As the market continues to rise higher, with the S&P500 Repeatedly reaching new all-time highs, there is at least one subsector of the market that is deeply undervalued compared to where the stock has historically traded. That would be the midstream energy sector.

In fact, the midstream industry as a whole is in much better shape today than it was a decade ago, when its stocks were trading at much higher valuations. Let’s take a look at the industry dynamics and some of the stocks in the sector that appear poised to outperform in the coming years.

The midstream sector of the energy industry

While the companies in the midstream space are best known for their pipeline assets, they perform a variety of tasks in the energy complex. This ranges from collecting crude oil and natural gas at the wellhead to separating the hydrocarbons (such as processing and fractionation) to delivering and removing water (fracking requires a lot of water). It also manages warehousing, long-distance transportation, marketing, compression and other services.

Midstream companies typically prefer fee-based contracts, where they do not take on commodities and do not accept spread risk. And when new projects are built, they often come with take-or-pay provisions, where the company is paid whether its services are used or not, or minimum volume commitments (MVCs), where the midstream company makes a shortfall payment receives if a customer does not do so. use all its volume capacity.

Some contracts still include pricing components that also allow midstream companies to benefit from the rise in commodity prices, typically on the natural gas and natural gas liquid (NGL) side of the business. For example, with a percentage-of-revenue contract, a midstream company would sell residual gas and/or NGLs into the market on behalf of a producer and retain a percentage of the sale. Another type of contract is keep-whole agreements, in which natural gas processors keep the purchased NGLs, but must replace them with an equivalent amount of gas on a BTU basis. This exposes a company to changes in prices between NGLs and natural gas.

However, the trend in recent years has favored fee-based contracts, which offer these companies a lot of visibility. And while there is volume risk, this is typically mitigated somewhat by take-or-pay and MVC provisions. Having assets tied to demand centers or stronger basins also helps mitigate risk, as energy demand tends to remain strong, while basins with better economic conditions tend to hold up better during periods of lower prices.

Meanwhile, given the demand for energy from data centers, given the artificial intelligence (AI) boom, companies involved in natural gas transportation appear well positioned to benefit from the current AI wave. Goldman Sachs recently predicted that data center energy demand will grow 160% by 2030, leading to new natural gas demand of 3.3 billion cubic meters per day.

Utilities will need to invest in new generation capacity, and new pipelines will be needed to support this growth. Midstream companies with established systems around places with cheap natural gas supplies, such as the Permian and Appalachia, will be best positioned to benefit.

Low historical valuations of the sector

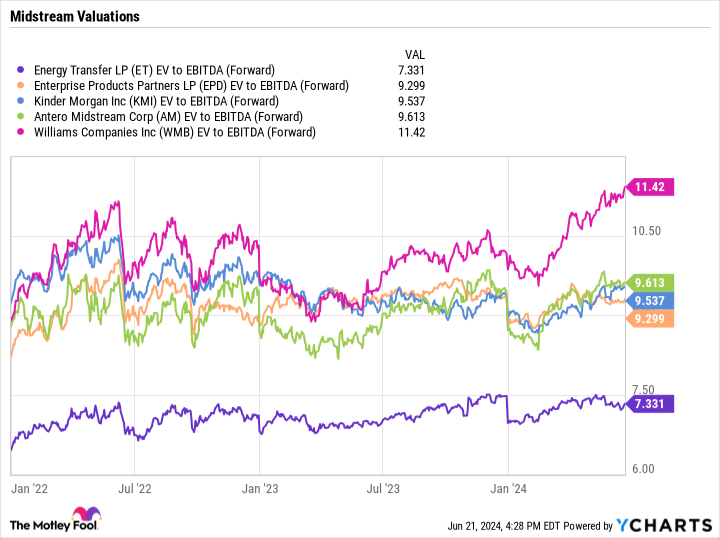

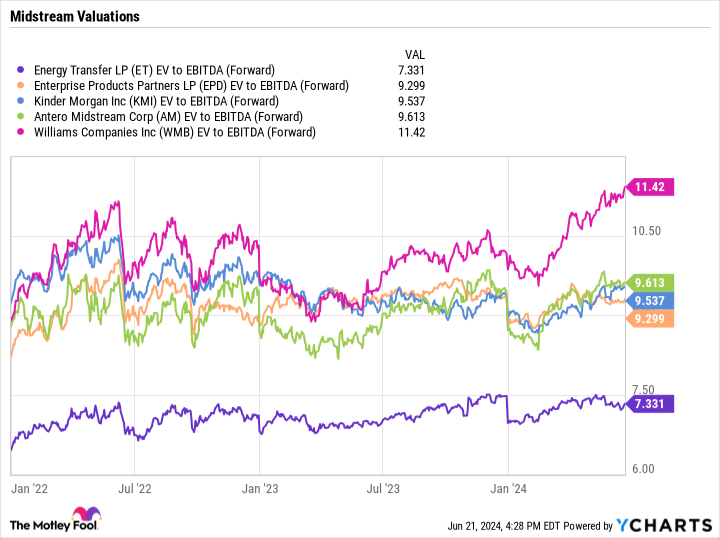

Between 2011 and 2016, midstream companies traded on average at an enterprise value (EV)-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) multiple of more than 13.5 times. This is one of the most commonly used metrics to value these companies because it takes into account their net debt and the depreciation costs associated with building out pipelines. Today, industrywide multiples are much lower.

The irony is that the companies in the sector are in much better shape now than they were during that period. Leverage (debt divided by EBITDA) has fallen significantly within the sector, while distribution coverage ratios have increased and midstream companies are generally generating strong free cash flow.

It’s also worth noting that power producer (E&P) customers of midstream companies are generally in better financial shape, reducing customer risk, and the industry has shifted its focus to free cash rather than chasing it before to volumes.

Midstream stocks are expected to outperform

Historically low valuations, combined with better financial health and strong growth due to increased natural gas demand from AI, means the sector may return to the valuation levels these stocks saw in their heyday.

Among the top stocks that will benefit Energy transfer (NYSE:ET), Enterprise product partners (NYSE:EPD)And Children’s Morgan (NYSE: KMI)all of which have large integrated systems and strong presence in the Permian. Williams Companies (NYSE:WMB) is another solid option given the major natural gas pipeline system running from the Appalachia region to energy demand centers in the Southeast. However, the shares are trading at a higher price than their peers.

Of the stocks highlighted above, Energy Transfer stands out for its low valuation and growth prospects and is my favorite stock in this space. It and Enterprise also have the most attractive yields of the group, at 8.1% and 7.2% respectively.

A more under the radar name that could benefit from this is Antero Middenstroom (NYSE:AM)that has noted how much data center power consumption the Marcellus shale region and its main customer need, Antero Resources (NYSE:AR), have seen. Antero Midstream is a well-run natural gas extraction company serving Antero. It is benefiting from the rebates (it previously gave Antero Resources a price discount when natural gas prices were low) and appears poised to increase its distribution in the future.

Energy Transfer, Enterprise, Kinder Morgan and Antero Midstream all trade at EV/EBITDA multiples below 10, while Williams trades below 11.5.

Given the opportunities they offer and their current valuations relative to historical valuations, these undervalued stocks could be among the best-performing value stocks in the coming years.

Do you now have to invest € 1,000 in energy transfer?

Consider the following before purchasing shares in Energy Transfer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 24, 2024

Geoffrey Seiler has positions in Energy Transfer and Enterprise Products Partners. The Motley Fool holds positions in and recommends Goldman Sachs Group and Kinder Morgan. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Prediction: These Could Be the Best Performing Value Stocks Through 2030 Originally published by The Motley Fool