On August 14, Warren Buffett’s conglomerate Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) has announced its updated shareholdings for the second quarter of 2024. The biggest notable developments were that the company sold all of its shares Snowflake (NYSE: SNOW) and initiated a position of approximately $260 million in Ulta Beauty (NASDAQ: ULTA)But both moves make perfect sense for Berkshire.

To be clear, Berkshire Hathaway has plenty of cash — it had $277 billion on its last report. In short, it can buy pretty much anything it wants; it didn’t have to sell one stock to buy another. But let me explain how Buffett thinks about investing, and why it makes perfect sense for him to swap Snowflake for Ulta Beauty in Berkshire’s portfolio.

This Is Why (I Think) Snowflake Stock Is Low

Berkshire Hathaway invested in Snowflake stock during its initial public offering (IPO) in 2020, perhaps the only time it bought an IPO stock. However, one of Buffett’s protégés Todd Combs was a Snowflake customer at Geico and spoke to Snowflake’s former CEO Frank Slootman.

This checks two important boxes for Buffett’s investing style: a personal relationship with leadership and familiarity with the product. Over the years, Buffett sought to buy companies and retain leadership that he trusted. And Buffett is often quoted as saying, “Never invest in a business you don’t understand.”

This probably wasn’t true for Buffett personally with Snowflake stock. But Combs likely knew Slootman, and was familiar with the company as a customer.

Things could be changing for Snowflake, however, and that likely contributed to Berkshire’s second-quarter sale. The company reports financial results for its fiscal 2025 quarter on August 21. But in the first quarter, management expected just 24% growth in fiscal 2025, down sharply from 38% growth in 2024. Additionally, spending is increasing as the company invests more in artificial intelligence (AI).

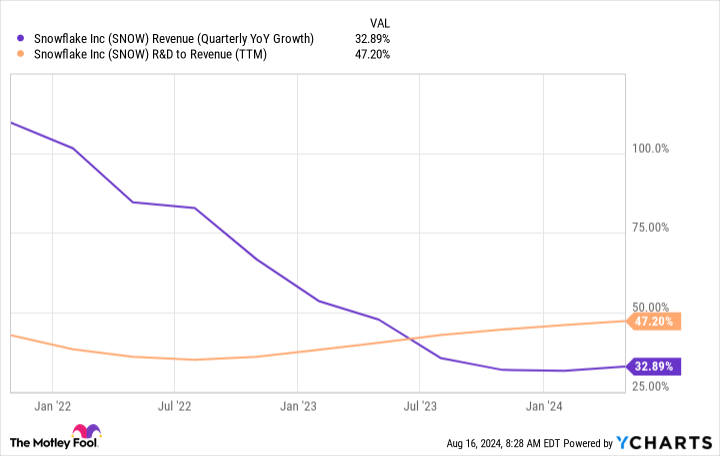

The chart below shows that research and development spending is increasing as a percentage of revenue, reflecting the investment in AI. But this is not necessarily paying off in better growth.

At Berkshire’s 2018 annual meeting, Buffett said, “We still like a business that needs very little capital, produces high returns, continues to grow, and needs very little additional capital.” Snowflake, on the other hand, is spending money to keep up with the competition when it comes to AI, which is not Buffett’s preference.

Not only that, Snowflake named Sridhar Ramaswamy CEO earlier this year. He may be a good fit for the job, but Combs had a personal connection to Slootman. So that may have played a role in Berkshire’s decision to sell Snowflake shares.

This Is Why (I Think) Ulta Beauty Stock Is In Fashion

Ulta Beauty operates about 1,400 brick-and-mortar stores that sell cosmetics and offer beauty services. Like Snowflake, growth has slowed — Ulta Beauty expects sales growth of just 3% this year. But the difference is that it doesn’t have to spend much to stay ahead of trends, because the industry isn’t changing much. That leaves plenty of cash to reward shareholders.

Consider that even in this upcoming quiet year, Ulta Beauty expects an operating margin of 14% — that’s really strong for a retail company. It expects to open about 60 new locations this year and remodel another 40, which will come with some costs. But that’s modest compared to its profits. Plus, it has no debt, meaning creditors can’t claim future profits.

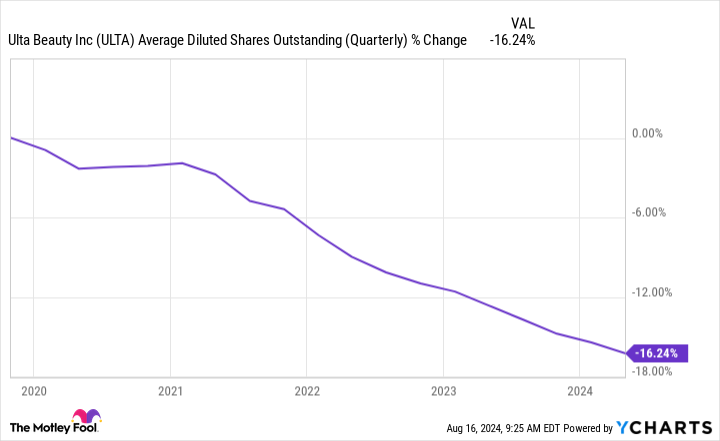

This situation leaves the bulk of Ulta Beauty’s profits to shareholders. Management plans to use $1 billion to buy back shares in 2024 alone. For reference, its market cap is just $17 billion as of this writing. And the company has been diligently buying back shares for years, as the chart below shows.

With Ulta Beauty, Buffett likely sees a simple business that is easy to understand, requires little incremental capital to remain competitive, and generates strong profits while returning capital to shareholders. That simple scenario could make Ulta Beauty stock a winner in the long run.

To top it all off, Ulta Beauty stock has fallen about 35% from its high and is now trading at one of its lowest valuations ever, down just 14%. times his profit. That’s cheap — and cheaper than most other comparable companies. This bargain valuation makes it even more likely that the stock will generate positive returns here, making it an ideal candidate for Berkshire Hathaway’s portfolio.

Should You Invest $1,000 in Ulta Beauty Now?

Before you buy Ulta Beauty stock, here’s what to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Ulta Beauty wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $779,735!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Snowflake and Ulta Beauty. The Motley Fool has a disclosure policy.

Warren Buffett’s Berkshire Hathaway Just Sold Shares of Snowflake. You’ll Never Believe Which Beaten-Down Value Stock It Bought Instead was originally published by The Motley Fool