Long-term investing requires optimism. This is why investing in recovery options is inherently dangerous. The danger for investors is that they do not properly assess the risks, because they look at the opportunities through rose-colored glasses. Their optimism emphasizes the good possibilities rather than the bad and makes it more difficult to develop a balanced assessment.

Companies sometimes perform poorly and need turnarounds. I would say that is the case PayPal (NASDAQ:PYPL) And Advanced auto parts (NYSE: AAP) straight away. Naturally, every company in difficulty draws up a recovery plan at once. There are as many failures as there are successes.

Let’s look at the optimistic scenario for each of these struggling companies, but also remember what could go wrong. After a review it may become clearer whether these two are on the verge of success.

How PayPal could quickly surprise

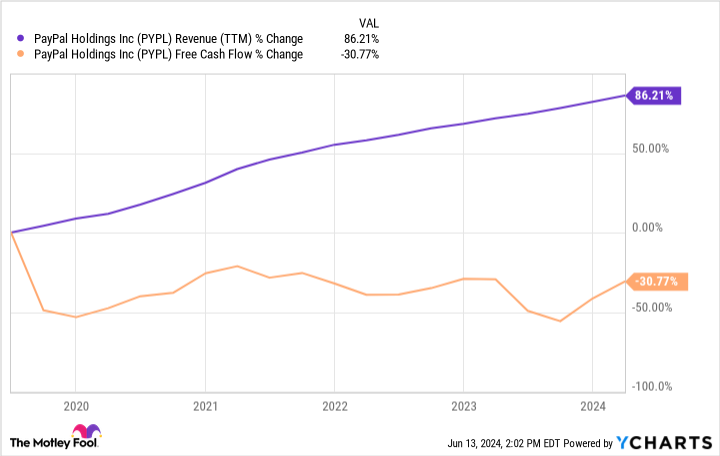

I can summarize PayPal’s problems in one graph. While revenue has grown and continues to grow, the growth has come from lower margin opportunities. As a result, revenue has increased by 86% over the past five years, but free cash flow has fallen.

On a free cash flow valuation basis, PayPal stock is quite cheap, trading at just 13 times free cash flow. A more typical valuation, even for a low-growth company, is often between 15 and 20 times free cash flow. However, if PayPal can’t grow its profits — and that hasn’t been possible for some time — then the cheap valuation is entirely appropriate.

Investors seem to believe that PayPal is a company in decline. But here’s one way the company could quickly improve the story: It just launched an advertising company. Digital advertising (unlike PayPal’s other efforts in recent years) is high-margin, and the platform still has hundreds of millions of active users for businesses to advertise to.

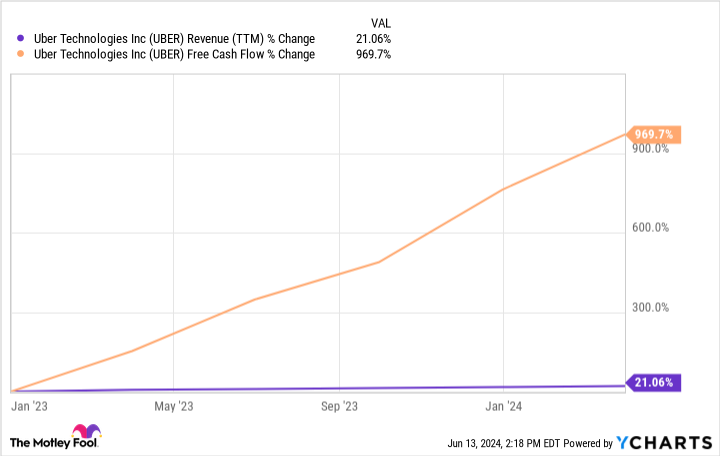

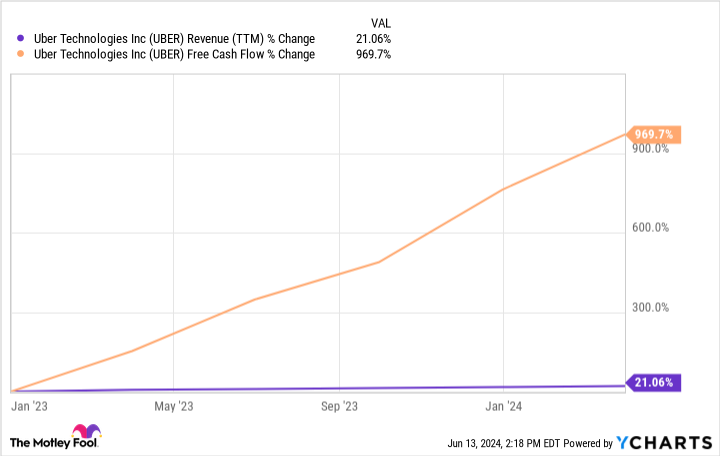

In October 2022, Uber Technologies made the same move by launching its dedicated advertising platform, which quickly became a $1 billion company. It’s worth noting that PayPal hired Uber’s architect Mark Grether to build its own offering. Therefore, someone with a quality reputation is in charge and can make things happen quickly.

It’s also worth noting what happened to Uber’s free cash flow after launching a dedicated advertising platform. I’m not saying that 100% of the profit growth came from advertising. But the chart below starts on the day Uber launched ads, and suggests that ads were a powerful catalyst for profit growth. Now that potential catalyst is here for PayPal.

How Advance Auto Parts is completely restructuring its operations to turn a profit

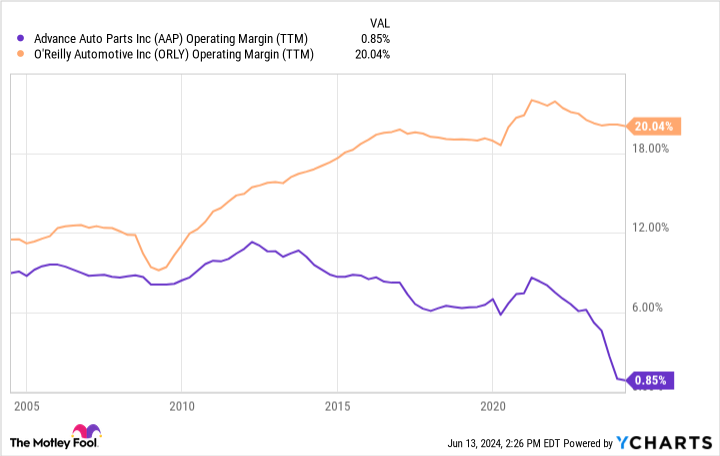

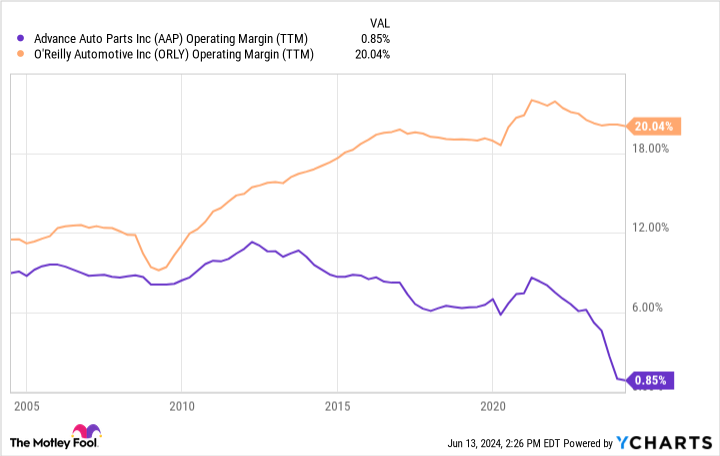

Just as I believe one graph summarizes PayPal’s problems, one graph can also summarize the major problem at Advance Auto Parts. The chart below shows that 20 years ago the operating margins for Advance and Competitor were O’Reilly Automotive were in the same stadium. But margins for Advance started declining around 2013 and never recovered. There is an excellent explanation for this.

In 2013, Advance acquired Carquest. This in itself was not the problem. But as the publication Supply Chain Dive points out, since acquiring Carquest, Advance has effectively operated two disconnected supply chains. That’s wildly inefficient, and it’s not surprising that the company’s profit margins have been steadily declining while O’Reilly’s margins have been steadily rising.

Fortunately for shareholders, Advance hired a supply chain expert when it hired new CEO Shane O’Kelly from HD Supply in August. As O’Kelly noted in the conference call to discuss first-quarter 2024 financial results, the company currently has 38 distribution centers and only needs 14 — that’s not a typo.

I believe PayPal’s turnaround could be quick. In contrast, the turnaround for Advance would likely take longer. Fully consolidating an inefficient supply chain will simply take time. And it will cost money; the company expects $200 to $250 million in capital expenditures in 2024 alone.

However, if Advance’s profit margins really take a hit due to an inefficient supply chain, then the future for investors is extremely promising. Consider that the company expects more than $11 billion in net sales this year. If it could increase its operating margin to 10% – which would still be half the margin for O’Reilly – the company would have an annual operating profit of more than $1.1 billion.

For perspective, Advance’s market valuation is just $3.8 billion at the time of writing. If it can pull off its turnaround, the stock could double or triple in the coming years, which would almost certainly be better than the returns of recent years. S&P500.

Of the two, PayPal’s turnaround time may be easier and faster. However, Advance shares could have a bigger upside due to how cheap the shares are right now compared to their potential.

Should You Invest $1,000 in PayPal Now?

Before you buy shares in PayPal, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Jon Quast holds positions in Advance Auto Parts. The Motley Fool holds and recommends positions in PayPal and Uber Technologies. The Motley Fool recommends the following options: June 2024 short calls of $67.50 on PayPal. The Motley Fool has a disclosure policy.

These two companies need a turnaround. But each has a potential catalyst that could send stock prices soaring. was originally published by The Motley Fool