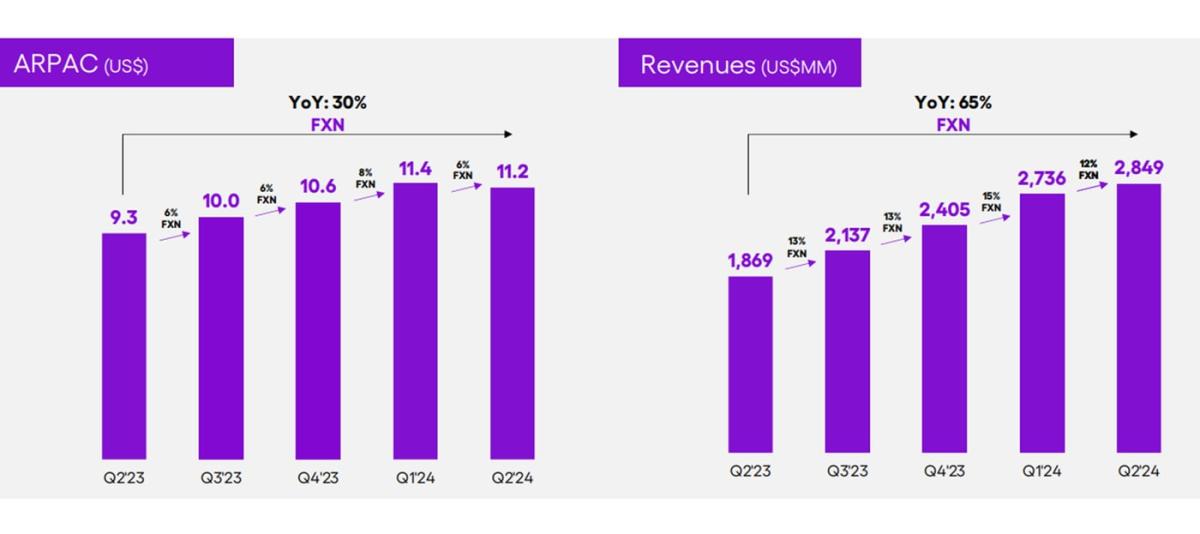

Average revenue per active user (ARPAC) increased by 30% year-over-year and continues to grow on a sequential basis, without adversely affecting the currency.

Long-term growth engines

The bank continues to gain market share in Brazil and is growing even faster in the newer markets of Mexico and Colombia. Mexico added 1.2 million customers in the second quarter, for a total of 7.8 million, while Colombia surpassed 1 million in the quarter.

It still has limited services in the countries and only recently launched its high-interest savings account, which is attracting new members. Growth in its Mexican business was the main driver of deposit growth in the second quarter, with deposits there tripling in the past two quarters since the savings account launched. Management says these two markets are still in their “investment phase.”

As Nu continues to add more accounts and launch new services, this will lead to increased engagement and more cross-sells and upsells. That should keep growth rates robust for the foreseeable future.

Nearly profitable or demonstrably profitable

All of that could still pose risks if Nu fails to turn sales dollars into profits. But the company has reported several straight quarters of strong profits, driven by stable costs to acquire and low costs to serve that it says are 85% lower than those of established companies. Increases in deposits are also fueling higher net interest income (NII) and margins (NIM) in the lending sector. NII rose 77% year-over-year in the second quarter, while NIM rose to 14% from 13%. Total net income rose 134% to $487 million on a currency-neutral basis.

Now, this kind of profitability shows even though the companies in Mexico and Colombia remain in the red. It’s important for a company that can grow over the long term to have that kind of capital available to grow without worrying about overall profitability, which is probably one of the reasons Warren Buffett likes this stock.

Hedging Bets

Buffett has talked about multiple income streams as a characteristic he looks for in a stock, and now he’s expanding his platform to protect his business. It’s diversified to cover bank accounts, lending products and other financial services.

High deposit growth, which is fueling growth in its newer markets, gives it cash to boost its lending activities, and it has taken on some additional risk and defaults given its growing and healthy loan portfolio. The total portfolio rose 49% year-on-year in the second quarter, and lending increased 78%.

Fair valuation

Now shares are trading at a forward price-to-earnings ratio of 23, which seems like a bargain relative to its performance and opportunity. It certainly seems fairly valued compared to other high-growth stocks.

Too good to be true?

So is Nu a no-brainer buy? There is still some risk because it operates in a region with high economic volatility and it is still a fairly young company. That is mitigated by the strong risk management and stability to date.

It’s also a Buffett stock. That’s not proof of anything, but since Buffett generally avoids riskier stocks, it gives investors an idea of the level of risk with Now stocks. I’d say it’s minimal at this point.

If you have $500 left over to spend after paying off debt and saving for emergencies, you can get a decent amount of Now stock while it’s still under $15. You’ll thank yourself later.

Should You Invest $1,000 in Nu Holdings Now?

Before you buy Nu Holdings stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $792,725!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Jennifer Saibil has positions in Nu Holdings. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The Ultimate Growth Stock To Buy Now With $500 was originally published by The Motley Fool