Over the past three years, the S&P500 has delivered a total return (capital gains and dividends) of 32.4%, better than the Nasdaq Composite‘s total return of 26.8%. Still, both indices have performed well during this period, especially considering that 2022 was the stock market’s worst calendar year since 2008.

Despite a widespread sell-off in growth stocks in 2022, Vanguard’s exchange-traded fund (ETF) for the technology sector has delivered a total return of just over 50% over the past three years and 187.6% over the past five years. The Vanguard Information Technology ETF (NYSEMKT: VGT) includes top stocks such as Microsoft, AppleAnd Nvidia. And with an expense ratio of just 0.10%, or $10 in annual fees for every $10,000 invested, it’s an ultra-cheap way to invest in the sector.

Here’s an overview of the fund and why it may be worth buying now.

Looking under the hood of the tech sector

Technology stocks and growth stocks are two terms that can seemingly be used interchangeably. But the industries within the technology sector have some major differences. The three major categories are semiconductors, software and hardware.

Nvidia is a fabulous chipmaker that designs its products and outsources production to a company like Taiwanese semiconductor. There are also suppliers of materials and equipment such as ASMLthat makes products needed for mass production of chips, such as extreme ultraviolet (EUV) lithography systems.

Software companies are typically categorized as infrastructure software, such as Microsoft, Oracle, Adobe, Palo Alto NetworksAnd CrowdStrike — or application software — such as Sales team, JUICE, Intuitive, Service now, UberAnd Shopify.

Apple is unique in that it is vertically integrated and makes its own software and hardware. But there are also computer hardware companies such as Dell Technologies, Arista NetworksAnd PK.

Here’s an overview of how Vanguard defines each sector, the Vanguard Information Technology ETF’s weighting by sector, and an example of the holdings for each category.

|

Industry |

Weighing |

Hold example |

|---|---|---|

|

Semiconductors |

27.6% |

Nvidia |

|

System software |

22.9% |

Microsoft |

|

Technology Hardware, storage and peripherals |

17.3% |

Dell Technologies |

|

Application software |

14.4% |

Sales team |

|

Semiconductor materials and equipment |

4.4% |

ASML |

|

IT advice and other services |

3.6% |

Accenture |

|

Communication tools |

3.2% |

Cisco systems |

|

Electronic components and electronic production components |

2.4% |

Amphenol |

|

Electronic equipment and instruments |

1.6% |

Garmin |

|

Other |

2.7% |

Data source: Vanguard.

One of the big advantages of a technology sector ETF is that it covers both the red-hot, high-margin growth stocks and companies that are more industrial and productive in nature. The spotlight is often on high-growth software stocks, but we rarely hear about the integral companies that are the sector’s picks.

An example is Amphenol, an $82 billion company that makes sensors, antennas, cables, fiber optic connections and more. The electrical components company is a key part of the technology sector and a holding in the Vanguard Information Technology ETF that might otherwise be overlooked.

The sector is benefiting from increased technology adoption and innovation. But it all falls apart without a network of suppliers, manufacturing services and component companies.

The advantages outweigh the disadvantages

By far the biggest disadvantages of investing directly in the technology sector, as opposed to a larger, more diverse growth fund, are that it is the most expensive sector with a price-to-earnings (P/E) ratio of just over 40. and it excludes many technology-oriented companies out Amazon, Alphabett, and Metaplatforms that are placed in other sectors.

The sector’s valuation is high compared to the broader market, but not terrible given the sector’s growth potential. For context: the Invesco QQQwhich tracks the performance of the 100 largest non-financial companies in the Nasdaq Composite, has a price-to-earnings ratio of 37.3.

Technology stocks are expensive right now due to the massive increase in share prices and enormous growth potential. We can expect that the semiconductor and software companies will generally have higher growth rates and more expensive valuations than the hardware and components companies.

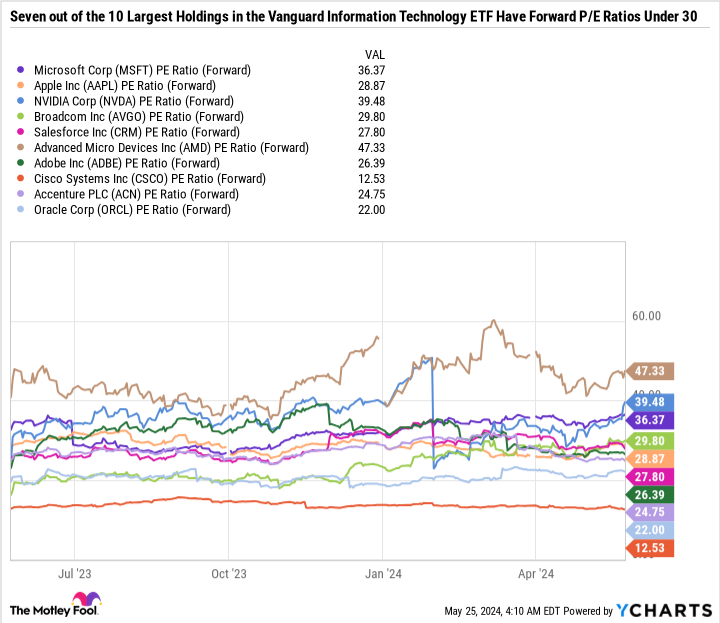

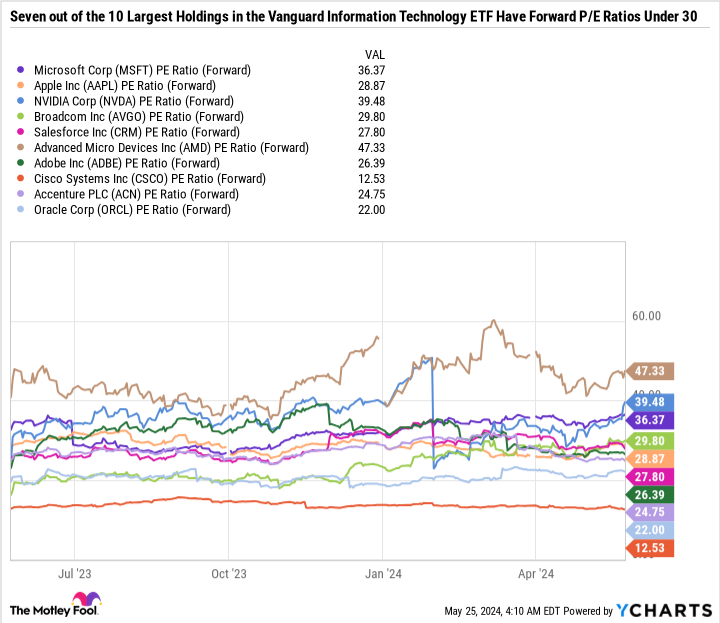

The good news is that many companies are growing quickly and are expected to continue growing at a breakneck pace. You can learn a lot about investor expectations from forward price-to-earnings ratios, which divide a stock’s price by its expected earnings for the coming year, rather than by its past twelve months’ earnings.

As you can see from the chart, even the most torrid hot tech stocks have quite reasonable price-to-earnings ratios. Of course, these are only estimates and should be approached with caution, as predictions rarely go as planned. But overall, the forward price-to-earnings estimates of many tech sector stocks make a lot of sense and indicate why the sector isn’t as expensive as it seems at first glance.

If you don’t care much about passive income and have a high risk tolerance, you might prefer to buy Apple, Adobe, or Salesforce at price-to-earnings ratios under 29 rather than Walmart with an expected price-earnings ratio of 27 or Procter & Gamble with a forward price-to-earnings ratio of 25.3. Technology isn’t the only sector hovering around an all-time high. The market is generally more expensive than in recent years, meaning investors must pay for quality one way or another.

Growth is a beautiful thing

The Vanguard Information Technology ETF is the best ETF for the technology sector because of Vanguard’s low costs, large net assets and rock-solid reputation. The fund is a particularly good choice for investors who want more exposure to the entire sector rather than choosing just a handful of popular stocks.

The valuation seems pricey, but if the earnings forecasts are correct, you could say it’s fair or even cheap.

The key takeaway is that earnings growth is the biggest catalyst for a sustained rally and can justify even the biggest gains. Nvidia is a good example as its earnings growth continues to fuel its higher share price. The fact that the stock is up 582% over the past three years but still has a price-to-earnings ratio of less than 40 says a lot about how good earnings growth has been.

All things considered, technology remains a great long-term purchase if you can tolerate the cyclicality of the sector and approach the investment with a time horizon of at least three to five years.

Should you invest $1,000 in the Vanguard World Fund – Vanguard Information Technology ETF now?

Consider the following before buying shares in Vanguard World Fund – Vanguard Information Technology ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $703,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber holds positions in Advanced Micro Devices. The Motley Fool holds and recommends ASML, Accenture Plc, Adobe, Advanced Micro Devices, Alphabet, Amazon, Apple, Arista Networks, Cisco Systems, CrowdStrike, Garmin, Intuit, Meta Platforms, Microsoft, Nvidia, Oracle, Salesforce, ServiceNow , Shopify, Taiwan Semiconductor Manufacturing, Uber Technologies and Walmart. The Motley Fool recommends Broadcom and Helmerich & Payne and recommends the following options: long January 2025 calls of $290 on Accenture Plc, long January 2026 calls of $395 on Microsoft, short January 2025 calls of $310 on Accenture Plc, and January 2026 short calls of $405 on Microsoft. The Motley Fool has a disclosure policy.

This Vanguard ETF just hit an all-time high and continues to outperform the S&P 500 and the Nasdaq Composite over the past three years. Originally published by The Motley Fool