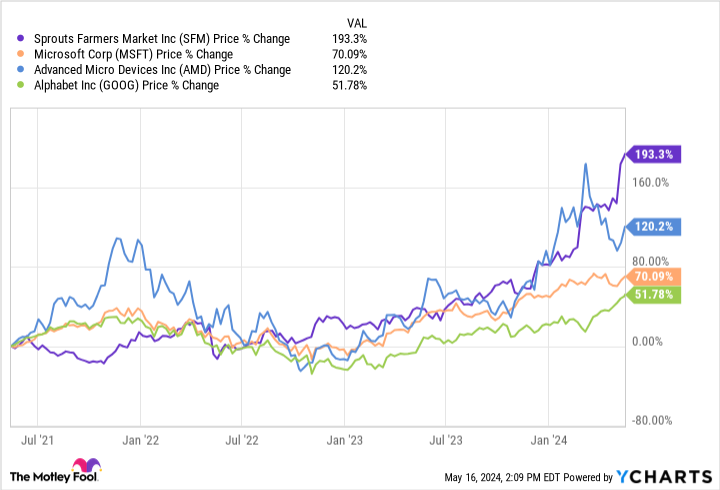

The big story in the stock market in recent years has been artificial intelligence (AI). Generative AI, which can create text, images, videos and audio, seems likely to be a transformative technology. Tech leaders love Microsoft, AlphabetAnd Advanced micro devices are investing heavily in AI to drive growth.

While the shares of all three of these AI-focused companies have soared over the past year, they’ve been handily beaten by a stock that has absolutely nothing to do with AI. Investing is about more than chasing buzzwords. The proven method of finding unvalued companies with solid growth prospects trading at pessimistic valuations still works.

This mysterious stock has more than doubled in the past year, beating all three of the aforementioned tech companies by wide margins. It has also beaten Microsoft, Alphabet and AMD over the past three years, nearly tripling in that time.

The stock is Sprouts farmers market (NASDAQ: SFM), a small supermarket chain that does things differently from the large supermarket chains. That strategy has paid off, and Sprouts still has plenty of growth ahead as it expands its footprint.

Small, curated stores

Sprouts operated 414 stores in 23 states as of March 31. Each store is relatively small. The older stores are about 30,000 square feet, while the newer stores are even smaller at about 23,000 square feet. Although the size of traditional supermarkets varies, they are often significantly larger.

Keeping stores small reduces the cost of building new stores, reduces ongoing operating costs and allows Sprouts to build in locations where larger supermarkets would not make sense. The average new store costs just $3.8 million. First-year sales average $13 million, with annual growth of 20% to 25% over the subsequent four years.

Sprouts focuses on two things: products and attribute-based items. Each store has a large product department with affordable prices. It makes a point of beating competitors on price.

About 70% of the products Sprouts sells are attribute-based – i.e. gluten-free, organic, vegan, non-GMO and the like. It does not attempt to compete with the major supermarket chains in terms of selection, but instead puts together a differentiated range of products. This works well with the company’s customer base, which focuses mainly on the wealthy and highly educated.

Hundreds of new stores could be added

The Sprouts model works. Comparable sales (comps) rose 4% in the first quarter of this year and the company expects full-year growth of 3% to 4%. The company expects adjusted earnings per share to top $3 this year, up from just $1.25 in 2019.

Sprouts will open 35 new stores this year. In 2025 and beyond, the company plans to increase the number of stores by approximately 10% annually. It sees potential to open more than 300 new stores in its expansion markets, including Texas, California, Florida and parts of the East Coast.

Based on the company’s guidance, the shares trade for about 25 times forward earnings, even after the multi-year rally that has propelled the stock to market-wrecking gains. With the company projecting 10% store growth, low single-digit growth and stable profit margins, double-digit annual earnings growth is on the horizon.

That valuation seems reasonable given the chain’s growth potential. It could also be an acquisition target. Amazon Whole Foods, another differentiated supermarket chain, was hit in 2017. Sprouts could be an attractive acquisition for a larger chain looking for growth.

The food industry is struggling and consumer behavior can change unexpectedly. Sprouts is navigating the post-pandemic environment well so far, and the company appears poised to significantly expand its footprint in the coming years. While the stock may not repeat the performance of recent years, it appears to be a solid long-term investment.

Should You Invest $1,000 in Sprouts Farmers Market Right Now?

Before you buy stock on Sprouts Farmers Market, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Sprouts Farmers Market wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $578,143!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Timothy Green has positions in Sprouts Farmers Market. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, and Microsoft. The Motley Fool recommends Sprouts Farmers Market and recommends the following options: long calls in January 2026 for $395 at Microsoft and short calls in January 2026 for $405 at Microsoft. The Motley Fool has a disclosure policy.

This stock has beaten Microsoft, Alphabet and AMD. It has nothing to do with AI. was originally published by The Motley Fool