Hydrogen company stocks had an incredible week as investors dived back into higher-risk assets and strange trading dynamics entered the market early in the week. On top of foreign trade, a $1.7 billion conditional loan guarantee is helping the sector.

According to data from S&P Global Market Intelligence, the shares Plug-in power supply (NASDAQ: PLUG) rose by no less than 32%, Fuel cell energy (NASDAQ:FCEL) increased by 21.4%, and Bloom Energy (NYSE:BE) rose 9.9% at its peak. The three stocks were up 30.1%, 19.6% and 9.6%, respectively, as of 1:00 PM ET on Friday.

The pressure on hydrogen supplies

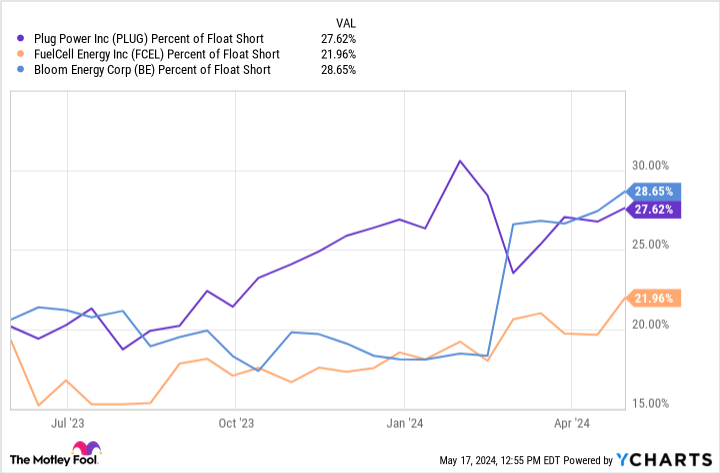

At least some of the movement this week was due to a short squeeze in the stock markets. On Monday, Reddit personality Roaring Kitty made a return and caused traders to speculate that short squeezes could occur in some stocks. That caused dozens of stocks to see big price increases, and as stocks were heavily shorted, Plug Power, FuelCell Energy, and Bloom Energy were some of the beneficiaries of that speculation.

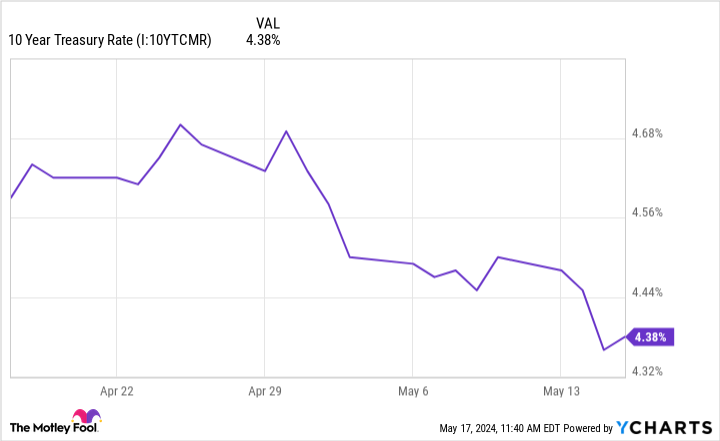

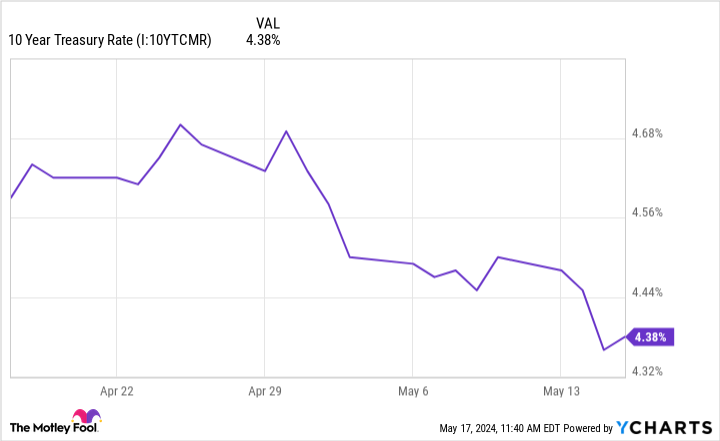

It didn’t hurt that interest rates also fell, making it easier to finance projects over decades, which utilities will eventually do as well.

But the biggest news came from the Department of Energy.

Plug Power’s $1.7 billion deal

On Wednesday, Plug Power announced a $1.7 billion conditional loan guarantee for six hydrogen facilities across the country. This will help the company and buyers negotiate better financing deals in a structure that has been used in renewable energy for years.

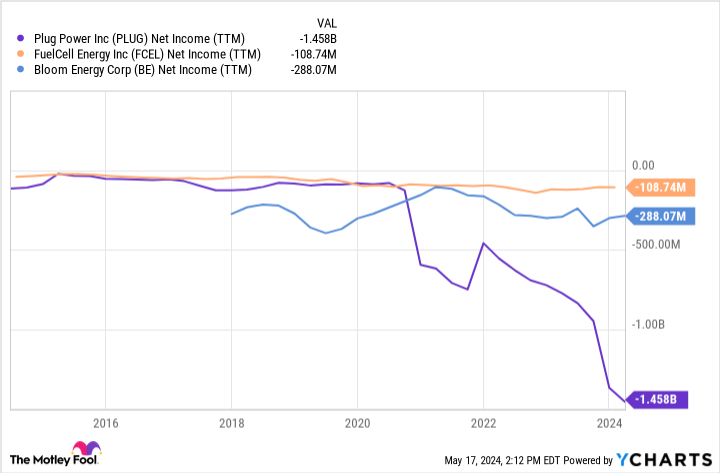

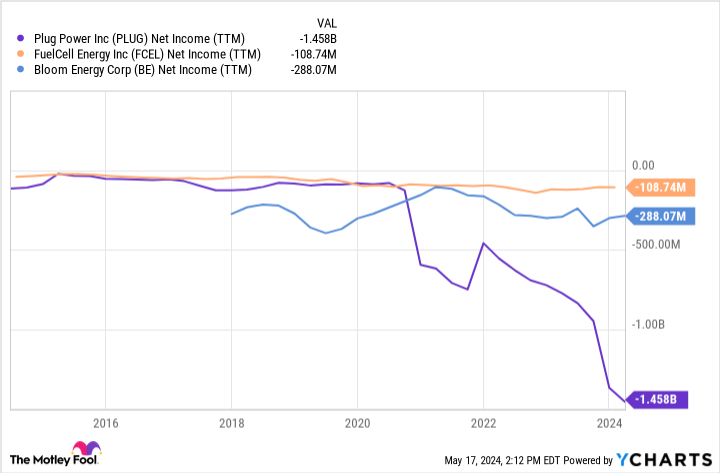

The fact that the government supports hydrogen is positive for the industry, but does not mean that these companies will be profitable. If you look at the long-term net income chart, history tells us that even revenue growth doesn’t translate into better earnings.

Projects may be financed with government assistance, but unless equipment can be sold at a profit and products can be produced economically, it doesn’t really matter how many guarantees these companies receive.

I am skeptical that any loan guarantee will result in hydrogen profits.

Are hydrogen shares a bargain now?

After the recent run-up, I think now is the time to exit hydrogen stocks. Shares are recovering from their recent lows despite any real fundamental change in their fortunes. Each of these companies is struggling to make money, and there’s nothing about this week’s news that will change that.

I think the challenge for everyone will be to continue to finance operations that have been so unprofitable for so long. Hydrogen is a great idea, but it lacks acceptance in the automotive market, long-distance transportation and even in utility-scale projects. That makes it difficult to build a business at scale, and that’s ultimately what they have to do. And without that scale and a sign of profit, I sell hydrogen stocks.

Should you invest €1,000 in Plug Power now?

Consider the following before purchasing shares in Plug Power:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $578,143!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Travis Hoium has no positions in the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Hydrogen Stocks Soared This Week was originally published by The Motley Fool