Pipeline and midstream energy stocks have had a strong start to 2024, as seen in the performance of key sector exchange-traded funds (ETFs) such as the Alerian Energy Infrastructure ETF (NYSEMKT: ENFR)an increase of about 18% this year so far, and the Alerian MLP ETF (NYSEMKT: AMLP), an increase of almost 17%. The latter includes only the shares of midstream companies structured as master limited partnerships (MLPs), while the former includes midstream companies structured as both MLPs and corporations.

While the first half of the year has been good for the sector, there are good reasons to believe that a number of stocks in the sector will outperform in the second half and beyond.

Let’s look at three midstream stocks that are poised to outperform for the rest of this year and into the future.

MPLX (NYSE: MPLX) is a midstream company involved in logistics and storage, but also in collection and processing (G&P). Marathon Petroleum owns approximately 65% of the company and represents just under 50% of revenue.

The stock has an attractive yield of 8% based on the most recent distribution and had a robust coverage ratio of 1.6 times in the first quarter of 2024. Meanwhile, the balance sheet is in good shape with a leverage ratio (net debt/adjusted EBITDA) of just 3.2 times. The company has been performing consistently and increasing base distribution every year since 2012.

The company is well positioned in both Appalachia (Marcellus and Utica) and the Permian, and has a robust pipeline of growth projects in both regions over the next several years. It plans to spend $950 million in growth capital expenditures (capex) this year. The company also recently acquired several G&P assets in Utica and entered into an agreement to combine the Whistler Pipeline and Rio Bravo Pipeline projects into a new joint venture to connect Permian supply with additional Gulf Coast demand, which the company believes will provide future growth opportunities.

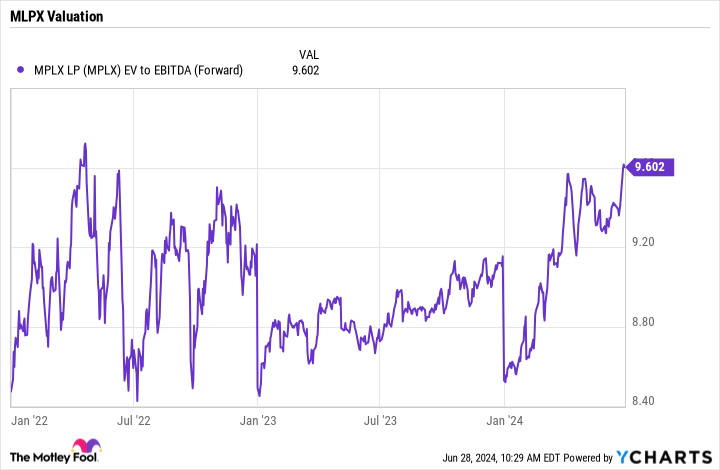

MPLX is in the right geographies and appears to be well positioned to continue increasing distributions. The expected enterprise value (EV)/EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio of 9.6 times (one of the most common ways to value midstream stocks) is attractive and well below 13.7 times at which the sector traded between 2011 and 2016.

MPLX EV to EBITDA (forward) data by YCharts

Western Midstream

One of the best performing midstream stocks in the first half of the year was Western Midstream (NYSE: WES)which rose by about 35%. The company mainly provides services Western petroleumthe collection and processing (G&P) needs in the Delaware Permian, Powder River Basin (PRB), and Denver-Julesburg (DJ) basins.

The company started the year strongly with record Q1 adjusted EBITDA of $609 million, up 22%, while free cash flow rose 60% to $225 million. That prompted Western to say it expected adjusted EBITDA to come in at the high end of its previous guidance, which called for full-year adjusted EBITDA of between $2.2 billion and $2.4 billion.

Impressively, the company increased its quarterly distribution by 52% from $0.575 per unit to $0.875. Based on this distribution, the stock now yields approximately 8.9%. Western appears on track to reach its leverage (net debt/adjusted EBITDA) target of 3x by year-end, at which point it could pay out excess (special or variable) distributions above its current quarter-based payout of $0.875. That would likely push the stock even higher and allow it to continue to outperform.

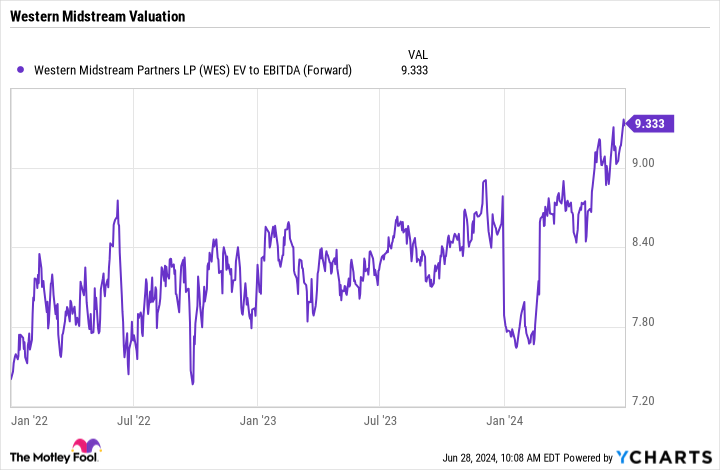

Meanwhile, the stock trades at an attractive valuation, well below historical levels, with an expected EV/EBITDA valuation of 9.6 times.

WES EV to EBITDA (forward) data by YCharts

Energy Transfer (ET)

One of the stocks best positioned to benefit from increasing energy consumption due to artificial intelligence (AI) is Energy transfer (NYSE:ET). The company has the largest integrated midstream system in the country with strong positions in low-cost natural gas producing regions, particularly the Permian. As a primarily prolific oil-producing basin, the associated natural gas from Permian production is among the cheapest in the country, which will likely attract many new data centers to the region given the immense energy required to power AI to provide.

Energy Transfer already has one of the most robust growth project backlogs in the midstream space, with the company expecting to spend nearly $3 billion in growth investments this year. Projects related to AI energy consumption are only likely to widen that backlog going forward.

At the same time, the company repaired its balance sheet to significantly reduce leverage, while the distribution coverage ratio was high: more than double the previous quarter.

Trading at just 7.4x forward EV/EBITDA, Energy Transfer is a cheap stock with a lot of potential growth ahead, making it my favorite midstream stock to outperform in the second half of 2024 and beyond.

ET EV to EBITDA (forward) data according to YCharts

Do you now have to invest € 1,000 in energy transfer?

Before you buy Energy Transfer shares, consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the years to come.

Think when Nvidia created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, you would have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns from June 24, 2024

Geoffrey Seiler has positions in Alps ETF Trust-Alerian Mlp ETF, Energy Transfer and Western Midstream Partners. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

These 3 High Yield Midstream Stocks Will Rise in the Second Half of 2024 and Beyond originally published by The Motley Fool