Nvidia (NASDAQ: NVDA) recently reached a market cap of $3 trillion and is now one of the top three most valuable companies in the world. Just above it in valuation is Apple (NASDAQ: AAPL)with a market cap of just under $3.4 trillion, while Microsoft currently ranks first with just over $3.4 trillion.

While Microsoft is a tech-savvy and safe stock, I think Apple and Nvidia both have better growth prospects in the long run. So which of them is more likely to reach a $4 trillion valuation first?

Nvidia has a gigantic growth footprint

It’s hard to bet against Nvidia when you consider how well its business has performed lately. The company is the leading provider of the artificial intelligence (AI) chips that other tech companies need to develop their next-gen software and models. And with its AI infrastructure and development still in its early stages, Nvidia could be poised for much more growth.

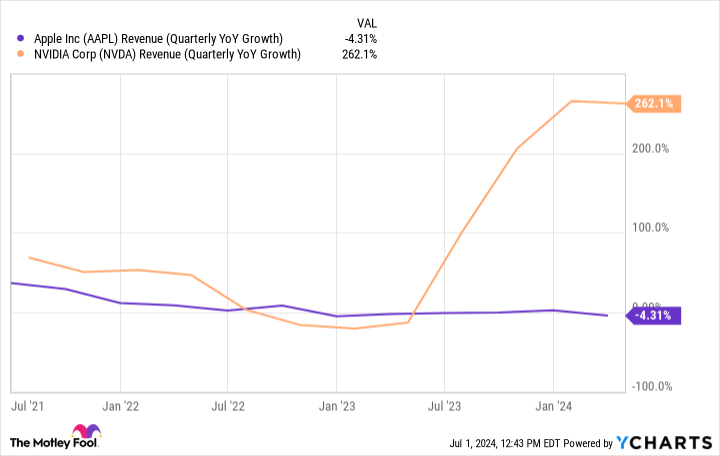

This is in stark contrast to Apple, which has recently struggled to grow its revenue.

But there’s reason to expect the gap between these growth rates to narrow. While Nvidia is a growth beast, it’s unlikely it can continue to triple its revenue on an annual basis. As it starts to match its latest massive numbers, it’s going to have a harder time keeping its growth rate this high. And with so many companies loading up on AI chips, Nvidia may be punching above its weight right now. As more competing chips enter the market and chip buyers potentially cut back on their AI-related spending, its growth rate could drop dramatically.

On the other hand, Apple’s growth rate should improve thanks to the recently unveiled Apple Intelligence, which will inject AI capabilities into the latest iPhones, Macs, and iPads. That will give users an incentive to buy the latest Apple devices when they launch later this year, so it could be the catalyst for a strong upgrade cycle. As Apple dives deeper into AI and improves its services, it has the potential to unlock more growth opportunities in the future.

Apple has the friendlier rating

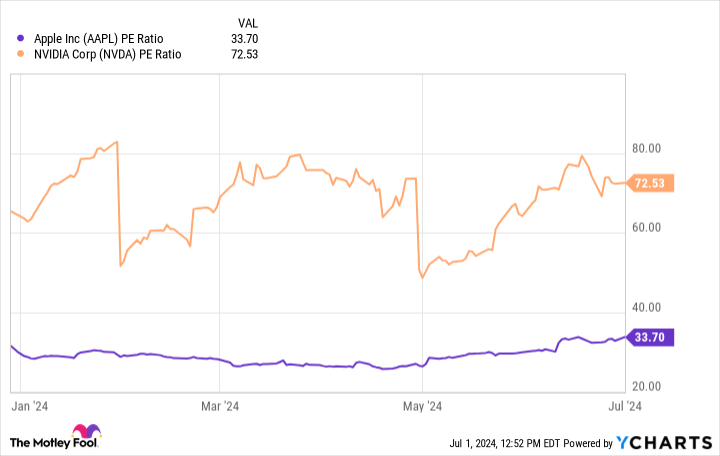

The biggest barrier to a strong rise in Nvidia’s stock price in the near future is its extremely high valuation of over 70 times earnings.

Apple trades on a much more modest price-to-earnings multiple of around 34, and could have more room to rise, especially if its growth numbers improve. Nvidia’s multiple, meanwhile, means it has a high bar to reach every time it reports earnings. That leaves the stock vulnerable to a sell-off if it has a below-expected quarter or if management issues an under-optimistic outlook.

While Nvidia is doing well at the moment, that doesn’t mean the company can keep up this pace.

My Prediction: Apple Will Be the First to Reach $4 Trillion

Both stocks are good long-term investments, but if I were to buy stocks today, I’d choose Apple over Nvidia.

There is a lot of excitement around Nvidia right now and it makes me worry that expectations have been raised too high. Apple may not be as popular with growth investors today, but it shouldn’t be written off because it has a lot more room to grow.

And Apple, I think, is the stock that will be the first to hit $4 trillion, surpassing both Microsoft and Nvidia.

Should You Invest $1,000 in Apple Now?

Before you buy Apple stock, here’s what to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $786,046!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Apple vs. Nvidia: Who Will Hit $4 Trillion First? was originally published by The Motley Fool