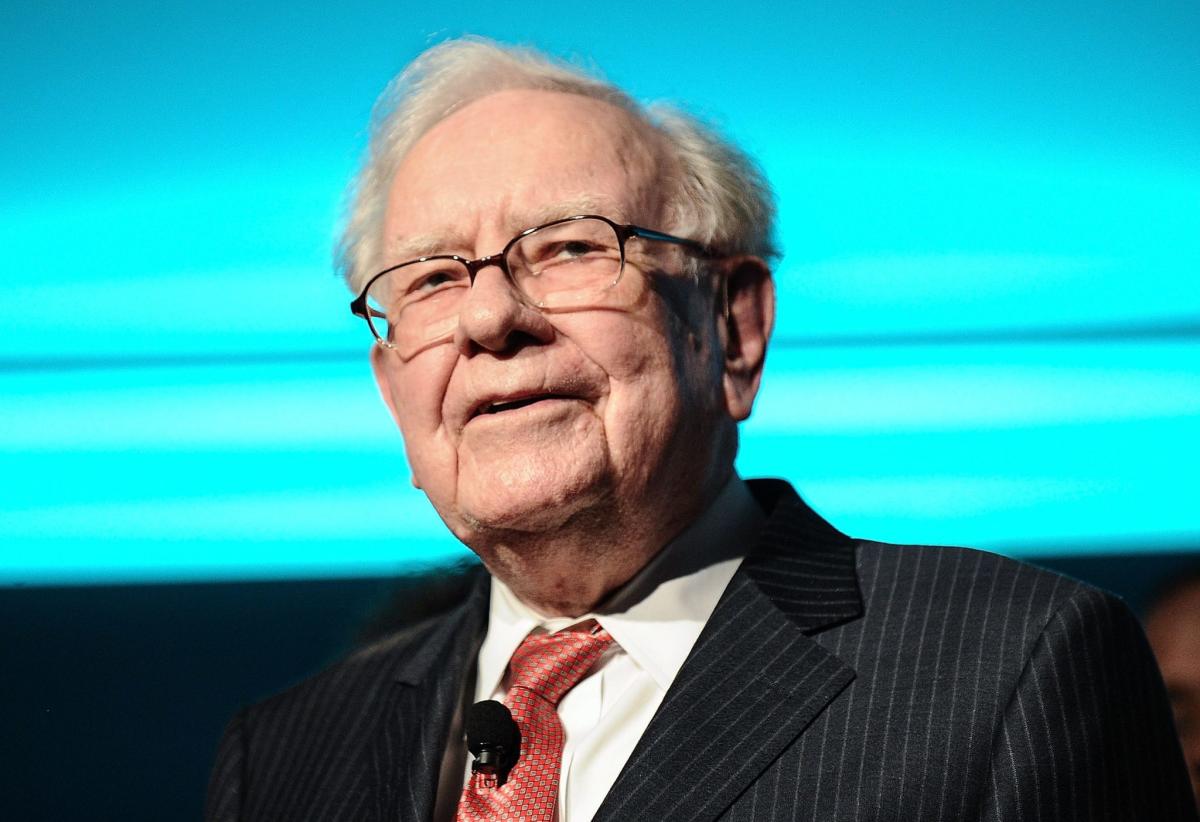

The Oracle of Omaha has set his sights on the oil industry. Berkshire Hathaway, the holding company backed by investment titan Warren Buffett, has increased its stake in Houston-based Occidental Petroleum, buying up shares over the past nine trading days to bring its ownership to nearly 29% of the company, filings show SEC.

The recent buying spree has been years in the making for Berkshire, which partnered with Occidental to finance an acquisition in 2019 and won regulatory approval to buy up to 50% of Occidental in August 2022, when it still held about 20% had in hand. At the time, financial experts predicted a takeover was likely, although Buffett told Berkshire’s annual shareholder meeting in May 2023 that it would not take control. “We wouldn’t know what to do with it,” he said.

While Berkshire hasn’t completely swallowed the oil and gas giant yet, it does own about 7.3 million shares, with the stock price rising from less than $60 on June 5 (the first day of nine buying days) to about $61 .20 at the time of the takeover. publication. In an earlier interview with CNBC, Buffett said he became interested in Occidental after reading a transcript of the company’s earnings call. “I read every word, and this is exactly what I would do,” he said.

The reasons for Berkshire’s interest are not clear, beyond its existing relationship with Occidental. “That’s a question people have been asking for a while,” said Leo Mariani, senior energy analyst at brokerage firm Roth Capital. “I’m not sure anyone has the perfect answer.”

Check out this interactive chart on Fortune.com

‘They have a history there’

Occidental might not seem like a natural target for Berkshire, which is known for its huge positions in popular stocks like Apple and Coca-Cola. Occidental is far from the only stake in the energy sector, however, as it owns about 7% of Chevron, although the investment giant cut its stake earlier this year. Berkshire has also cut its stake in Chinese electric vehicle company BYD, which has owned about 7% of the manufacturer since October and has sold about 1% of its total outstanding shares.

Greggory Warren, a senior equity analyst for Morningstar who covers Berkshire Hathaway, said that Buffett’s recent buying spree in Occidental is unlikely to reflect a broader strategy toward the energy sector, and that the company has been wary of BYD due to concerns about China’s market. .

Founded in 1920 and later led by legendary businessman Armand Hammer, Occidental expanded its operations around the world, from Venezuela to the North Sea. Occidental’s current CEO is Vicki Hollub, who took over in 2016 and became the first woman to lead a major U.S. oil company. Its early years were marked by a collapse in crude oil prices, and Hollub was forced to cut costs and withdraw from non-core regions in the Middle East and North Africa. In Buffett’s interview with CNBC, he said Hollub is “running the company the right way.”

Berkshire Hathaway’s relationship with Occidental began in 2019, when it committed $10 billion to the company’s cash-and-stock bid for rival petroleum company Anadarko and won the right to buy Occidental stock. Three years later, Berkshire Hathaway received regulatory approval to purchase up to 50% of the company.

Mariani speculated that Berkshire Hathaway wants more oil exposure and went with a company it knew. “I’m just going to put it down to the fact that they have had a history there for a number of years and are familiar with the company,” Mariani said. Fortune.

He added that Occidental’s differentiation from other oil and gas companies comes from its investments in carbon capture, or removing carbon dioxide from the environment, and specifically direct air capture. While Mariani said decarbonization is a costly process that will likely lose money in the coming years, Occidental could find a customer base among companies like airlines that try to be “corporate citizens.”

Warren, the Morningstar analyst, said Occidental’s appeal is instead driven by Buffett’s desire to diversify his portfolio, and the fact that Berkshire Hathaway has already received regulatory approval to pick up more shares in Occidental . “The things Berkshire buys at this scale are more a function of what they can buy, rather than big preferences one way or another,” he said. Fortune. “Their opportunities are somewhat limited by the size of their portfolio.”

Despite Buffett’s interest in Occidental, the prospects are not entirely rosy. In early May, Morningstar published a research note lowering the fair value of Occidental’s stock by 7% to $53 per share, due to lower oil prices. The analysts also pointed to slow progress on Occidental’s planned acquisition of shale oil producer CrownRock, which the company hopes to complete in August.

This story originally appeared on Fortune.com