Nvidia (NASDAQ: NVDA) will report its fiscal 2025 second-quarter results (for the three months ended July 28) on August 28. The chip giant’s numbers are eagerly awaited by the market as it plays a leading role in the spread of artificial intelligence (AI).

While there have been concerns recently about Nvidia’s ability to maintain its AI-driven growth, a closer look at recent developments suggests that the company could indeed deliver better-than-expected results. Demand for Nvidia’s graphics cards is outstripping supply, and the market share for AI graphics processing units (GPUs) is so large that analysts expect the excellent growth to continue beyond the current fiscal year.

More importantly, a solid set of results from Nvidia will give the AI ecosystem a nice boost, as GPUs are critical building blocks for companies looking to build and deploy AI applications. This article takes a look at two names that are major players in the AI market and will likely benefit from Nvidia’s impressive results due to their ties to the company.

1. Taiwanese semiconductor production

Taiwanese semiconductor production (NYSE:TSM)better known as TSMC, is the world’s largest semiconductor foundry, with a market share of almost 62%. Since Nvidia is a fabless semiconductor company, it uses TSMC’s production facilities to produce its chips. The healthy demand for Nvidia’s AI chips also translates into more orders for TSMC, leading to impressive growth in the latter’s revenue and profit.

It’s worth noting that TSMC has seen an acceleration in its growth this year, thanks to customers like Nvidia.

TSMC reported a 13% year-on-year revenue growth in the first quarter of 2024 to $18.9 billion. This was followed by stronger growth in Q2 when topline rose 33% year-on-year to $20.8 billion. The foundry giant has forecast revenue of $22.8 billion for Q3, which would be a 34% increase year-on-year.

However, TSMC’s revenue for July rose an impressive 45% year-on-year, suggesting it’s on track to grow even faster in the current quarter. Nvidia’s solid results are also likely to boost TSMC investor confidence. That’s because Nvidia’s AI chips are manufactured using TSMC’s advanced process nodes.

For example, Nvidia’s highly popular H100 AI graphics card is built using TSMC’s 5-nanometer process node. Furthermore, Nvidia is reportedly one of the companies that has fully reserved TSMC’s 3nm chips for the next few years. Not surprisingly, TSMC is focused on expanding its production capacity to meet strong demand from customers like Nvidia, and recently approved a $30 billion expansion plan to build new manufacturing facilities and upgrade existing ones.

All of this explains why Nvidia’s better-than-expected results are likely to have a positive effect on TSMC’s stock. That’s why investors should consider buying it now that the company is trading at just 27 times forward earnings, a discount to the 44 times average for the U.S. tech sector.

2. Micron technology

Nvidia’s AI GPUs feature a special type of memory known as high-bandwidth memory (HBM) to accelerate AI workloads and Micron technology (NASDAQ: MU) is one of the companies supplying the graphics card specialist with this chip. During the June earnings conference call, Micron management said the company expects to generate “several hundred million dollars” of HBM revenue in the current fiscal year 2024, which ends this month, followed by “multiple billions of dollars of HBM revenue in fiscal year 2025.”

It’s worth noting that Micron has sold its HBM capacity for 2024 and 2025. However, the company is looking to capture a bigger share of this market by expanding its customer base and developing HBM chips that can deliver more power and efficiency. That’s a smart move, considering the HBM market is expected to generate $14 billion in revenue this year and $20 billion in revenue in 2025, up from just $5.5 billion last year.

This exceptional growth in the HBM market is directly proportional to the growing demand for AI chips, as companies like Nvidia and AMD have been trying to fill their lineup with more of this memory. The good news is that the AI-driven surge in the memory market is turning around Micron’s fortunes, leading to a recovery in margins and helping the company return to revenue growth.

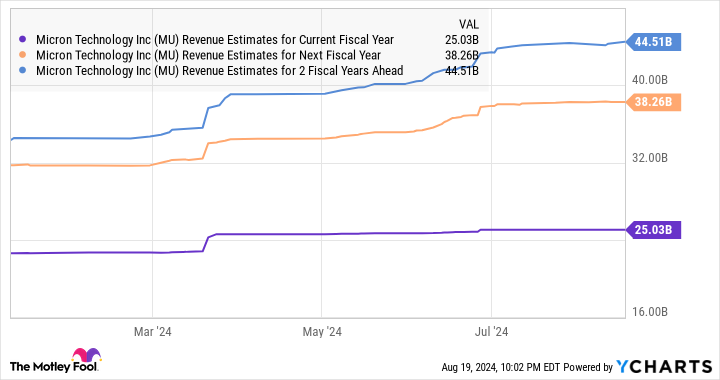

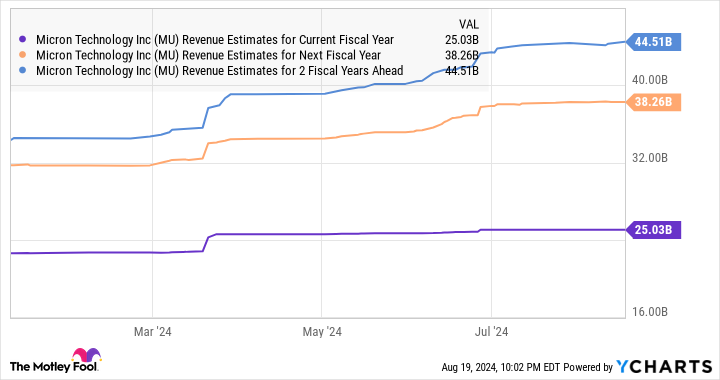

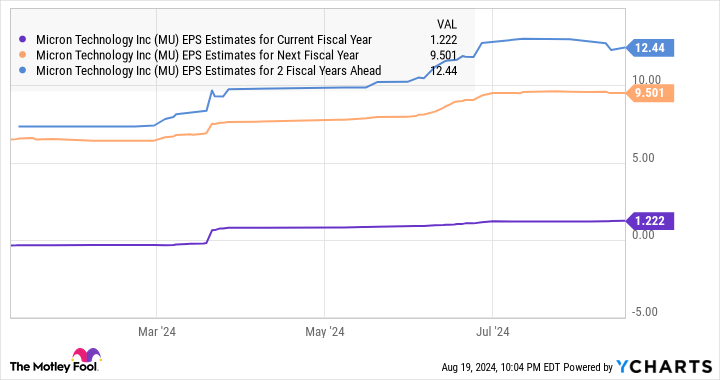

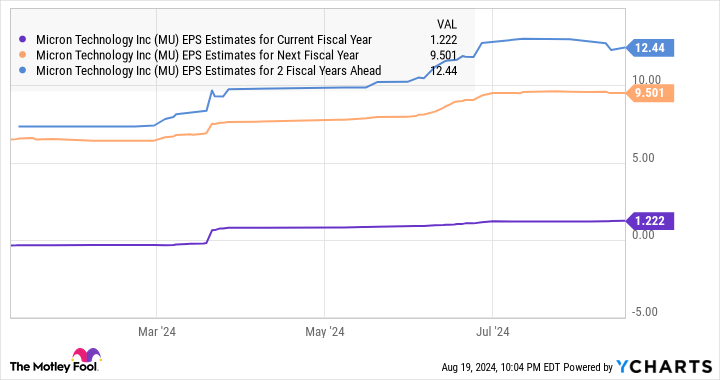

Analysts expect Micron’s revenue to rise 61% to $25 billion in fiscal 2024, followed by a 54% increase in fiscal 2025 to $38.6 billion. Meanwhile, the company is expected to post a profit in the current fiscal year, compared to a loss of $4.45 per share in fiscal 2023.

However, the stock’s performance has been mixed of late, losing 25% of its value over the past few months. Given that the stock is currently trading at an incredibly attractive 12 times forward earnings, investors may want to consider buying it before August 28, as Nvidia’s results are likely to give the memory specialist a boost.

Should You Invest $1,000 in Taiwan Semiconductor Manufacturing Now?

Before you buy Taiwan Semiconductor Manufacturing stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $779,735!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Prediction: These 2 Growth Stocks Could Rise After Nvidia’s August 28 Quarterly Results was originally published by The Motley Fool