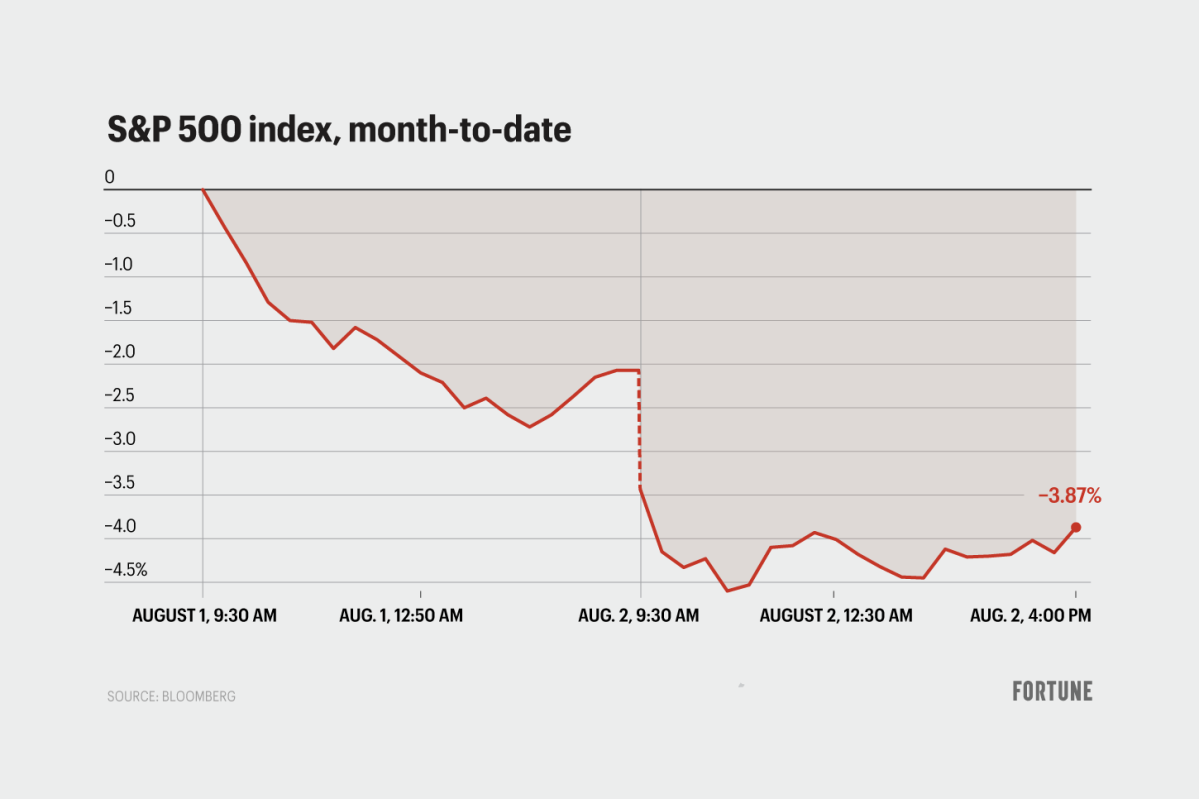

What a way to end the week. The market crashed again on Friday, with the Dow closing down 600 points, the Nasdaq down 2.4% and the S&P down 6% from its recent all-time high.

Market analysts pointed to three main culprits for the collapse:

-

Weak jobs numbers rekindled recession fears on Wall Street. The rise in the unemployment rate to 4.3% certainly seemed to spook investors. The new data from the Labor Department triggered the so-called Sahm Rule, which signals the likely onset of a recession when the three-month moving average of the unemployment rate exceeds the lowest point on that measure over the past 12 months. “We’ve completely turned from a position where a weaker economy was optimistic to a weaker economy,” said [one where] “A weaker economy is bearish,” said Jay Hatfield, CEO of Infrastructure Capital Advisors.

-

Short-term traders led a global sell-off. According to Hatfield, short-term investors such as hedge funds have been selling en masse over the past two days. He thinks they are hesitant to stay long in stocks now that earnings season is over. That said, “We think the probability of a recession remains extraordinarily low,” Hatfield said, “and the sell-off is irrational.”

-

Investors wanted a rate cut. Hatfield agreed with investors who criticized the Federal Reserve for not cutting rates on Wednesday. He compared Fed Chairman Jerome Powell, who said a cut could be “on the table” for September, to Inspector Clouseau, the fictional detective who consistently outsmarted the The Pink Panther movies. “One of their three mandates is to stay behind the curve,” Hatfield said of Powell’s Fed. “So until it’s crystal clear to everybody in the investment community that they need to cut, they’re not going to cut.”

One factor that experts said likely didn’t play a role? Steep losses by mega-cap names, Hatfield added, were unlikely to be a major driver of the market’s dip. Intel shares fell 26% after the company reported a big profit drop and announced mass layoffs, while Amazon shares fell 9% after a disappointing earnings call. But Apple, America’s largest company, came out of Friday’s session slightly higher.

This story originally appeared on Fortune.com