I follow the Gardner-Kretzmann Continuum, which suggests that individual investors hold at least as many stocks as they age, and I currently have 36 core holdings in my retirement account. Although I also own many more starting positions in other stocks, I concentrate the majority of my monthly dollar-cost averaging (DCA) buying on these 36 positions.

So far in 2024, my worst performing stocks out of these 36 companies have been fintech SoFi technologies (NASDAQ: SOFI) and streaming platform Roku (NASDAQ: ROKU)which are down between 36% and 38%. As discouraging as these declines are, they are a standard part of life as an individual investor — and I have absolutely no interest in selling at this point.

Why?

I have a serious case of FOMO (fear of missing out) when it comes to selling a stock too early, only to watch it become a multibagger in the coming decades. To consider Nvidia when the stock price basically went nowhere for a decade in the early 2000s. Or how bad Amazon caused the failed launch of its Fire phone. Or how inconsistent Netflix watched amid the Qwikster debacle.

All of these stocks have since become multibaggers, after what initially seemed reasonable selling times. So rather than sell, I would much rather pause my DCA additions and leave a struggling stock alone – see what happens over a longer period of time.

That said, here’s why I’m nowhere near ready to panic about the sell-off so far in 2024 for SoFi and Roku — and why one of them looks downright interesting at current prices.

1. SoFi technologies

Shares of diversified fintech SoFi have fallen about 35% so far in 2024 despite the company beating expectations on both revenue and earnings in the most recent quarter. After revenue surged 26% in the first quarter of 2024 — despite its largest unit, lending (personal loans, student loans and home loans), posting slow growth — SoFi is shaping up to be a versatile financial powerhouse.

The company’s fledgling financial services segment drove revenue growth of 86% as people continued to flock to SoFi’s Money accounts, which currently offer a 4.6% interest rate. Those attractive rates generated another $3 billion in deposits during the quarter, bringing the company’s total to more than $21 billion. These deposits are critical to the company’s long-term success, as they provide a stable source (90% of which comes from recurring direct deposits) of lower-cost funding for the lending segment.

Meanwhile, the company’s technology platform segment – which management wants to build into the ‘AWS [Amazon Web Services] of fintech” – increased revenue by 21% as the company continued to approach major banks in the Americas.

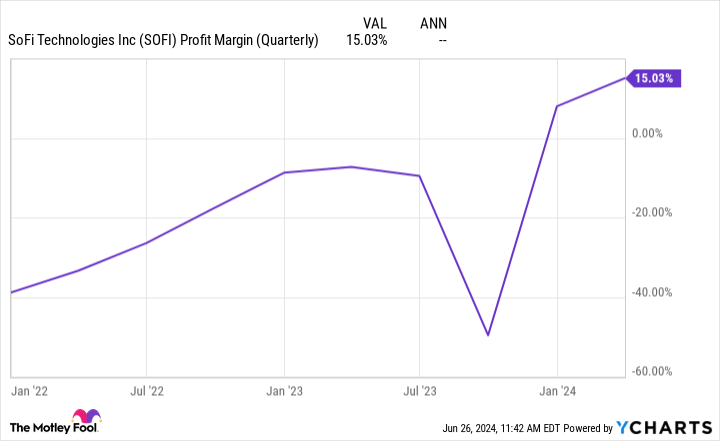

The best yet for investors? Despite the market’s negative reaction to management’s cautious guidance for the second quarter, SoFi’s net profit margin continues to rise (barring a one-off event in 2023).

With management forecasting earnings per share to grow to between $0.55 and $0.80 by 2026, SoFi’s current share price of around $6.50 could prove to be a steep discount. In addition, Chief Executive Officer Anthony Noto continues to buy shares of the company. Given SoFi’s growth potential, early profitability, and robust liquidity from its growing deposit base, I’m happy to continue buying shares alongside Noto.

2. Roku

Streaming platform leader Roku’s stock price has fallen sharply since it was considered one of the “pandemic darlings” in 2020 and 2021. So far in 2024, the stock is down 38%. Roku is now 88% below its all-time high and trades with a price-to-sales ratio (P/S) of just 2.2, which is close to an all-time low of 1.7.

This steep drop in price and valuation obviously makes the company an interesting turnaround story. After the number of streaming households rose 14% to 84 million and streaming hours rose 23% to 31 billion in the first quarter of 2024, there’s a strong argument that Roku is worth buying today.

Additionally, the company’s Roku Channel has now grown to be the third largest streaming app on its platform, drawing approximately 120 million viewers to the Roku home screen every day.

After a collaboration with The Trade Bureau and its industry-leading connected TV (CTV) advertising power, Roku is poised to improve its monetization of the 84 million households it reaches. By connecting The Trade Desk’s advertising solutions and extensive customer base with Roku’s wealth of customer data, the partnership should enable advertisers to deliver more targeted marketing campaigns and maximize their ad spend.

With streaming services now accounting for 60% of total hours watched compared to linear TV, but only receiving 30% of total ad spend, there is still a long road ahead for growth before this partnership can continue to pay off.

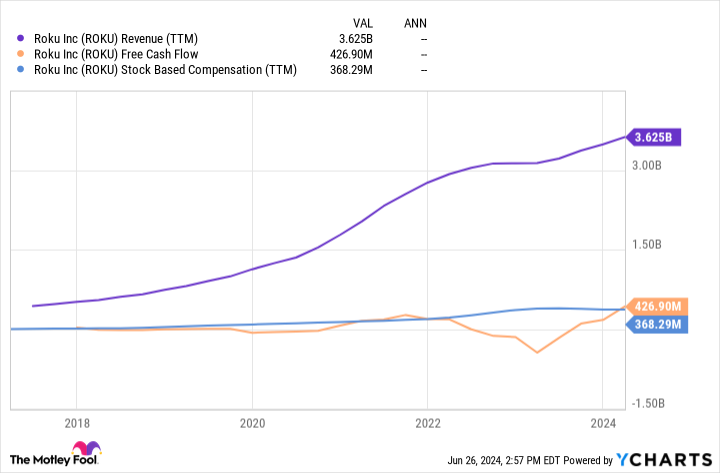

As big as all of these factors are, though, I’m not ready to go all-in on Roku at today’s potentially discounted price. While free cash flow (FCF) has improved dramatically over the past year following the arrival of Chief Financial Officer Dan Jedda from Amazon and later Repair stitchThe company’s stock-based compensation (SBC) remains a concern for me.

Consider the following diagram.

Once we subtract Roku’s SBC from its FCF, we see that it only has an adjusted FCF margin of 1.6% over the past year. While this is an improvement from the negative FCF of 2022, I’d rather be patient with Roku and see if its cash generation and profitability can continue to improve.

However, thanks to the continued shift in ad spend to CTV working in Roku’s favor, the company’s deal with The Trade Desk, and the company’s industry-leading reach, I wouldn’t dream nor of selling my position yet. With Roku already holding a healthy 2% position in my retirement account, I’m more than happy to be patient — and give the long-term megatrends that work in the company’s favor time to play out.

Should You Invest $1,000 in SoFi Technologies Now?

Before buying shares in SoFi Technologies, you should consider the following:

The Motley Fool Stock Advisor The team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, you would have $774,526!*

Stock advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Josh Kohn-Lindquist has positions in Netflix, Nvidia, Roku, SoFi Technologies and The Trade Desk. The Motley Fool has positions in and recommends Amazon, Netflix, Nvidia, Roku, Stitch Fix and The Trade Desk. The Motley Fool has a disclosure policy.

Mid-2024: Why I’m Not Freaking Out About the Two Worst Performing Growth Stocks in My Retirement Account, originally published by The Motley Fool