Chipotle Mexican Grill (NYSE: CMG) has a moment. The company’s shares have been red hot this year and are up about 70% since November last year. And now investors are looking forward to the upcoming 50-to-1 stock split. When the markets open on June 26, shareholders will own fifty times as many shares as they did at the end of trading on June 25, but the price of each share will be about one-fiftieth of what it was before. The stock split won’t change the value of people’s investments or the company’s valuation – at least not on its own.

However, it will make the stock a little more accessible to smaller retail investors, including Chipotle employees. Chief Financial Officer and Chief Administrative Officer Jack Hartung said the move would help the company “reward our team members and allow them to have ownership in our business.” And as stocks become more accessible, demand for them could increase, adding to the momentum behind the stock.

Regardless of the direct and indirect consequences of a split, the question remains: Is Chipotle a good investment at its current valuation?

Impressive growth

Consistently growing revenues, especially at double-digit rates, is one of the surest ways to make Wall Street love a company. Chipotle is doing just that at a time when many of its competitors are struggling. Take a look at this table, which shows Chipotle’s revenue growth over the past five years, compared to McDonald’s (NYSE:MCD) And Yum! To notice (NYSE: YUM)the parent company of KFC, Taco Bell, Pizza Hut and The Habit Burger Grill.

|

Company |

Sales growth 2019 |

Sales growth 2020 |

Sales growth 2021 |

Sales growth 2022 |

Turnover growth 2023 |

|---|---|---|---|---|---|

|

Chipotle |

14.8% |

7.1% |

26.1% |

14.4% |

14.3% |

|

McDonald’s |

(0.5%) |

(10.1%) |

20.9% |

(0.2%) |

10% |

|

Yum! To notice |

(1.6%) |

1% |

16.5% |

3.9% |

3.4% |

Data sources: Corporate documents.

The only year Chipotle didn’t post double-digit percentage growth was 2020. (I think we might know why.) Despite pandemic lockdowns, the company still achieved more than 7% growth in a year when McDonald’s sales were up more than 10 percent shrank. %.

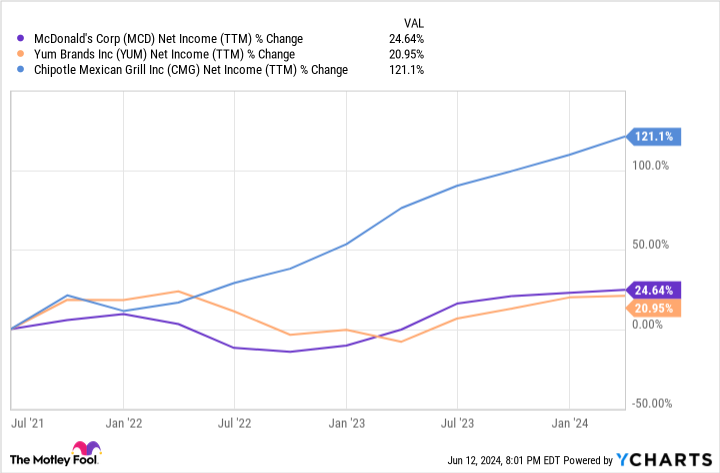

The story is similar for net income. Chipotle has more than doubled its profits since 2021, easily outpacing its peers.

While revenue growth is important to investors, it isn’t everything.

Chipotle’s valuation should give you pause

Chipotle currently trades at a price-to-earnings (P/E) ratio of 67.7. That’s pretty high for the restaurant industry. McDonald’s and yum! both trade at ratios just above 20.

However, investors are often willing to pay a premium for a stock based on expected earnings growth.

To weigh that up, they look at the price-to-earnings-growth ratio (PEG), which you get by dividing the company’s price-to-earnings ratio by its expected growth rate over a given period. This gives a better idea of a company’s value in relation to its expected future profits. In this case, lower (but not negative) is better, and a stock with a PEG ratio of less than 1 is generally considered undervalued.

Chipotle’s PEG ratio is 2.5, which is in line with McDonald’s 2.9 and Yum! Brands’ 2.2. So on a forward-looking basis, it may not be as overvalued as it seems.

Still, a weakness of the PEG ratio is its reliance on earnings growth forecasts; there is no guarantee that these predictions will prove accurate. For example, if the economy turns around and consumers reduce their discretionary spending, restaurant sales will decline. While all three of these companies would likely suffer under those circumstances, a drop in sales could hit Chipotle’s stock harder as it would expose its current overvaluation. Why buy a stock that is trading at a premium if there is no expectation that future earnings will justify it?

It’s also worth considering that Chipotle’s revenues have increased due to the company’s aggressive expansion. Last year alone, the company opened 271 new locations. However, comparable store sales – which do not take into account the impact of adding more stores – grew by only 7.9%. That rate was lower than McDonald’s comps growth of 9%.

Despite the TikTok backlash, Chipotle still appears to be on the right track

Currently, Chipotle is receiving some criticism from social media users who accuse it of reducing portion sizes to maximize profits. In response, some customers have used their smartphones to record store staff preparing their burritos and bowls, in an attempt to prove the claim or prompt employees to be more generous with their buns.

The company, meanwhile, has categorically stated, “There have been no changes to our portion sizes,” adding that management has “reinforced appropriate portion sharing with our employees.”

Whether portion sizes have actually changed may be less relevant than consumer perception – and consumer response. The unrest does not yet seem to have any influence on the chain’s figures, but if it continues like this, it could. Chipotle built its brand in part on burritos that were bursting at the seams.

Regardless of these concerns, Chipotle still seems to be doing a lot right. Given the growth it delivers quarter after quarter and year after year, I’m inclined to look past the high valuation, but I also recommend caution. Keep an eye on the TikTok protests, the company’s response to them, and whether the issue has a material impact on revenue in the coming quarters. But those concerns aside, Chipotle remains a good bet.

Should You Invest $1,000 in Chipotle Mexican Grill Now?

Before you buy shares in Chipotle Mexican Grill, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Chipotle’s Stock Split Is Almost Here: Time to Buy Now Before It Happens? was originally published by The Motley Fool