The broader technology sector has seen a major boost in the past year and a half thanks to the rise of artificial intelligence (AI), which explains why the Technology sector Nasdaq-100 The index has risen as much as 83% since the start of 2023. However, not all tech stocks have benefited from this rise; Snowflake (NYSE: SNOW) is one such example.

Shares of the company, which offers a cloud-based data platform, are up just 5% since the start of last year. Snowflake’s latest results for the first quarter of fiscal 2025 (for the three months ending April 30, 2024) also didn’t do much to boost investor confidence, as shares fell more than 5%.

However, a closer look at Snowflake’s results shows that investors may have overreacted.

Snowflake wants to take advantage of a fast-growing market

Snowflake’s first-year revenue rose 33% year over year to $829 million, well above the consensus estimate of $787 million. However, the company’s adjusted earnings fell 6% year over year to $0.14 per share, remaining above the estimate of $0.18 per share. Snowflake lowered full-year margin guidance. It now forecasts a non-GAAP (adjusted) operating margin of 3% for the year, up from its previous forecast of 6%.

Investors may have hit the panic button due to the weaker margin projection. However, the company is making a smart move by ramping up investments in AI infrastructure, a strategy that will hurt margins in the short term but could open up new growth opportunities. CFO Mike Scarpelli said: “We are lowering our full-year margin guidance in light of higher GPU-related costs associated with our AI initiatives. We operate in a rapidly evolving market and we view these investments as key to unlocking additional revenue opportunities in the future.”

Snowflake is buying graphics processing units (GPUs) so it can build AI-focused services such as Snowpark, Cortex, Document AI, and its own large language model (LLM). For example, Cortex gives Snowflake customers access to multiple LLMs so they can build AI applications like chatbots using their own data without having to invest in expensive hardware.

Chief Executive Officer Sridhar Ramaswamy points out that Snowflake is witnessing “an impressive increase in Cortex AI customer adoption since it became generally available.” More than 750 Snowflake customers have been using Cortex since it became generally available on May 7. The company ended the previous quarter with a total customer base of just over 9,800, meaning a good chunk of its customer base has lost its AI-focused offering in a short time.

This bodes well for Snowflake, as its strategy to add AI services to its cloud data platform will encourage its existing customers to spend more money, while also bringing new customers into the company’s fold. After all, the AI-as-a-service market that Snowflake is targeting is expected to see nearly 37% annual growth through 2029, generating $72 billion in revenue by the end of the forecast period.

The great thing is that Snowflake is already witnessing healthy growth in its customer base while also capturing a larger share of their wallets, and AI could accelerate this trend.

These figures point to a bright future

Snowflake’s customer base rose 21% year over year in the previous quarter. Better yet, the number of customers who have generated more than $1 million in product revenue for the company has increased 30% year over year. Additionally, Snowflake’s dollar-based net retention rate was an impressive 128%. This is a sign of increased spending by existing customers, as this metric compares the money spent on the company’s offerings in a quarter with the same customer cohort’s spending in the year-ago period.

This combination of an improvement in Snowflake’s customer base and increased customer spend explains why residual performance obligations (RPO) increased 46% year over year to $5 billion. That was an improvement over the 41% RPO growth in the previous quarter. According to Snowflake, RPO represents “the amount of contracted future revenue that has not yet been recognized.”

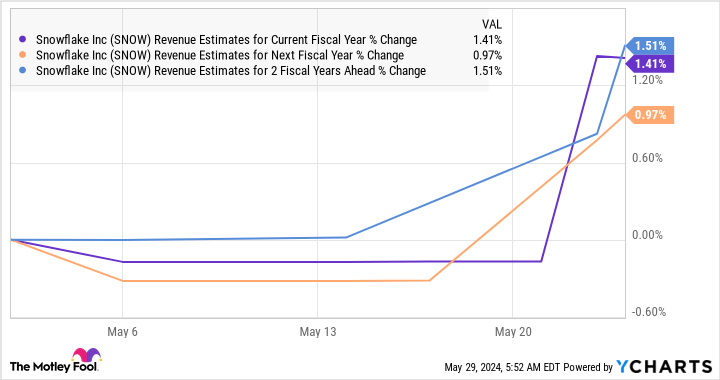

The fact that Snowflake’s RPO growth has accelerated and the metric is growing faster than revenue suggests that its future revenue pipeline is improving. Not surprisingly, Snowflake has raised full-year product revenue expectations to $3.3 billion, up from its previous estimate of $3.25 billion. Additionally, analysts have increased their growth expectations for Snowflake following the latest results.

Smart investors should therefore consider taking advantage of Snowflake’s underperformance, as AI could help this tech stock regain its mojo.

Should You Invest $1,000 in Snowflake Now?

Before you buy shares in Snowflake, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Snowflake. The Motley Fool has a disclosure policy.

Prediction: This Tech Stock Could Make a Big Move Thanks to Artificial Intelligence (AI) was originally published by The Motley Fool