For the better part of sixty years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is one of Wall Street’s most respected investors. Overseeing a cumulative return of more than 5,650,000% in Berkshire’s Class A shares (BRK.A) since becoming CEO has earned Buffett a considerable following, as well as the nickname “Oracle of Omaha.”

Professional and casual investors alike regularly await Berkshire Hathaway’s quarterly Form 13F filing to get a sense of what sectors, industries, trends and stocks Buffett and his top lieutenants, Todd Combs and Ted Weschler, bought and sold last quarter.

Sometimes Berkshire’s quarterly results, or Form 4 filings with the Securities and Exchange Commission, can tell a more comprehensive story, even if that story is unpleasant.

Warren Buffett has been a net seller of stocks over the past two years

Perhaps the best thing about Warren Buffett is that he is usually an open book. While there have been a few occasions when he and his team have built a significant position in a stock using confidential treatment — underwriter Fatty is the most recent example: Buffett is generally outspoken about his thoughts on the US economy and the stock market.

On more than one occasion, the Oracle of Omaha has warned investors not to bet against America. While Buffett, Combs and Weschler are fully aware that recessions are perfectly normal and inevitable, they also realize that periods of economic growth and bull markets substantial last longer than recessions and bear markets.

Despite this stance, what Warren Buffett does on shorter timelines doesn’t always align with the long-term ethos that he and former right-hand man Charlie Munger established at Berkshire Hathaway. Munger died in late November at the age of 99.

Buffett has been a rather aggressive seller of late Bank of America (NYSE: BAC) shares. Between July 17 and August 30, Berkshire’s stake in BofA fell by about 150 million shares, or about $5.4 billion.

This $5.4 billion worth of sales activity is a clear warning to Wall Street and investors.

For starters, there’s no sector Buffett is more invested in than finance, and perhaps no financial stock he’s favored more over the past seven years than Bank of America. BofA’s interest-rate sensitivity, combined with CEO Brian Moynihan’s desire to reward his company’s shareholders with a robust capital return program (dividends and share buybacks), has made Buffett a happy camper.

The fact that Buffett has dumped nearly 15% of his firm’s stake in Bank of America in the space of just over six weeks suggests clear concerns about the U.S. economy and the stock market. Like virtually all bank stocks, BofA is cyclical.

The other problem is that Berkshire Hathaway is on track for the eighth straight quarter of selling more securities than it buys.

Warren Buffett sold $131.6 billion more in securities than he bought between October 1, 2022, and June 30, 2024.

The logical explanation for this is that stocks are historically expensive and Buffett wants nothing to do with the ‘casino’.

The stock market has historically been pricey

To reiterate, Warren Buffett advises investors not to bet against America. You will never see Buffett or his team buying put options or short-selling securities.

However, being a long-term optimist and expecting the U.S. economy to grow over time does not mean that the Oracle of Omaha is going to pay an exorbitant premium for stocks. If a “fair price” cannot be obtained for great companies, Buffett will sit on his hands for as long as necessary until a fair price is reached or significant price distortions occur.

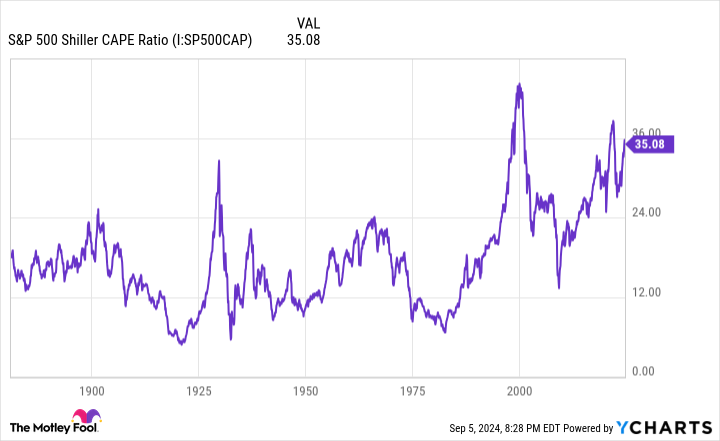

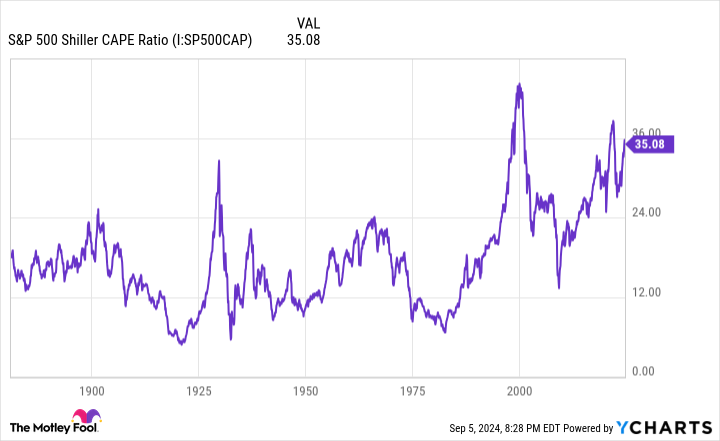

Based on the S&P 500‘S (SNP INDEX: ^GSPC) According to the Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings (CAPE) ratio, stocks have only been more expensive overall during two other bull markets over the past 153 years.

While the traditional P/E ratio examines a company’s earnings per share (EPS) over the past 12 months relative to its stock price, the S&P 500’s Shiller P/E takes into account 10 years of inflation-adjusted EPS. The advantage of the latter is that it smooths out the impact of one-off events and shocks, providing a more accurate valuation measure.

Back-tested to January 1871, the Shiller P/E of the S&P 500 ranged from a low of 4.78 in December 1920 to a peak of 44.19 during the dot-com boom in December 1999. At the closing bell on September 5, the Shiller P/E stood at 35.38, more than double the 153-year average of 17.16.

The bigger concern is what happened in the previous five times in which the S&P 500’s Shiller P/E exceeded 30 in history. While the Shiller P/E is not a timing tool, hindsight shows that the S&P 500 and/or Dow Jones Industrial Average have fallen by 20% to 89% after each previous event in which stock valuations were increased.

In other words, it is only a matter of time before the investment frenzy dissipates and traditional valuation metrics come back into the picture. Based on what history tells us, this will happen sooner rather than later.

Buffett’s best buys often occur during periods of panic

By selling nearly $132 billion more in securities than it has bought since the beginning of October 2022, Berkshire Hathaway’s cash hoard — which includes cash, cash equivalents and U.S. Treasuries — has soared to a record high of $276.9 billion. There’s a good chance that this cash hoard will grow even further in the current quarter, given the continued selling we’ve seen in Bank of America shares.

This $5.4 billion warning is a clear indication from Buffett that turmoil is to be expected in the stock market and/or the economy. Yet, this is exactly what the Oracle of Omaha hopes for with such a huge treasury at his disposal.

There is a virtual guarantee that Warren Buffett will continue to buy shares of his favorite company, Berkshire Hathaway. For 24 consecutive quarters (i.e., six years), he has overseen the buyback of nearly $78 billion in his company’s stock.

But the bigger story is what price disruption Buffett will attract next. After the financial crisis, Buffett invested $5 billion in Bank of America preferred stock. That helped shore up BofA’s balance sheet at a time when banks were Wall Street’s minced liver. More importantly, it gave Buffett access to warrants that gave him the right to buy 700 million shares of BofA stock at $7.14 per share, which he did for Berkshire Hathaway in mid-2017.

Periods of emotion-driven selling, while brief, have historically been Warren Buffett’s time to shine. With stocks at some of their most expensive valuations in history, Buffett’s selling activity portends both the danger and promise of what lies ahead.

Should You Invest $1,000 in Bank of America Now?

Before you buy Bank of America stock, consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Bank of America wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $630,099!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett’s $5.4 Billion Wall Street Warning Predicts Coming Trouble was originally published by The Motley Fool