For almost sixty years now, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been put on a pedestal by Wall Street, and for good reason.

Since the “Oracle of Omaha,” as Buffett has become known, took the reins in the mid-1960s, he has overseen a cumulative return of more than 5,710,000% on Berkshire’s Class A shares (BRK.A) through the closing bell on August 29. He has also outperformed the annual total return, including dividends, of the widely followed S&P 500 over the same period.

Riding on Buffett’s success has proven to be a winning strategy for long-term investors. Thanks to quarterly Form 13F filings — a 13F gives investors an over-the-shoulder look at what stocks Wall Street’s top money managers bought and sold in the most recent quarter — which reflects the trading activity of Berkshire’s brightest minds, including Warren Buffett and his two investing “lieutenants,” Todd Combs and Ted Weschler, it can be done with ease.

However, Buffett’s real darling and the stock that recently reached a milestone has only been acquired by eight other publicly traded companies. ever achieved, will not be found in Berkshire’s 13F quarter results.

The Oracle of Omaha has been a selective buyer lately

While Buffett and his team are staunch supporters of the American economy and American companies, what they do in the short term does not always align with the long-term vision that Charlie Munger developed at Berkshire Hathaway.

Based on both public 13Fs and Berkshire’s quarterly financial statements, investors will see that Buffett’s company has been a net seller of stock for seven consecutive quarters, to the tune of nearly $132 billion. With Buffett overseeing the sale of about $5.4 billion in Bank of America shares since mid-July, it is likely that we will see this net share selling activity continue into the eighth quarter.

While Buffett has unwavering faith in the long-term U.S. economy, he is also a value investor at heart. He wants to pay a “fair price” for “great companies” and is willing to sit on his hands and wait for stock valuations to make sense.

But this doesn’t mean Buffett hasn’t made any purchases, it’s just terribly selective.

For example, he bought shares in an integrated oil and gas company Occidental petroleum (NYSE: OXY) with some degree of consistency since the start of 2022. In addition to supplying energy commodities that are in demand, Occidental is heavily dependent on its drilling segment. By generating a higher percentage of its revenue from drilling than other integrated operators, Occidental can enjoy outsized operating cash flow upside if the spot crude oil price remains high.

During the COVID-19 pandemic, global energy giants have been forced to cut capital expenditure (capex) amid a cliff in demand for energy commodities and unprecedented uncertainty. Even as capex levels return to normal, crude oil supply constraints remain, which could help boost spot prices.

Warren Buffett and his team have also been buyers of satellite radio operator Sirius XM Holdings (NASDAQ: SIRI) and Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group (NASDAQ: LSXMA)(NASDAQ: LSXMK).

In just over a week, Sirius XM and Liberty Sirius XM Group will merge to create a single class of stock. Sirius XM will also conduct a reverse 1-for-10 stock split upon completion of the merger in an effort to reduce the number of outstanding shares, boost the stock price and hopefully attract more interest from institutional investors.

The merger between legal satellite radio monopoly Sirius XM and Liberty Sirius XM Group has all the hallmarks of a rare Oracle of Omaha arbitrage game.

Warren Buffett’s favorite stocks to buy just joined an exclusive company

But at the end of the day, neither Occidental Petroleum nor Sirius XM are Warren Buffett’s favorite stocks to buy. “Favorite stock” is a term reserved for the company that bought the Oracle of Omaha for 24 consecutive quarters.

As mentioned, this “favorite stock” won’t be found in the Q13Fs. Instead, you’ll have to dig into Berkshire’s Hathaway’s quarterly results, which detail, down to the penny, buying activity in Warren Buffett’s favorite stock. Toward the end of each report, just before executive certifications, you’ll find detailed information on stock buyback activity and come to the realization that the stock Buffett buys more than any other (drum roll) shares in his own company.

Prior to mid-July 2018, Berkshire had no share buybacks. Current guidelines only allowed for share buybacks if Berkshire Hathaway’s stock fell to or below 120% of book value in the most recent quarter. Because the stock didn’t fall to or below that threshold, Buffett and right-hand man Charlie Munger (who died in November 2023) were forced to sit on their hands.

On July 17, 2018, Berkshire’s board of directors changed the criteria for share buybacks to accommodate Buffett and Munger. Berkshire’s board did not set a ceiling or end date for the buyback activity, as long as:

-

The company has at least $30 billion in cash, cash equivalents and U.S. Treasury securities on its balance sheet; and

-

Buffett believes that stocks are inherently cheap.

While the second point is entirely subjective, Berkshire, with nearly $277 billion in cash, has a significant buffer that allows Buffett to buy back shares of his own company on a regular basis. In six years, he has overseen nearly $78 billion in buybacks.

It just so happens that Buffett’s favorite stocks to buy last week reached a milestone that only eight other companies in history have ever achieved. At the closing bell on Aug. 28, Berkshire became only the ninth publicly traded company to end a trading session with a market cap of at least $1 trillion. Seven of those eight exclusive companies are members of the “Magnificent Seven,” while the eighth is oil giant Saudi Aramco, which is not traded on U.S. exchanges.

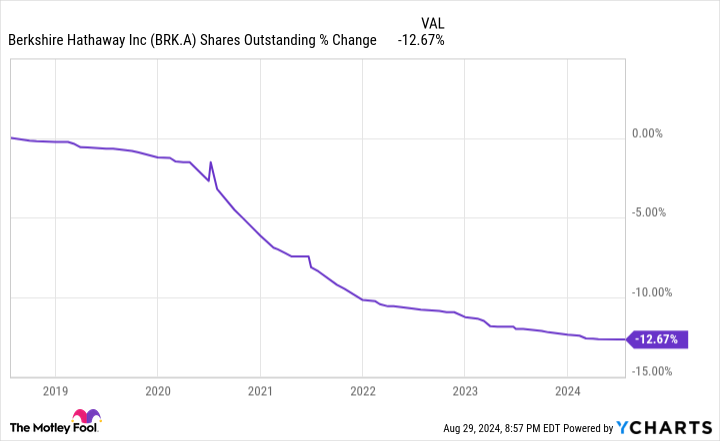

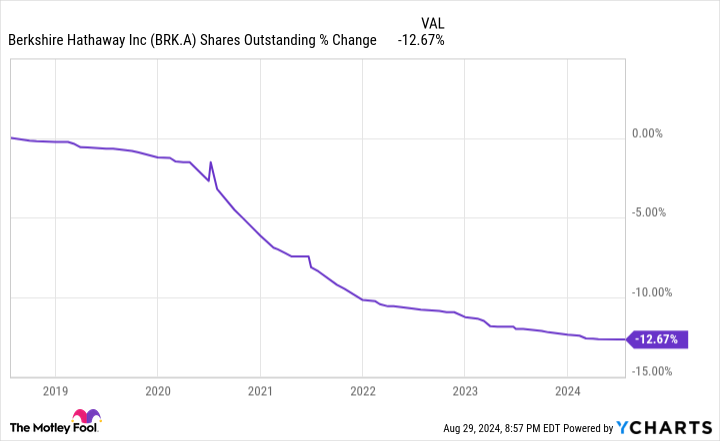

Because Berkshire doesn’t pay dividends, relying on share buybacks is Buffett’s way of rewarding his company’s shareholders. By reducing Berkshire’s outstanding shares by nearly 12.7% over the past six years, the remaining investors’ ownership stake has steadily increased. More importantly, it underscores the importance of long-term investing, something Charlie Munger preached during his decades at Berkshire.

In addition, companies with stable or growing net income and declining shares outstanding see their earnings per share (EPS) increase through buybacks. Over time, share buybacks have made Berkshire’s stock fundamentally more attractive to investors.

You could also argue that overseeing cumulative share buybacks of nearly $78 billion in six years is evidence of Warren Buffett’s confidence in the company he led for nearly 60 years.

Berkshire owns about five dozen companies, and the Oracle of Omaha oversees a 45-stock, $318 billion investment portfolio that is largely comprised of cyclical companies. In other words, Buffett and his team have placed a big bet on the U.S. economy and top U.S. companies that will grow over time. It’s a simple numbers game that clearly favors the long-term optimists.

While Berkshire Hathaway’s market cap of $1 trillion is a large number, there’s no reason to believe the stock won’t rise even further.

Should You Invest $1,000 in Berkshire Hathaway Now?

Before you buy Berkshire Hathaway stock, consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America and Sirius XM. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett’s Favorite Stock to Buy Just Hit a Milestone Only 8 Publicly Traded Companies Have Ever Achieved was originally published by The Motley Fool