In a year where virtually every company involved in artificial intelligence (AI) saw its stock price soar, UiPath (NYSE: PAD) has done the opposite. 2024 has been a disastrous year for investors so far, with stocks down 49%.

While the lion’s share of this decline followed the last earnings announcement on May 29, the stock had been falling steadily leading up to that report. However, the sell-off is far too exaggerated and the stock is an attractive value at this point.

UiPath Integrates AI with Its Core Offerings

UiPath offers its customers robotic process automation (RPA) software. In other words, it helps users automate repetitive tasks, thereby improving productivity and employee morale in the process.

Strictly speaking, UiPath isn’t an AI company, but it does have several AI applications that enhance the functionality of its product. And it has add-ons that can mine data from digital communications and understand legal documents, as well as a generative AI feature that can create responses to product questions.

The use of RPA software is expected to grow significantly in the coming years. According to Grand View Research, the global RPA market opportunity will grow from approximately $3 billion in 2023 to nearly $31 billion in 2030. That’s a significant increase, and UiPath is well-positioned to capture its share of the market.

However, UiPath’s long-term outlook didn’t seem to matter much after the company released its earnings report for the first quarter of fiscal 2025.

Q1 earnings report was a disaster for UiPath

For UiPath, a key metric that investors watch is annualized renewal run-rate (ARR). While revenue is still a useful figure, it’s skewed by quarter-over-quarter changes that occur when a customer launches a new product, as UiPath provides the technical support to get them up and running. Instead, ARR represents the annualized value of billings for subscription customers.

In March, management forecast ARR of $1.508 billion to $1.513 billion for the first quarter. Actual results came in at the lower end of that range, with ARR of $1.508 billion. While disappointing, management’s decision to lower its full-year outlook was even more concerning. UiPath is cutting its previous ARR forecast of $1.725 billion to $1.730 billion to a range of $1.660 billion to $1.665 billion.

This implies full year ARR growth of 14% instead of 18%. Furthermore, management lowered its full year adjusted operating income forecast from $295 million to just $145 million.

In addition to these downward revisions to the guidelines, UiPath made a major change to its leadership. CEO Rob Enslin stepped down after just four months in the role. He had previously served as co-CEO with founder Daniel Dines for nearly two years. Dines replaces him, but the market has been hurt by the uncertainty in the executive team.

The combination of updates sent UiPath shares down 34% the day after the earnings announcement.

But have investors gone too far? I think so.

While there are good reasons to be concerned about the CEO shakeup and the latest guidance, I think the company is being extremely conservative. In the earnings call, management said it saw a lot of variability in Q1 deals and wanted to be cautious about its outlook. This could set the stage for a beat and a raise in fiscal Q2.

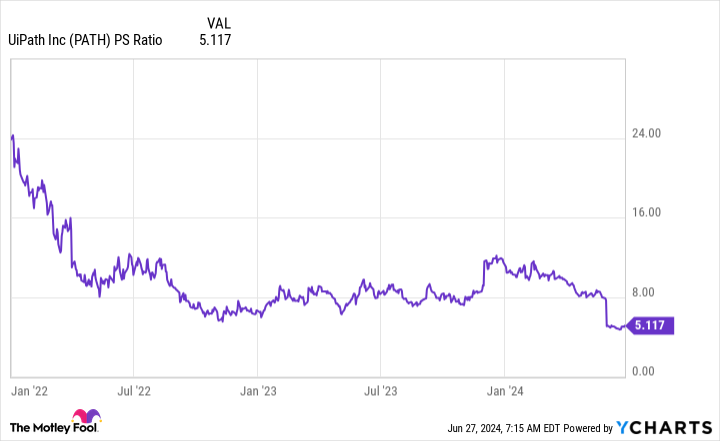

Meanwhile, the stock is trading at its lowest valuation ever. Investors are overlooking the fact that this is still a company growing at a healthy pace, and the RPA market should grow rapidly over the next decade.

With that in mind, this stock is too cheap to ignore and investors should consider buying shares before the recovery sets in.

Should You Invest $1,000 in UiPath Now?

Before you buy shares in UiPath, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Keithen Drury has positions in UiPath. The Motley Fool has positions in and recommends UiPath. The Motley Fool has a disclosure policy.

UiPath Stock Is Down 49% This Year. Here’s Why It’s Time to Double Down. was originally published by The Motley Fool