Super microcomputer (NASDAQ:SMCI) this year started strong. Earnings soared, and in the months that followed, the S&P 500 and Nasdaq 100 invited stocks to join in. The stock’s performance even surpassed that of the market darling Nvidia. The stock rose 188% in the first half of the year, compared to Nvidia’s 149% rise.

But times have been tougher for Supermicro in recent weeks. A research firm that was shorting the stock released a report claiming there were problems at the company. Around the same time, Supermicro, in an unrelated move, delayed the filing of its 10-K annual report. And more recently, The Wall Street Journal reported that the Department of Justice had launched an investigation into Supermicro.

All of this has weighed heavily on Supermicro, sending its shares down 25% since the brief report in late August. And that makes the market wonder what’s next for this technology company. My prediction is that this is the direction Supermicro will go in 2025…

Supermicro’s earnings growth

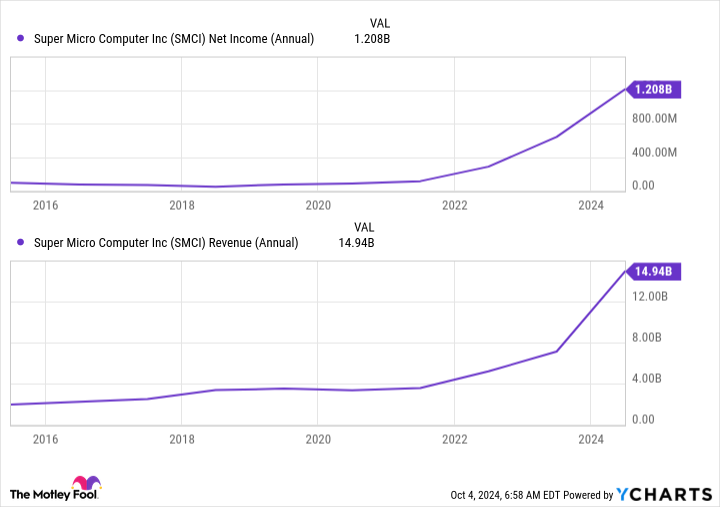

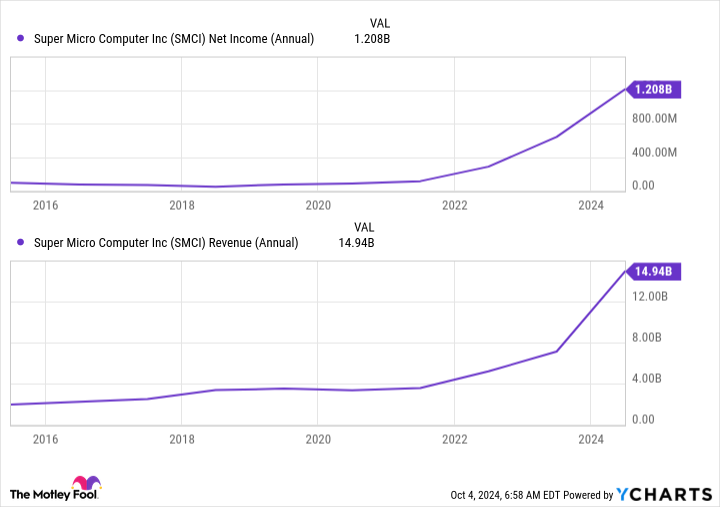

But before I talk about my prediction, let’s give some background on Supermicro’s path so far. This technology company is not a newcomer, but has been around for more than 30 years, selling workstations, servers and other equipment. Supermicro steadily increased its revenues and became profitable over time, but revenues really increased in recent years as artificial intelligence (AI) accelerated.

SMCI net income data (annual) according to YCharts

Companies building AI platforms are turning to Supermicro for their data center needs – and Supermicro’s strategy has put the company on top, with a growth rate over the past twelve months that is five times faster than the industry average .

Why is the company so successful? Supermicro works closely with top chip designers during their development process so that it can immediately integrate their innovations into its products. In addition, Supermicro’s “building block” technology, where most products share common components, allows the company to more quickly tailor a particular product to customer needs.

All this has allowed Supermicro to achieve quarterly turnover this year that exceeded a full year’s turnover in 2021. And given the expected growth of the AI market – which is expected to grow from $200 billion today to $1 trillion by the end of the decade – – Supermicro could see revenue continue to rise.

A short report and other headwinds

Of course, the negative news of recent weeks remains a headwind at the moment. Let’s take a look at the details. Hindenburg Research alleged “glaring accounting red flags” and other problems at Supermicro in its brief report. It’s important to note that Hindenburg is short Supermicro, meaning it will benefit if the stock falls – and this makes it difficult for us to rely on Hindenburg for unbiased information. Supermicro also responded to the report, saying the claims were “false or inaccurate” and vowing to address this further in due course.

As for the delayed annual report, Supermicro also spoke further about this and said it does not expect any significant changes to its earnings figures. That should ease investors’ minds.

Finally, regarding the possible Justice Department investigation: The Wall Street Journal quoted people familiar with the matter – but an investigation has not been confirmed. And the Magazine said spokespersons for Supermicro and the U.S. attorney’s office declined to comment.

My prediction for 2025

Taking all this into account, my prediction for Supermicro in 2025 is as follows. At this time it is impossible to say whether the Justice Department has launched an investigation. If this is the case and problems are identified, it could weigh on the stock, but only the magnitude of the potential problems could tell us to what extent.

There are a lot of ‘ifs’ though, and I’d rather go with what we know so far. And what we do know is that Supermicro’s business has been strong in recent years and demand from AI customers continues. In fact, these customers are now looking for cooling technology for their AI data centers – and Supermicro is a specialist. This could mean a whole new wave of growth for the company starting in 2025.

Moreover, Supermicro, which reported a lower gross margin last quarter, plans to open a new factory in Malaysia by the end of this year – a move that should reverse that trend with its focus on high volumes and low costs.

So my prediction is that if the allegations about the company are not confirmed, Supermicro’s earnings and stock price could rise in 2025. The average estimate on Wall Street calls for an 87% upside over the next twelve months, and if the recent troubles don’t gain momentum, I think the stock could meet those expectations.

Does this make Supermicro stock a buy? Possibly – if you are an aggressive investor. But otherwise, and especially if you’re a cautious investor, it’s important to remember that stocks remain risky at this point. And that means it’s probably a good idea to wait for further clarity on the recent headwinds before picking up shares of this AI stock.

Should You Invest $1,000 in Super Micro Computer Now?

Consider the following before buying shares in Super Micro Computer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Adria Cimino has no positions in the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Prediction: This is where the supermicrocomputer will go in 2025, originally published by The Motley Fool