The stock market continues to boom this year, with the S&P 500 up nearly 13% and the NASDAQ up 16%. Like last year, mega-cap tech stocks led the gains, providing a positive boost to the markets as a whole.

But the tech giants are not the whole story. Investors will find good news in several other areas, including the outlook for the Federal Reserve’s interest rate policy. Inflation remains stubborn, but the general expectation is that the Fed will provide broad economic support with interest rate cuts later this year.

The investment bank UBS takes these points – the strong technology performance and the Fed’s outlook – and builds an overall positive view, predicting solid market growth.

“We continue to view the current environment as supportive for US equities, driven by solid earnings growth, a potential Fed turn later this year and accelerating AI investments,” UBS’s chief investment office said. “Overall, we maintain our 9% earnings growth forecast for the S&P 500 this year. We remain of the view that US interest rate cuts are likely to be postponed rather than canceled. We see two 25 basis point cuts this year, most likely starting in September.”

Against this backdrop, UBS stock analyst Roger Boyd has fallen sharply after buying two tech stocks ‘on the dip’. That is, while their stock prices have fallen. These stocks are down, but not out yet, and as Boyd notes, they’re worth investors’ interest. We used the TipRanks platform to look up the broader picture on each of them, and found that they have Buy ratings and solid upside potential versus the rest of the Street. Here are the details.

SentinelOne (S)

The first is SentinelOne, a cybersecurity company dedicated to protecting the critical digital infrastructure on which today’s network systems depend. SentinelOne offers enterprise customers a security platform optimized for business needs – bringing all digital security features into one interface. It is a single cybersecurity platform that consolidates products and business functions to maximize value. The company estimates that its customers achieve a 66% reduction in security costs while increasing efficiency by 90%.

SentinelOne’s platform allows users to protect endpoints, securely manage assets, and prevent attackers from gaining access; to secure cloud operations, a natural weak point in cybersecurity; and to strengthen identities, reduce risk on active directories, detect and stop credential misuse, and prevent unauthorized lateral movements. Together, these features provide solid digital protection for business PCs, mobile devices, and IoT—any set of devices that can connect to a network and generate, send, or receive information.

No cybersecurity company can be comprehensive unless it stays at the forefront of today’s technology – and that means using AI effectively. SentinelOne offers its own Purple AI, an AI-powered security analytics software designed to enable earlier detection and faster response, so users can stay ahead of any potential attacker. According to the company, early adopters of Purple AI reported 80% faster threat detection.

All this results in a solid online security company. Nevertheless, S shares suffered a decline this year (down 37% year-to-date), with a big decline coming after the company’s Q1 25 fiscal report disappointed with its future expectations .

So what did the Q1 report say? The immediate quarterly financial results were better than expected. Revenue rose more than 39.7% year-over-year at $186.4 million and exceeded forecasts by $5.3 million. The bottom line – non-GAAP EPS – came in at a flat zero, breakeven, but that was 5 cents per share better than expected. Annualized recurring revenue, or ARR, was up 35% year-over-year to $762 million as of April 30 this year, and the company reported a 30% increase in the number of customers with an ARR of $100,000 or more.

But the company has scaled back revenue expectations for fiscal 2025, cutting it from a range of $812 million to $818 million back to a range of $808 million to $815 million. The new guidance compares unfavorably to the company’s fiscal 2025 consensus guidance, which forecast revenue of $817.28 million.

Looking at the view of UBS and analyst Roger Boyd, we see that he is optimistic about S, despite lowered expectations. Rather than pull back, Boyd would use the lower share price to buy, writing: “Even with CY24 ARR estimates down 2%, S remains one of the cheapest stocks on a growth-adjusted basis at ~0 ,20x EV/S. /G for both CY24 and CY25 estimates. While the company appears limited by its drive for profitability (single digit opex growth), it remains a technology leader and strategic asset in our view. The company seems to have particular momentum around its Purple AI offering, which attracted a lot of attention at RSA, and early customer feedback appears to support the claims around automation.”

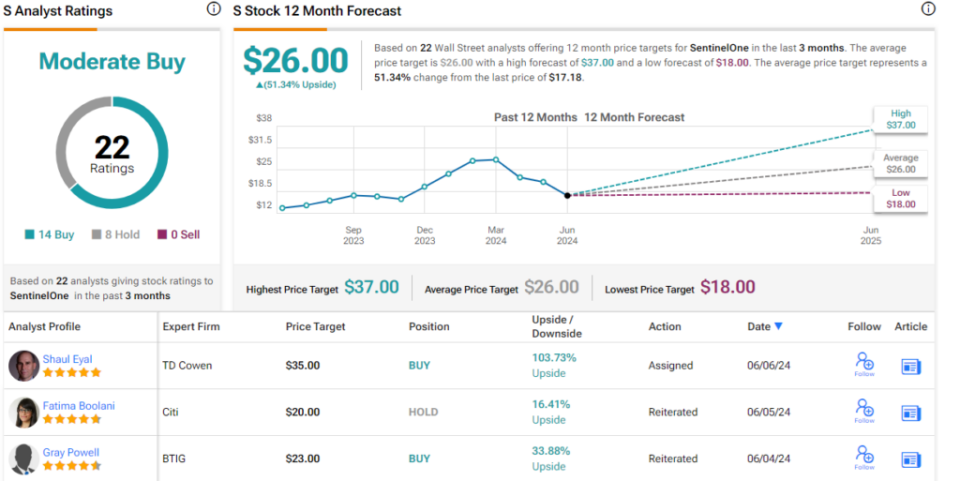

Boyd then rates S shares a Buy, with a $27 price target implying 57% one-year upside potential. (To view Boyd’s track record, click here)

Wall Street gives this cybersecurity company an overall Moderate Buy rating, based on 21 recent recommendations, including 14 for Buy and 8 for Hold. The shares are priced at $17.18 and their average price target of $26 suggests a 51% upside over one year. (To see SentinelOne’s stock forecast)

Zscaler (ZS)

The second UBS pick we’ll look at is Zscaler. This company calls its cloud-native network security platform the ‘Zero Trust Exchange’,‘ a name that summarizes the approach to cybersecurity: no trust without verification. The platform provides “any-to-any” security for cloud networks, designed, in the company’s words, to “securely connect individual users, devices and applications.” Zscaler Exchange can connect any device or app, from anywhere, to both internal and external apps, while providing solid protection for the user’s system and networks at any scale.

Some of the numbers show the scale of the job and underline the extent of Zscaler’s success in the industry. The company monitors more than 400 billion daily online transactions and prevents more than 9 billion security incidents and/or policy violations every day. The platform also monitors more than 500 trillion signals every day for AI and machine learning effects, in short, and teaches itself how to monitor the online and cloud security environment more effectively. The company has more than 7,500 customers, including many of the companies on the Forbes Global 2000 list.

While cybersecurity is in high demand, Zscaler shares are down 29% in 2024 from their peak earlier this year. That said, shares have recently risen in value following the release of fiscal third quarter results May 24-30.

Those results were solid. Zscaler’s revenue for the quarter was $553.2 million, up 32% year over year – and exceeded forecasts by more than $17 million. Non-GAAP earnings per share were 88 cents per share, a full 23 cents above expectations. Another metric that bodes well for the future was deferred revenue, or backlog; this was reported as $1.577 billion on April 30 this year, a figure that was 34% higher than the previous year. Calculated billings in the fiscal third quarter increased 30% year over year to $628 million. Finally, Zscaler ended the quarter with deep pockets, reporting $2.24 billion in cash and other liquid assets.

Scanning the results, while being aware of where issues will arise in the future, UBS analyst Boyd takes a positive stance, writing: “ZS reported strong F3Q results that were above expectations, with billings growth of 30% and other profitability figures that were significantly above expectations. The initial FY25 guidance of billings growth of roughly 20-21% should allay investor concerns about revenue; However, the debate from here is likely to focus on the upside margin after the FY25 profitability outlook looks a bit bleak. That said, results were much better than feared, and with the impressive revenue performance and improving GTM execution commentary against a still-tough macro, we have become incrementally more positive following the push.”

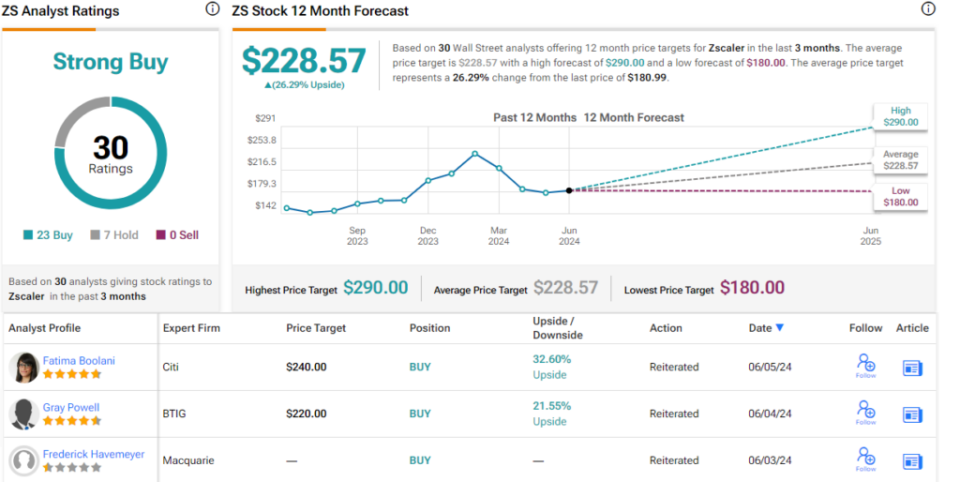

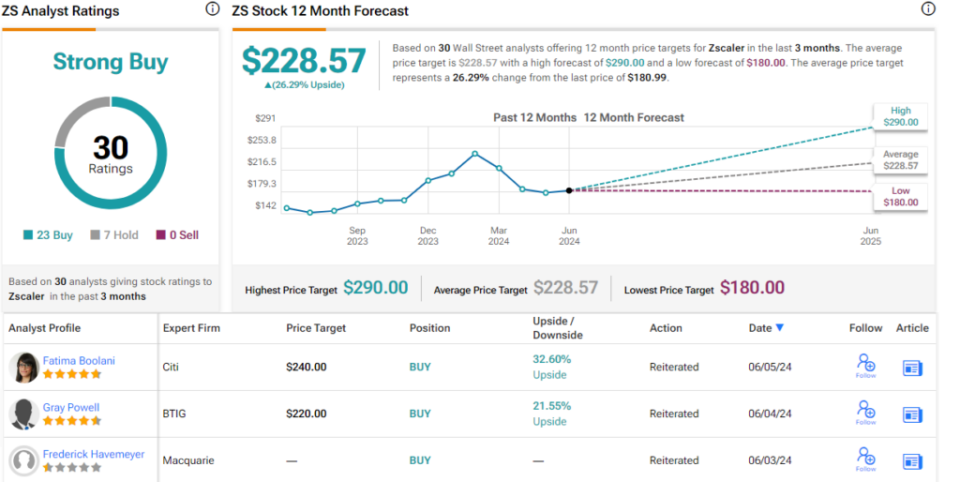

Boyd takes his “incrementally more positive” view and uses it to give a buy rating here, while his $270 price target shows he’s confident of a 49% upside over the next twelve months.

UBS’s view here is more optimistic than the overall Street view – which is already decent enough. ZS stock has a Strong Buy consensus rating, based on 30 recent reviews, including 23 for Buy versus 7 for Hold. The shares are priced at $180.99 and have an average price target of $228.57, implying a one-year upside potential of 26%. (To see ZS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.