While a few big names in semiconductors typically get all the attention in the AI space, the entire chip manufacturing ecosystem is benefiting from the growing AI expansion.

That includes semiconductor equipment stocks, which are tasked with making more volumes of increasingly complex chips. Amid high demand for more complex chips, revenues and profits are sure to flow to these companies.

That’s happening at a semi-cap equipment leader, which recently announced a 15% increase in its quarterly payout.

Lam Research is flush with cash and poised for growth

Giant in chip production Lamb Research (NASDAQ: LRCX) is one of the few major players in the critical etch and deposition steps of the chip manufacturing process. Lam specializes in equipment used to vertically stack chip components, which benefited the company when NAND flash went from planar structures to stacked 3D structures a decade ago. Fortunately for Lam, both high-bandwidth DRAM memory and advanced logic chips are now implementing more 3D structures. Even more fortunately, DRAM and advanced logic are now driving the bulk of AI-related growth.

During the recent analyst conference call, management highlighted several new products that provide advanced etch capabilities for new complex vertical structures for AI. CEO Tim Archer noted, “Overall, etching and deposition are becoming increasingly important to meet the complex semiconductor requirements of a growing AI environment. We are excited about the breadth of opportunities we see for the business, particularly those created by technology inflexions into gate-all-around, backside power delivery, advanced packaging and dry EUV resist processing.”

AI-driven growth is also profitable for Lam

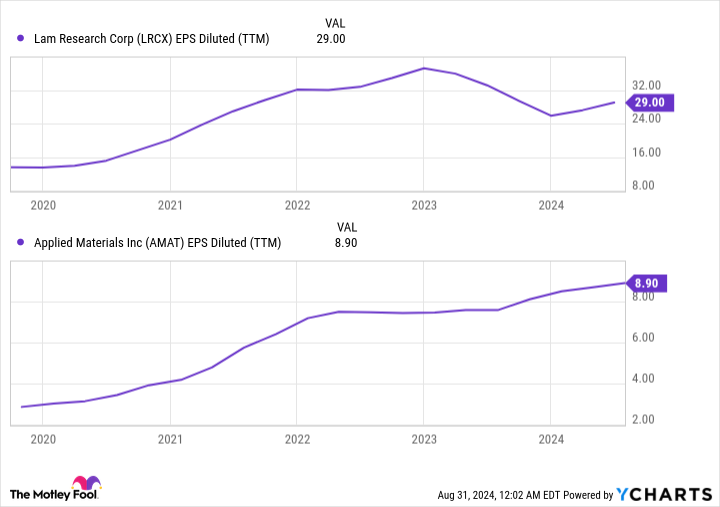

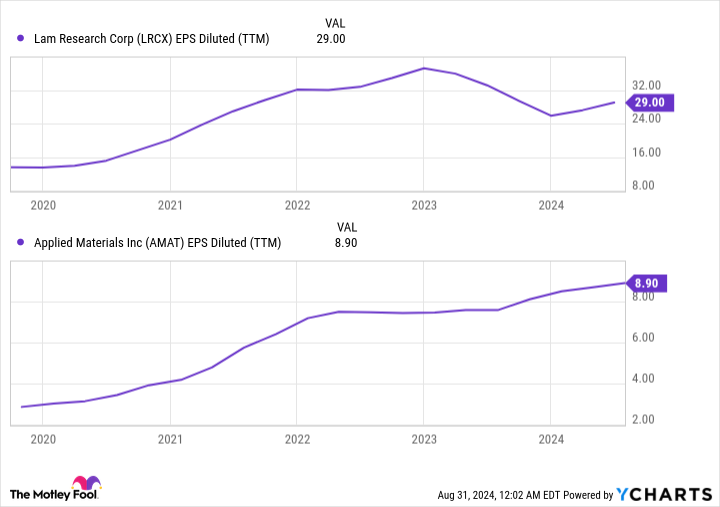

What is particularly positive about Lam’s growth is that it also comes with high margins and cash flow, which is fueling the company’s growing dividend. Over the past 12 months, Lam has achieved an impressive 30% operating margin and a 45% return on equity. The margin is boosted by Lam’s technology moat and the fact that it faces limited competition, mainly from Applied materials (NASDAQ: AMAT). Both Lam and Applied have similar metrics, which show rational pricing. So it’s no surprise that Applied is also a great dividend growth stock.

Last Thursday, August 29, Lam announced that it would increase its quarterly payout by 15%, from $2.00 to $2.30, for an annual dividend of $9.20. That’s a yield of about 1.12% at the current share price.

While a 1.12% yield may not seem like much today, the 15% increase is a promising sign. If a company has the ability to grow its dividend above inflation for an extended period of time, that stock could be a great long-term investment to provide a solid retirement income in the future.

Lamb’s payout could grow by double digits for years

Like Applied, Lam has a low payout ratio of just 27.6%, meaning it pays out just over a quarter of its net income as dividends. While not as low as Applied’s 15% payout ratio, it’s still a fairly low ratio, with plenty of room for improvement. Additionally, Lam’s current dividend yield is higher than Applied’s, at 0.83%.

Lam’s earnings may also be more cyclical now. While Lam has shown excellent long-term growth over time, it is only now on the verge of emerging from its recent cyclical slump. Meanwhile, Applied has had more stable earnings growth. The difference likely lies in Lam’s outsized exposure to NAND flash investments, which has been meager in recent years following the pandemic.

But if Lam and Applied have similar long-term growth prospects, Lam’s earnings are more cyclically depressed and could rebound more. After all, the NAND recovery hasn’t happened yet, so if Lam experiences a NAND recovery combined with new AI growth opportunities in DRAM and advanced logic, normalized earnings should be higher.

That means Lam’s higher payout ratio would be lower with more normalized, cyclical earnings.

Share buybacks add fuel to the fire

Like Applied, Lam is giving back even more money to shareholders than just its dividend through share buybacks. Last quarter, Lam bought back $373.5 million, more than the $261.4 million it paid out in dividends. And Lam has been even more aggressive with buybacks in the past when its stock price was lower, buying back $980 million of stock in the June 2023 quarter.

That’s a good capital allocation, and it’s how Lam has managed to reduce the number of shares by more than 10% since the end of 2019, while maintaining a cash-rich balance sheet of $5.85 billion in cash and just $4.98 billion in debt.

In short, a company with growing earnings, a declining share count, and a low payout ratio is a great recipe for lots of dividend growth per share going forward. Like peer Applied Materials, Lam is poised to deliver in the years ahead, especially with AI tailwinds.

Should You Invest $1,000 In Lam Research Now?

Before buying Lam Research stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Billy Duberstein and/or his clients have positions in Applied Materials and Lam Research. The Motley Fool has positions in and recommends Applied Materials and Lam Research. The Motley Fool has a disclosure policy.

This AI Stock Just Raised Its Dividend By 15%, And More Passive Income Should Be Coming was originally published by The Motley Fool