One of the most anticipated events of the year is officially over. Less than 24 hours ago, after the close of trading on Friday, June 7, the infrastructure backbone of the Artificial Intelligence (AI) revolution, Nvidia (NASDAQ: NVDA)completed his 10-to-1 forward split.

A “stock split” is an event that allows publicly traded companies to cosmetically change their stock price and outstanding share count by the same amount. It is cosmetic in the sense that stock splits have no effect on a company’s market capitalization or operating performance. Stock splits can make shares more nominally affordable for retail investors, such as a forward stock split. They can also increase a company’s stock price to ensure it maintains its listing on a major stock exchange, such as in a reverse stock split.

Investors have favored stock splits over the past three years as they have a history of outperformance. More than a dozen high-flying stocks have announced and/or implemented stock splits since mid-2021, including Nvidia, which just completed its second split since July 2021.

Nvidia has gained $2.68 trillion in market value in just over 17 months

On paper, Nvidia has given investors every reason to jump on board and enjoy the ride. On June 5, Nvidia’s market capitalization reached $3 trillion for the first time, with the company surpassing the mark. Apple for second place among America’s largest publicly traded companies. Since the start of 2023, Nvidia has added approximately $2.68 trillion in market value, driven entirely by AI.

Nvidia’s AI-inspired graphics processing units (GPUs) are the cornerstone of high-compute data centers. Based on varying estimates, Nvidia’s chips account for about 90% of the AI GPU market share, with the ultra-popular H100 GPU powering generative AI solutions and helping train large language models.

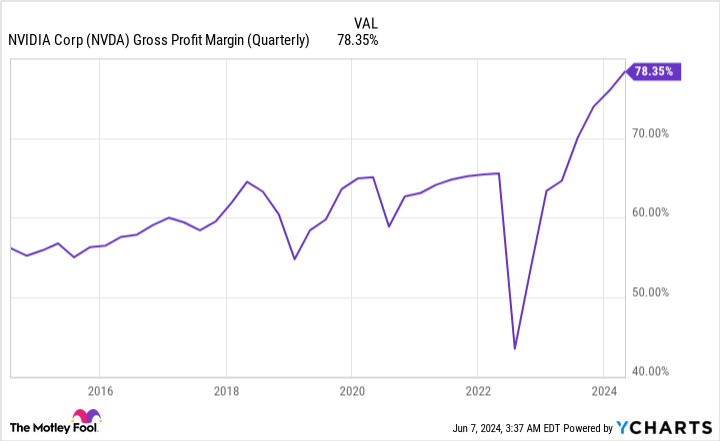

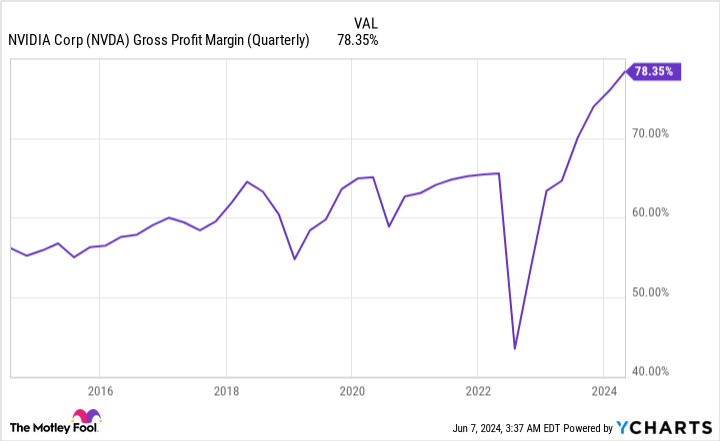

Nvidia’s innovative advantage also drives profits. The company’s next-generation Blackwell chip, which costs between $30,000 and $40,000, will be sold out well into 2025, according to some Wall Street analysts. With demand outpacing supply, Nvidia has had no qualms about raising the price of its AI GPUs and reaping the rewards of a massive increase in gross margin – 78.35% in the first fiscal quarter of 2025 ending April 28 .

Despite Nvidia’s shares being up 738% in just over 17 months, they still look fairly cheap on a fundamental basis. Although shares currently trade around 34 times full-year earnings, the Wall Street consensus calls for annualized earnings growth of 46.5% over the next five years.

On the surface, Nvidia looks perfect after its 10-to-1 stock split. But as an investor, I can’t judge a book by its cover alone.

History suggests that Nvidia could be a ticking time bomb

Taking a step back, widening the lens and letting history be my guide will lead to a completely different investment view on Nvidia in the coming months and/or years. While there’s no denying that it’s firing on all cylinders and handily exceeding even the highest expectations of Wall Street analysts, there are a handful of reasons why I wouldn’t touch Nvidia stock with a 10-foot pole in the wake of the 10 -to-1 split.

The main reason I don’t want anything to do with Nvidia has to do with the history of its next big innovations.

Since the advent of the Internet some thirty years ago, Wall Street has had no shortage of subsequent trends expected to change the growth curve of corporate America. Some of these innovations include genome decoding, the rise of nanotechnology, business-to-business commerce, 3D printing, blockchain technology, the metaverse and now artificial intelligence.

While some of these trends were successful in the long term, they all have one thing in common (except AI): an early-stage bubble burst. Investors have consistently overestimated the adoption of new technologies and innovations for over thirty years. Every breakthrough innovation comes with huge promises and high expectations from analysts. Unfortunately, any new innovation takes time to mature, and artificial intelligence is unlikely to be an exception. If and when the AI bubble bursts, no company will take notice more than Nvidia.

Mind you, I have no idea when the AI bubble might burst. History has shown that stock valuations can extend for years before correcting. But possibly (keyword!), we have witnessed every new innovation making its way through a bubble popping event.

We’re also starting to see subtle “warnings” from Nvidia that the peak is here or close to it.

If you were to search Nvidia’s fiscal first quarter operating results and conference call, you would find nothing but positive commentary from the management team. However, the company’s fiscal second quarter gross margin guidance of 75.5%, plus or minus 50 basis points, is the red flag I’m talking about.

After a 13.8 percentage point increase in gross margin in a year, a forecast decline of 235 to 335 basis points (78.35% to a range of 75% to 76%) might sound like a nothingburger. But it’s remarkable when you consider that third-party competitors are getting started with their own AI GPUs. Additionally, Nvidia’s four largest customers, which account for about 40% of revenue, are developing AI GPUs in-house for their data centers.

This expected decline in sequential quarterly gross margins appears to be a signal that Nvidia’s pricing power has reached its peak. If GPU scarcity diminishes, Nvidia’s pricing power will decline as well.

The third reason I don’t want anything to do with Nvidia after the now full 10-for-1 stock split is, again, history – but this time I’m talking about its valuation.

As I noted earlier, Nvidia is still relatively cheap, based on its price-to-earnings-growth (PEG) ratio. But based on last twelve months (TTM) sales, Nvidia has reached a historic price level that only can compete Amazon And Cisco systems before the dotcom bubble burst.

At the end of March 2000, Cisco Systems peaked at just under 39 times TTM sales. Meanwhile, Amazon reached 43 times TTM sales in January 1999 before falling off a cliff. Nvidia currently sits at a multiple of 38 times TTM sales.

History may not repeat itself perfectly on Wall Street, but it does tend to rhyme. For these reasons, I won’t touch this artificial intelligence titan with a 10-foot pole.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions at Amazon. The Motley Fool holds positions in and recommends Amazon, Apple, Cisco Systems and Nvidia. The Motley Fool has a disclosure policy.

Nvidia Completed Its 10-for-1 Stock Split: Here’s Why I Still Won’t Touch This Artificial Intelligence (AI) Titan With a 10-Foot Pole Originally published by The Motley Fool