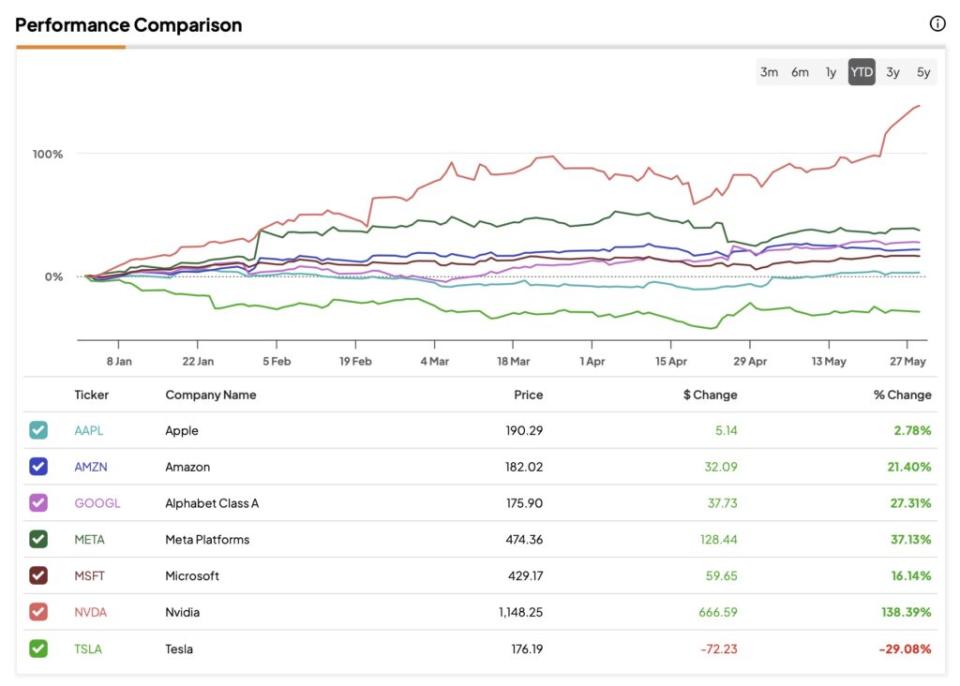

It may seem that the Cupertino-based giant Apple (NASDAQ:AAPL) has fallen behind its Big Tech peers in the race for AI, as the company has posted a modest performance of just 3% this year compared to the “Magnificent Seven” group of leading tech companies. However, there are several reasons that justify my optimistic attitude towards Apple. In this article, I’ll outline three: Apple’s progress in AI, its potential growth in China, and the company’s robust fundamentals and strategic stock repurchases.

AI is finally playing its game on AAPL

Since last year, Apple has taken a number of steps to catch up with its competitors, but the company is still far from the leader. This has sent a bearish wave through the stock, leaving the Cupertino company’s stock price stuck in second gear.

But that doesn’t mean Apple isn’t making progress in AI. The Cupertino-based company has been on a shopping spree, acquiring 32 AI startups in 2023 – more than any other tech giant, highlighting the company’s efforts to expand its AI capabilities. But as the old saying goes, “Rome wasn’t built in a day,” and it seems the market is ignoring this fact as other tech companies seem to be more advanced with their AI developments.

I believe some of the market’s skepticism toward Apple and its early AI efforts has been influenced by the launch of the VisionPro, the “magic” virtual reality glasses powered by AI and machine learning. The VisionPro has received mixed reviews, with some users calling it a dud and others praising its immersive experiences. The steep $3,500 price tag hasn’t helped matters either, making it a tough sell for the average consumer.

Additionally, Apple has faced challenges in production and demand forecasting, with reports of reduced production numbers and waning hype.

In reality, VisionPro was just Apple’s first foray into AI. But Apple has also been working on its own large language models (LLMs) and has even developed a chatbot, although it has yet to define how it will be revealed to the general public. When this model is integrated into the hardware, an important step is taken. This integration is expected to begin with the launch of the AI App Store in June during the prestigious WWDC developer conference.

Eventually, Apple will integrate AI and LLMs into its hardware. There are also big expectations for Siri’s AI capabilities on the device, such as real-time analytics using the iOS 18 camera.

In short, as AI is integrated into Apple’s massive user base of two billion active iPhones, not counting other iOS devices, it’s highly likely that Apple will be taken more seriously about its AI capabilities.

China may be shifting from headwind to tailwind

iPhone demand in China has been a black eye for Apple all year. The iPhone, Apple’s core segment and accounting for 54% of its revenue, has exposed the company’s over-reliance on a single industry.

China is a crucial market for Apple, but local competition, especially from Huawei, is gaining ground. A report earlier this year highlighted that Huawei has eaten into Apple’s market share, leading to a 19.1% decline in iPhone sales in China in the first quarter. Meanwhile, Huawei’s sales rose 69.7%, driven by a significant upgrade to its new smartphone model after months of struggle to obtain parts due to Western sanctions.

However, what currently looks like a black eye may soon turn into a silver lining. Wedbush’s perma-bull analyst Dan Ives suggests that while current economic data in China does not indicate a turnaround, a rise in upgrades could change the story. There are 225 million iPhones in China, and 70% of them have not been upgraded in the last three years. Ives’ theory is that many of these consumers will switch to Pro models, which will increase the average selling price (ASP) of iPhones in China.

Robust fundamentals and share buybacks

In addition to the two reasons mentioned above, I think Apple’s extremely robust fundamentals complete the argument for why Apple stock still has significant upside potential and can bounce back from its lackluster performance so far this year.

First, Apple’s fundamentals remain rock solid. While market fears have dampened hardware demand amid unimpressive economic growth, Apple is far from a struggling company. The service was an important bright spot.

Take the most recent quarter, for example. Despite iPhone sales down 12% year-over-year and product revenues down 10% year-over-year, services revenues increased 14.2% year-over-year, hitting an all-time high. This growth in services helped minimize the overall 4.3% decline in net sales, allowing Apple to exceed market expectations in both earnings per share and revenue.

Since Apple operates in two main segments (products and services), I believe the company’s valuation could see the most growth in this latter segment, especially with the potential AI adoption cycle. The high scalability of the App Store and Apple TV+ further supports this potential.

Moreover, Apple has generated a huge amount of cash over the past three years: $336.6 billion. In addition, the board recently approved another $110 billion in share buybacks, an amount large enough to buy almost all of Lockheed Martin’s stock.NYSE:LMT), to give you an idea.

With this move, Apple has clearly shown its interest in satisfying investors concerned about its share price underperformance this year compared to other major tech companies. As a result, AAPL stock has risen more than 11% since its earnings release, demonstrating its historic ability to bounce back from valuation declines.

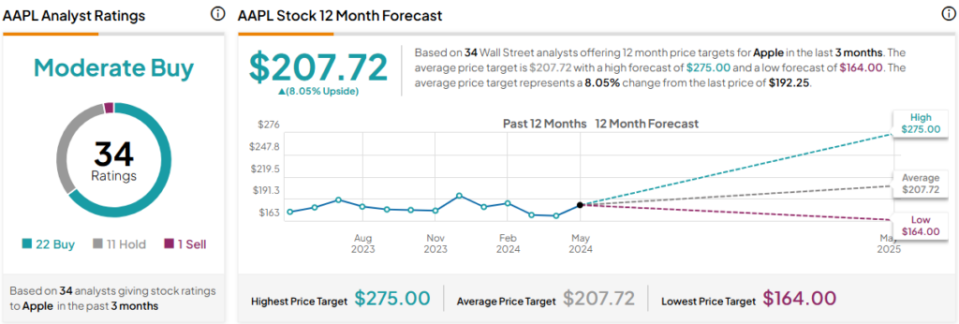

Is AAPL Stock a Buy According to Analysts?

The Wall Street consensus on AAPL stock is largely bullish. Of the 34 Wall Street analysts who have issued recommendations and price targets for the company over the past three months, 22 have issued a buy rating, 11 have a hold rating and only one has a sell rating. AAPL’s average price target is $207.72, indicating 8.1% upside potential.

It comes down to

Despite fears that Apple has missed the AI bandwagon and a number of other headwinds, Apple shares have underperformed compared to their big tech peers. But from my perspective, it’s only a matter of time.

June will be a key month for Apple, especially with advances in AI, which should bring a new cycle of updates to iPhones and potentially mark a turning point for the company.

Given Apple’s extremely solid fundamentals – as evidenced by a monumental buyback announcement and significant growth in services that could be the key catalyst for Apple around AI – I remain bullish on the stock.

Revelation