Apple (NASDAQ: AAPL) is the world’s most valuable company, with a market cap of nearly $3.3 trillion. The popularity of the company’s iPhones played a pivotal role in helping the tech giant achieve this position. So it was no surprise that Apple’s stock price fell after TF International Securities analyst Ming-Chi Kuo pointed out that demand for the company’s latest iPhones isn’t as strong as expected.

Kuo estimates that pre-orders for Apple’s latest iPhone 16 models are down nearly 13 percent from last year, with first weekend sales expected to hit 37 million units. Apple has touted this latest model as a significant change from previous iPhones, as it’s the first to feature artificial intelligence (AI). But some skeptics question whether it’s been introduced too late. Samsung leads the generative AI smartphone market with a 36% share, according to industry estimates, while Chinese manufacturers Xiaomi and Huawei control a 22% and 13% share of this market, respectively.

Kuo’s report of lower pre-orders may provide some evidence that the doubters are right, and it’s a cause for concern. However, a closer look at the reasons behind the iPhone 16 lineup’s reportedly poor start suggests that investors needn’t panic. It won’t be surprising to see sales of Apple’s AI-powered iPhones gradually gain momentum, delivering healthy gains for the stock over the next three years.

Apple investors must be patient

The generative AI smartphone is still in the early stages of its growth, so investors shouldn’t panic based on just one weekend’s worth of sales data for Apple’s latest iPhones. According to market research firm IDC, shipments of generative AI smartphones are expected to reach 234 million units in 2024, a whopping 364% increase year-over-year.

Even then, generative AI smartphones are predicted to account for 19% of the global smartphone market this year, suggesting that their sales could continue to grow tremendously in the coming years. IDC predicts that the generative AI smartphone market could see a compound annual growth rate of 78% between 2024 and 2028, with shipments reaching 912 million units by the end of the forecast period. So, it’s not too late for Apple to make a dent in the generative AI smartphone market and witness an acceleration of growth in the future.

Another reason the new iPhones are likely to get off to a slow start is that they won’t run Apple Intelligence right away. Apple’s suite of generative AI features will first be available in US English via a software update next month. Other English-speaking countries like the UK, Canada, Australia, New Zealand and South Africa will join the list in December, while other languages like French, Chinese, Spanish and Japanese will likely get Apple Intelligence next year.

It’s no surprise then why customers aren’t immediately eager to buy the latest iPhone models at launch. However, the company’s long-term opportunity within the generative AI smartphone market remains intact, especially given its significant installed base of users in an upgrade window.

According to Counterpoint Research, there are 50 million iPhone 12 models currently in an upgrade window in the US alone. Wedbush analyst Dan Ives estimates that around 300 million iPhones have not been upgraded in more than four years. So Apple could be on a massive upgrade cycle that could boost sales of the iPhone 16 and subsequent AI models.

That’s why investors would do well to look at the bigger picture rather than relying on one week’s worth of sales data. It’s also why analysts expect Apple’s growth to accelerate over the next few fiscal years.

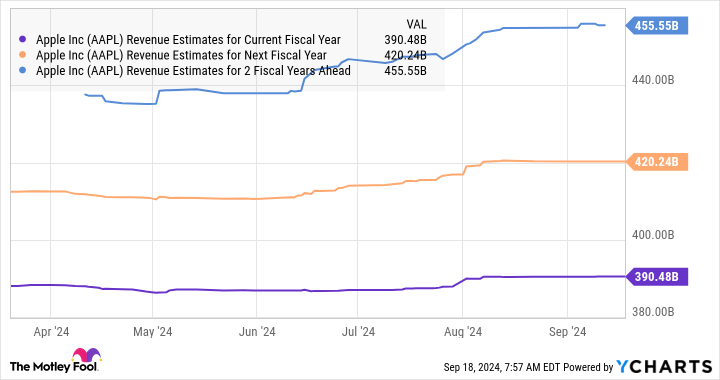

Apple is expected to generate just over $390 billion in revenue in the current fiscal year, which would be an improvement of less than 2% from its fiscal 2023 revenue. However, the estimate for fiscal 2025, which starts next month, suggests the company’s revenue is on track to increase by nearly 8%. The estimate for fiscal 2026 suggests Apple is on track to maintain its revenue growth momentum.

Stronger earnings growth could boost share prices over the next three years

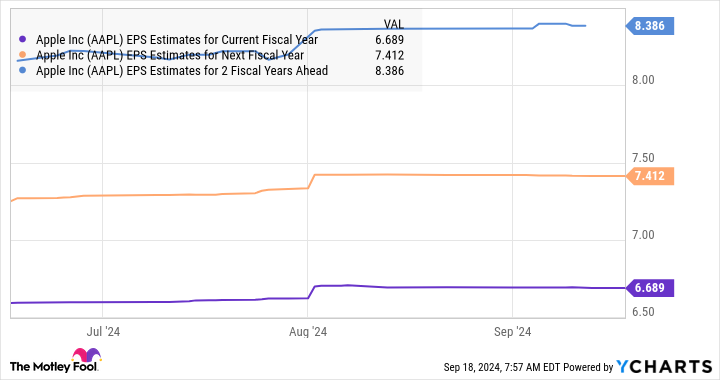

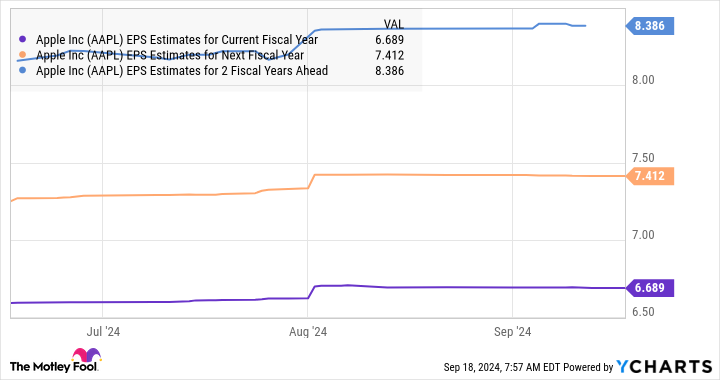

The improvement in Apple’s top line will also trickle down to the bottom line. The company reported $6.13 per share in earnings in fiscal 2023, and the chart shows that the bottom line is on track to improve 9% in fiscal 2024. However, growth is expected to improve over the next few years.

Assuming Apple’s earnings do indeed rise to $8.39 per share after three years, and it trades at 33 times earnings at that point (in line with its current earnings multiple), the stock could hit $277. That would be an upside of 28% from current levels.

However, Apple shares could see an even bigger rally if the market decides to reward the company’s AI-driven growth with a higher earnings multiplier. This is largely due to the fact that the stock is currently trading at a discount to the U.S. tech sector’s average earnings multiplier of 44.

Investors in Apple may have to look further afield, as the generative AI smartphone still has plenty of room for growth and the company has already installed a large number of users, which could help it capitalize on this lucrative opportunity.

Should You Invest $1,000 in Apple Now?

Before you buy Apple stock, here’s what to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $722,320!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Where Will Apple Stock Be in 3 Years? was originally published by The Motley Fool