The S&P500 (SNPINDEX: ^GSPC) The index just hit an all-time high, buoyed by tech heavyweights and hopes for rate cuts. Still, some rock-solid dividend stocks that make up the S&P 500 index are still far from their all-time highs, offering investors an excellent buying opportunity.

These great dividend stocks can not only generate decades of passive income for you, but even help you build wealth. For example, two such stocks have generated total returns of almost 60% each over the past five years. Here’s why you might want to buy these two S&P 500 dividend stocks now and hold them forever.

37 years of consecutive dividend growth

Chevron (NYSE: CVX) has become one of the most affordable dividend stocks in the energy sector. Despite the inherent volatility of oil and gas prices, Chevron has not only paid a dividend for decades, but has raised it for 37 years in a row.

Chevron reported its highest production in history in 2023, driven in part by its acquisition of PDC Energy last year in an all-stock deal worth $7.6 billion. However, the oil and gas producer is also expanding capacity in the Permian Basin and has already started 2024 well, with a 12% year-over-year increase in production in the first quarter. At this rate, 2024 should be another record production year for Chevron.

Importantly, even as Chevron continues to invest in growth, it has returned a record $26.3 billion in cash to shareholders in 2023, including $11.3 billion in dividends. Chevron also recently announced an 8% dividend increase for 2024, compared to a 6% increase in 2023.

A strong case can now be made in favor of buying Chevron stock: the company expects to grow its annual free cash flow (FCF) by almost 10% through 2027 at a Brent crude oil price as low as $60 per barrel. Brent crude is hovering around $83 per barrel at the time of writing. Chevron has also improved its return on capital employed (ROCE) in recent years, which reflects management efficiency as ROCE shows how much money a company makes on all the capital it has put into its operations, including debt.

But despite such a solid profile, Chevron stock is down nearly 19% from its all-time high and is yielding 4.3%, compared to the S&P 500, which is yielding 1.3%. That makes Chevron one of the few S&P 500 dividend stocks you can buy now and hold forever.

A no-brainer dividend growth stock to buy

NextEra Energy (NYSE: NO) is one of the largest renewable energy companies in the US. However, the company stands out from the rest of the clean energy players due to two factors.

First, NextEra Energy is the world’s largest producer of wind and solar energy, as well as a leading battery storage company. Second, the company also owns and operates the largest electric utility in the U.S., Florida Power & Light (FPL) Company, which provides electricity to nearly 12 million customers throughout Florida. The two factors together make NextEra Energy a dividend powerhouse, as the utility business offers stability while the renewable energy side offers growth.

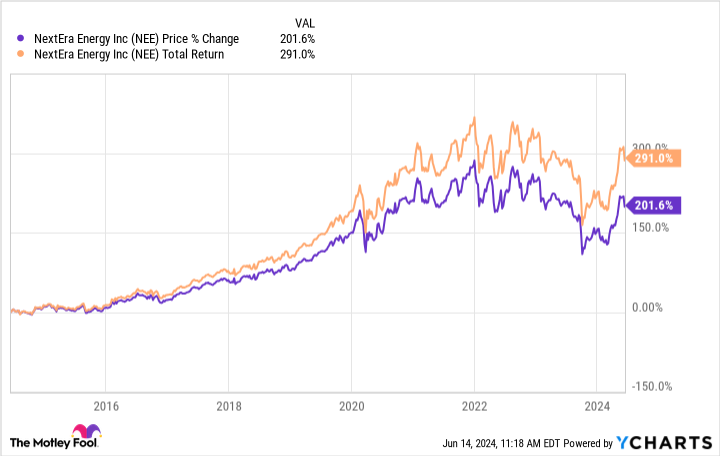

NextEra Energy’s achievements over the years are nothing short of impressive. Adjusted earnings per share (EPS) and operating cash flow have grown at compound annual growth rates (CAGR) of 8% and 9%, respectively, over the past decade. Therefore, the company was able to grow its dividend per share at 10% CAGR over the period.

It’s no surprise, then, that the stock has become a winner over time: If you had invested $10,000 in NextEra Energy stock a decade ago, you would have nearly quadrupled your investment, including dividends.

Here’s why NextEra Energy is such a solid dividend stock to buy today: Despite expected steady earnings and dividend growth, the renewable energy stock is down nearly 22% from its all-time high even now the S&P 500 reaches record highs.

At Investor Day 2024, held on June 11, NextEra Energy reiterated its target of growing adjusted earnings per share 6% to 8% through 2027 and growing annual dividend per share approximately 10% through at least 2026 , driven by huge investments in both activities. . NextEra Energy expects to own nearly 81 (gigawatt) GW of renewables and storage capacity by 2027, which is more than double the current clean energy portfolio in use.

The 2.8% yield on NextEra Energy stock may not be high, but the dividend growth alone could make you rich if you buy and hold this stock forever.

Should You Invest $1,000 in NextEra Energy Now?

Consider the following before purchasing shares in NextEra Energy:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Chevron and NextEra Energy. The Motley Fool has a disclosure policy.

2 Great S&P 500 Dividend Stocks Down 19% to 22% to Buy and Hold Forever originally published by The Motley Fool