It can be tough for investors to get excited about a company that lost nearly $1.5 billion on its operations in the first half of this year. In fact, the Chinese electric vehicle (EV) maker Nio (NYSE:NIO) has never made a profit.

That explains why the stock has lost more than 80% of its value over the past three years. But there was also some meaningful and positive news in Nio’s second-quarter report. That business momentum has translated into the stock price, as Nio’s American Depositary Shares have risen more than 40% over the past month.

The company’s market cap now stands at around $11 billion, and the EV maker ended the quarter with $5.7 billion in cash and equivalents. That makes now a good time to see what Nio’s next big move will be and whether it’s a stock that should be in your portfolio.

A step towards profit

One of Nio’s most notable achievements in Q2 was significantly increasing its profit margin on vehicles. Vehicle margin, which is based on revenue and costs of new vehicle sales, was 12.2% in the quarter, compared to just 6.2% in the same period last year. That was helped by revenue that nearly doubled from a year ago.

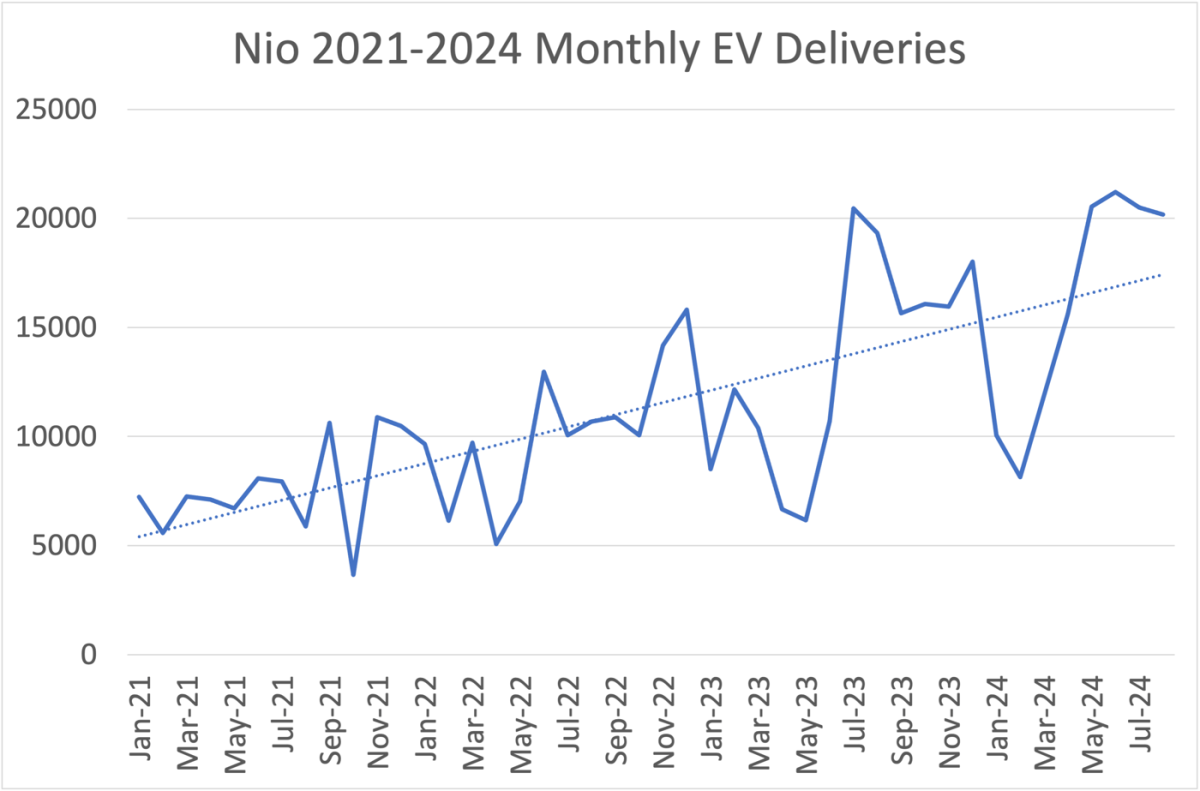

After years of trial and error, Nio appears to finally be on a roll in terms of vehicle production and sales growth. That’s because global competition in the EV sector has increased. Nio sold more than 20,000 EVs for the first time for four consecutive months, helping it gain market share and increase margins.

The company just set a new quarterly record with over 57,000 units shipped. It also gave a forecast for third-quarter vehicle deliveries in a range of 61,000 to 63,000 EVs. Nio CEO William Li noted that the company’s Q2 sales volume helped it secure over 40% of the market share in China for EVs priced above the equivalent of around $42,000. And Nio has a plan to keep expanding. Its focus on the luxury end of the market has helped it compete with the Chinese EV leader by Dwhich has the lion’s share of China’s cheaper electric car market.

Dealing with range anxiety

Nio is a leader in China and elsewhere in expanding battery charging and its unique battery-swapping technology. Nio’s battery-swapping stations give EV buyers the ability to reduce the upfront cost of a vehicle by paying a monthly subscription for its Battery as a Service (BaaS) plan. Drivers can use its swapping stations to replace dead batteries with fresh, charged ones, a process that takes just minutes.

Last month, Nio announced a new plan to strengthen its charging and battery swapping network in China. The “Power Up Counties” plan will accelerate the expansion of those networks.

As of August 31, Nio had more than 2,500 battery swapping stations worldwide, with more than 800 strategically located on China’s highways. With more than 577,000 Nio vehicles on the road, it has performed more than 50 million battery swaps. The new plan will see power swapping stations available in thousands of Chinese countries by the end of next year. It also plans to build a new factory to create up to 1,000 power swapping stations annually.

Mass market brand

Nio’s new Onvo brand will also leverage the expanding charging and swapping networks. Onvo is Nio’s new entry-level EV brand that aims to tap into more mass market and Tesla‘s Model Y. The Onvo L60 mid-size SUV has a starting price of around $30,000.

That brand, combined with Nio’s existing and growing charging technology and infrastructure, could be the next driver for Nio’s business and the stock. Investors willing to be aggressive could add to Nio stock now, ahead of the next phase of growth with Onvo. Otherwise, watch for signs that Onvo is gaining traction to be a bit more conservative and potentially still ahead of Nio’s next big move.

Should You Invest $1,000 in Nio Now?

Before buying Nio stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $722,320!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Howard Smith has positions in BYD Company, Nio and Tesla. The Motley Fool has positions in and recommends BYD Company and Tesla. The Motley Fool has a disclosure policy.

Prediction: This Will Be Nio’s Next Big Move was originally published by The Motley Fool