There’s no denying it: the stock market is red hot. The S&P500, Nasdaq CompositeAnd Dow Jones Industrial Average have increased by approximately 25%, 31% and 13% respectively over the past twelve months. Many individual stocks have risen even further.

But the thing is: touching red-hot objects can burn you.

So, is this the time to stock up or play it cool? This week, a panel of Motley Fool contributors examined three of the hottest stocks on Wall Street: Amazon (NASDAQ: AMZN), CrowdStrike (NASDAQ: CRWD)And Nvidia (NASDAQ: NVDA).

Amazon is up 45% in the past year. Here’s why it could go higher.

Justin Pope (Amazon): Shares of cloud and e-commerce giant Amazon are up 45% over the past twelve months, outperforming the S&P 500 by a comfortable margin. But at a time when many stocks have surpassed their fundamentals and could face headwinds, Amazon could be willing to go the extra mile.

Amazon’s culture is perhaps my favorite part of the company. It ruthlessly invests profits into the business to grow, always looking for the next big thing.

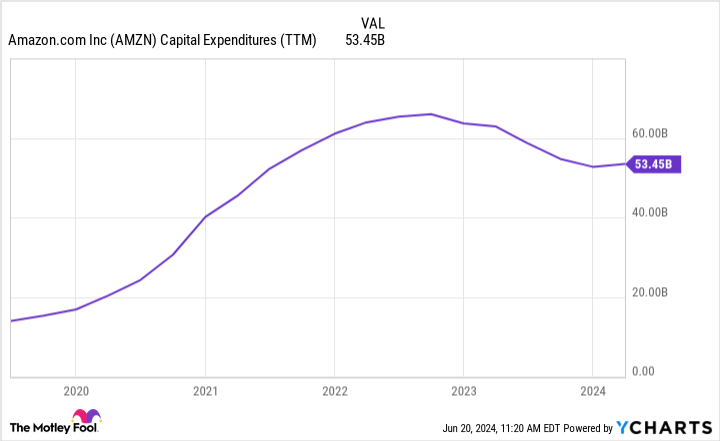

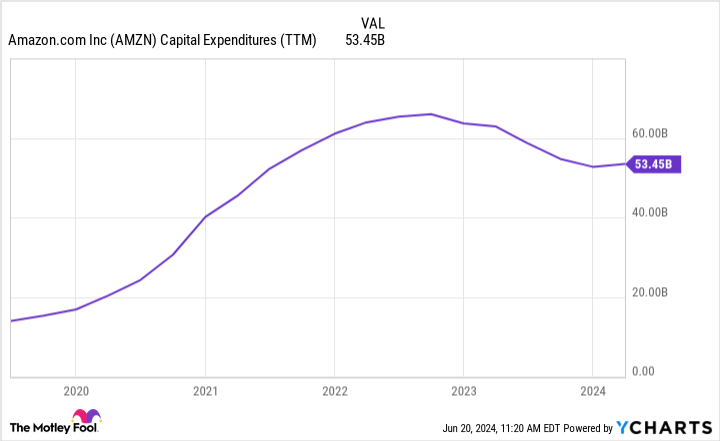

The pandemic has depressed demand for e-commerce and digital services, impacting Amazon’s core retail and cloud businesses. The company stepped up and invested significantly in expanding its supply chain capacity and cloud capabilities. You can see that Amazon has spent tens of billions of dollars on capital expenditures in recent years:

Now Amazon is starting to see a return on all that invested capital. Cash flow from running the business is at a record high, and profits are poised for a period of rapid growth. Analysts believe the company can grow earnings an average of 30% per year for three to five years. Meanwhile, the shares are trading at “just” 39 times earnings today. In retrospect, that valuation will seem like a bargain if Amazon’s earnings growth meets expectations.

Over the years, Amazon has shown that it will continue to get into trouble by investing in itself. Not every Amazon project will be a home run, but long-term investors can safely put their money behind such a management team. Fortunately, even if you’re relatively new to the stock industry, you may not have to wait long for stocks to create shareholder wealth. The stock’s 45% run is remarkable, but the reality is that more could follow.

CrowdStrike’s run is cause for celebration and concern

Will Healy (CrowdStrike): Perhaps no cybersecurity stock has benefited more from the artificial intelligence (AI) boom than CrowdStrike. The endpoint security specialist is up 151% in the past year as it capitalizes on the threats and functionality that emerging technology brings. Amid this surge, the company will become the newest member of the S&P 500 on June 24.

CrowdStrike’s Falcon platform has long been a leader in endpoint security, a segment focused on protecting laptops, smartphones, servers and other devices.

Additionally, the company offers what it claims is the most complete AI-native defense, using the most reliable security data to train its AI models. The more the models are trained, the better they become at defending customer networks.

CrowdStrike has also maintained growth in an environment where customers increasingly deal with just one cybersecurity vendor. Management said based on first-quarter 2025 earnings results (ending April 30), 65% of its customers have purchased five or more of its modules. Also, deals involving eight or more modules rose 95% in the quarter, a factor that could indicate market share is rising.

The question for potential buyers is whether they waited too long to buy the shares. First-year revenue grew 33% year-over-year to $921 million, slower than the 36% increase in fiscal 2024. If fiscal 2025 revenue reaches the midpoint of the expected $3.97 billion to $4.01 billion , it will slow down to 30%.

That slowdown in sales growth may prompt investors to question the high sales figures. CrowdStrike’s price-to-sales ratio (P/S) now stands at 29, well above the average P/S ratio of 20 over the past year and about 10 times the average sales multiple of 2.9 for the S&P 500. Such valuations increase the risk of a decline in the share.

Admittedly, a high price-to-earnings ratio does not undermine the longer-term bull thesis. Nevertheless, investors should probably wait for a lower sales multiple before putting more money to work in CrowdStrike.

Nvidia has climbed the mountain and is now the most valuable company in the world

Jake Lerch (Nvidia): With a 226% increase in the past twelve months, Nvidia’s recent rise will go down in history. The company recently surpassed Microsoft to become the most valuable company in the world, with a market capitalization of more than $3.4 trillion.

Still, the question for many investors is whether Nvidia’s rally can continue. Could be a stock that has already risen more than 10x in less than two years Real be a smart long term investment?

To answer this question, you have to dig into the numbers – and they are eye-popping.

Let’s start with Nvidia’s earnings. The company’s revenue over the past twelve months has more than tripled, from a low of $26 billion to almost $80 billion. Moreover, revenue estimates continue to skyrocket. For Nvidia’s current fiscal year (ending January 28, 2025), analysts forecast $120 billion; sales estimates rise to $160 billion the following year. In short, Wall Street expects the company’s revenue total to be roughly six times larger by 2026 are 2022 total.

So despite the company’s impressive revenue and high expectations for future revenue, Nvidia stock is still ahead of the numbers. This is easy to see when you look at the stock’s price-to-sales ratio (P/S), which is approaching its all-time high of 46x.

But while the stock’s high valuation is notable, it doesn’t mean Nvidia isn’t a great long-term investment. Remember, the reason the company’s sales are soaring is because Nvidia’s products are, too most wanted hardware worldwide. They help shape advanced technology that is driving the AI revolution.

If you believe AI is the technology that will dominate for the next 10 to 20 years, investing in Nvidia today – even with its high valuation – still makes sense.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions at Amazon, CrowdStrike and Nvidia. Justin Pope has no position in any of the stocks mentioned. Will Healy holds positions in CrowdStrike. The Motley Fool holds positions in and recommends Amazon, CrowdStrike, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Up 45% to 226%: Are These Three Stocks Too Popular to Buy Now? was originally published by The Motley Fool