Let’s talk about technology and investing for the long term. While the mega-cap tech giants are soaking up the headlines and hype, the simple fact is that these companies have already climbed to the very top. If you want to find an investment that will yield big profits in five years, you need to find the companies that are just starting to take off.

The technology sector is a rich field for such a search. Technology stocks are known for their innovation and their position at the forefront of today’s economy, and there are plenty of under-the-radar names showing potential for long-term outperformance. The only trick is to find them.

Analyst Moshe Katri covers the technology sector for Wedbush, and he has delved into the details of some of the smaller tech names, with the aim of finding those ‘diamond in the rough’ stocks that will later support a solid portfolio.

Based on insights from the TipRanks platform, let’s take a deeper look at two such tech stocks and find out why Katri says it’s time to press buy.

Grid Dynamics Holdings (GDYN)

First up is a small-cap technology company, Grid Dynamics. This company offers a range of services, all aimed at enabling its clients to grow their business. Founded in 2006, this cloud-native company has been developing cloud technology solutions since before the term “cloud” came into common use. Grid offers a combination of advice and technical insight, developing its solutions along a clear path: analysis, design, prototyping, implementation, culminating in running the product.

For customers, this means that solutions are tailored to the problem or situation, so that they fit the customer’s needs as they define them. For Grid, this means that its services are in high demand, from big names like Google, Verizon and Tesla. The company’s services are available through a network of 25 offices in 13 countries, and Grid has a presence in major business and financial centers such as New York and London, as well as setting up technical facilities in emerging hotspots in India. .

On the financial side, Grid recently announced its Q1 24 results. These showed total revenues of $79.8 million, a figure that remained stable year-on-year, although up 2.2% on the previous quarter. Ultimately, the company’s non-GAAP earnings were $5.2 million, or 7 cents per share. These earnings per share were deemed to be in line with pre-release estimates.

For Katri, when setting out the Wedbush vision for Grid, a key point is the high growth potential of the company’s various business units. Impressed by Grid’s strong positions in key vertical markets, Katri writes: “We believe the company’s excessive exposure to retail (33.2% of CY23 revenue) and TMT (31.3%), that impacted growth in CY23 could come in handy in CY24. , as funding for new programs in these areas gradually improves. We believe the company is well positioned to deliver mid-single-digit and mid-double-digit revenue growth in CY24 and CY25 respectively, with expanding EBITDA margins.”

Katri also notes that Grid has a track record of success in AI technology, which will shape the technology world in the future. She adds about the company: “Looking at AI, Grid has more than seven years of experience delivering enterprise-level AI solutions for world-leading companies across multiple verticals… GDYN has successfully deployed solutions on the areas of customer intelligence, pricing and supply chain, IoT, product discovery and risk management.”

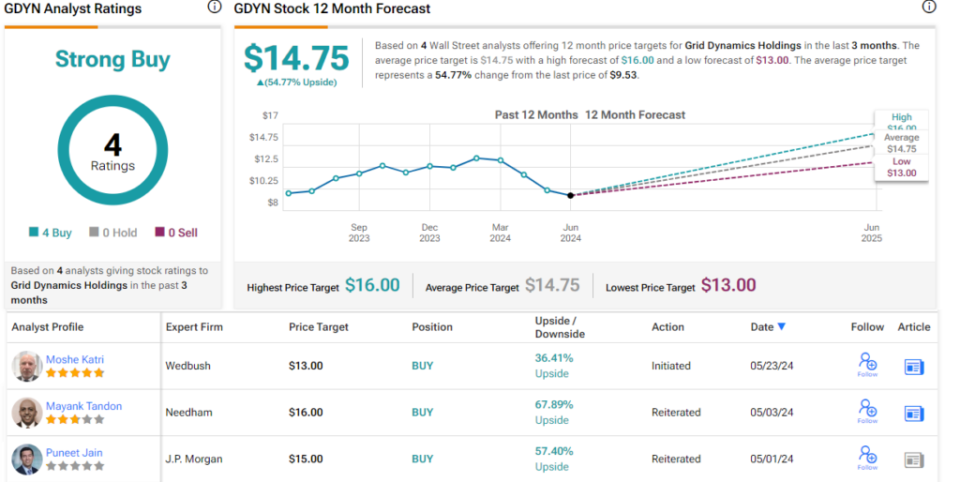

Overall, the analyst gives an Outperform (Buy) recommendation for GDYN, and his $13 price target implies a 36.5% one-year upside potential for the stock. (To view Katri’s track record, click here)

Although there are only four recent analyst ratings on record for Grid Dynamics, they are all positive, making the Strong Buy consensus rating unanimous. The stock is selling for $9.53, and the average price of $14.75 suggests a 55% gain is in store for the next year. (To see GDYN stock forecast)

Toast (TOST)

Next on our list of Wedbush tech picks is Toast, an interesting company bringing leading technology to the kitchen. Specifically, Toast has developed a software platform optimized for the foodservice and restaurant industries, with features to streamline everything from inventory to point of sale and employee payroll. Toast’s insight was that foodservice has many of the same problems as retail, but adds issues like time-sensitive warehousing, high overhead due to expensive, energy-intensive equipment (think refrigerated warehouses), and the need to keep customers moving. hold. through the system. Toast’s platform is tailored to these industry-specific needs.

The benefits of the Toast platform come in the form of ‘friction-free’ operations on the user side, along with a fully scalable, cloud-based system that can adapt and grow to the specific requirements of the individual end user. Toast has found applications and acceptance across a range of food service providers, from neighborhood bakeries to craft breweries, corner food trucks, fine and casual dining, upscale hotel bars and even factory-scale food production facilities.

In its recent Q1 24 financial release, Toast reported some impressive numbers. The company’s total revenue rose nearly 32% year over year to nearly $1.08 billion, beating forecasts by $40 million. The result suffered a bit; the company suffered a net loss of 15 cents per share by GAAP standards, a loss that was 1 cent larger than expected.

Three other metrics will show how Toast is experiencing rapid growth. As of March 31, the company’s annual recurring revenue, or ARR, was up 32% year over year to $1.3 billion. The company saw gross payment volume increase 30% year over year to $34.7 billion. And Toast saw its platform usage expand to 112,000 locations, up 32% year over year.

And with that background, it stands to reason that Moshe Katri’s description of Toast’s stock for Wedbush is both short and sweet, boiling down to a simple conclusion: “Given TOST’s robust location expansion in the US (as well as its burgeoning success in abroad) and Given recent improvements in operating and financial metrics, we believe the company is well positioned to deliver 30%+ annualized gross profit and adjusted EBITDA growth in CY24 and CY25 respectively.”

Katri complements these comments with an Outperform (Buy) rating, and he gives it a $30 price target, indicating upside of 36% over one year.

That’s the bullish view. Wall Street is generally not as bullish, although TOST stock does have a consensus rating of Moderate Buy. This is based on 19 recent stock reviews, split into 8 buys, 10 holds and 1 sell. The stock is priced at $22.02 and the average price target of $26.75 indicates room for 21.5% appreciation this coming year. (To see TOST stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.