The rise of Nvidia (NASDAQ: NVDA) is nothing short of incredible. No company has grown as fast as Nvidia at the scale it is now. But that’s all in the past; investors want to know what’s next for Nvidia stock.

The problem is that Nvidia’s future is extremely murky. While it can continue its rapid growth, it may face challenges with its core products.

Nvidia’s GPU growth has been phenomenal

Nvidia’s primary products are graphics processing units (GPUs). These pieces of hardware were originally designed to quickly process gaming graphics, but their use cases have expanded beyond that. GPUs can run engineering simulations, research medicine, mine cryptocurrency, and, most importantly, train artificial intelligence (AI) models. The latter has contributed substantially to Nvidia’s rise over the past year and a half.

GPUs are a top choice for running massive workloads because they can split a computation into multiple parts and perform parallel computations. Furthermore, GPUs can be combined in a server to multiply this effect. The main limitation to building one of these powerful servers to run AI models on is essentially the size of a company’s checkbook.

The explosive growth that AI has delivered can be seen in Nvidia’s data center revenue, which increased 427% year over year to $22.6 billion in its fiscal first quarter (ended April 28). Perhaps more impressively, it was up 23% quarter over quarter, showing that demand is still growing rapidly. All other things being equal, if a company were to grow its quarterly revenue by 25%, its quarterly revenue would more than double by the end of the year. Nvidia is right at that point, and its quarterly revenue is one of the best signs to look at to see if the demand for its GPUs is still there.

Additionally, the biggest tech companies have told investors that they plan to continue increasing their spending to build computing power for AI demand. This bodes well for Nvidia, as it needs its customers to keep spending to stay afloat.

But there may be more to it.

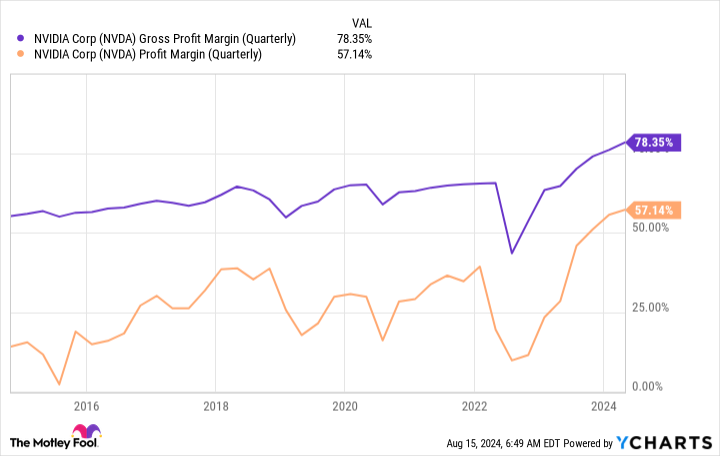

Nvidia’s profit margin is at record levels

There’s an old saying, “Your margins are my opportunities.” And this could become a problem for Nvidia.

Nvidia’s gross and profit margins have risen to record levels, which is great for investors. But they may be unsustainably high. Some of its largest customers have already developed their own chips in-house to replace GPUs for their AI computing infrastructure. This is likely a response to the high prices they have to pay for GPUs.

To take Alphabet‘s tensor processing unit (TPU), for example. When configured properly for an AI workload, the TPU can deliver much higher performance than a GPU. Given that every major cloud computing company has its own product, this could be a problem for Nvidia.

Still, GPUs are fantastic for running AI models and will continue to see widespread use. Investors should be wary, however, as Nvidia’s margins could soon come under pressure.

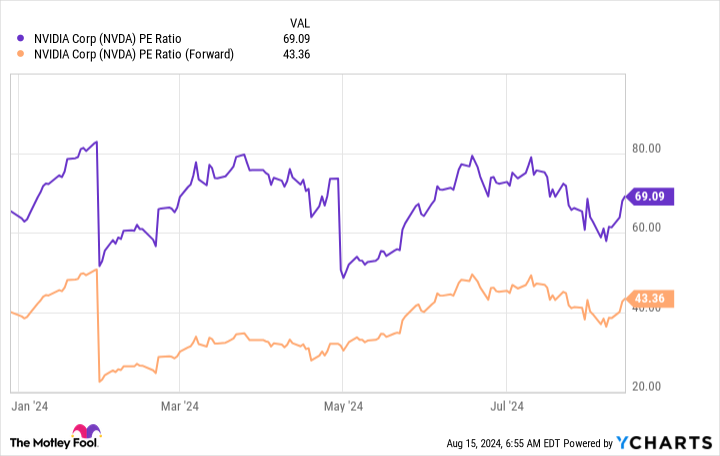

If Nvidia’s profit margin returns to its previous peak of around 40%, it will take about 42% more revenue to generate the same profit it can generate now with its 57% profit margin. That’s a concern because Nvidia already commands a premium.

So what might Nvidia’s stock price look like in three years? I think the company is still a resilient company, producing an incredible number of GPUs to meet AI demand. However, I wouldn’t be surprised to see the stock price stay around the same level due to margin compression.

This is an underrated consideration when investing in Nvidia. I think investors need to consider the possibility that even if revenue continues to grow rapidly, profit margins will need to remain high for the stock to make sense.

Should You Invest $1,000 in Nvidia Now?

Before you buy Nvidia stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $779,735!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions at Alphabet. The Motley Fool holds positions at and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

Where Will Nvidia Stock Be in 3 Years? was originally published by The Motley Fool