Battery technology company for electric vehicles (EV). QuantumScape (NYSE:QS) gave investors a reason to cheer last night with its third-quarter report, and as a result, shares are rising. The stock fell nearly 36% in early morning trading. At 11:38 a.m. ET, the stock was still up 21.6%.

The company announced that it has reached a major milestone in its work to develop commercially viable solid-state batteries for EV manufacturers. It has sent samples for its first commercial product to automakers and other Original Equipment Manufacturers (OEMs) for testing. That was one of QuantumScape’s main goals for 2024.

QuantumScape has a two-phase plan to mass produce the parts needed for its solid-state EV battery. The first stage “Raptor” process has been used to produce prototypes in low volumes.

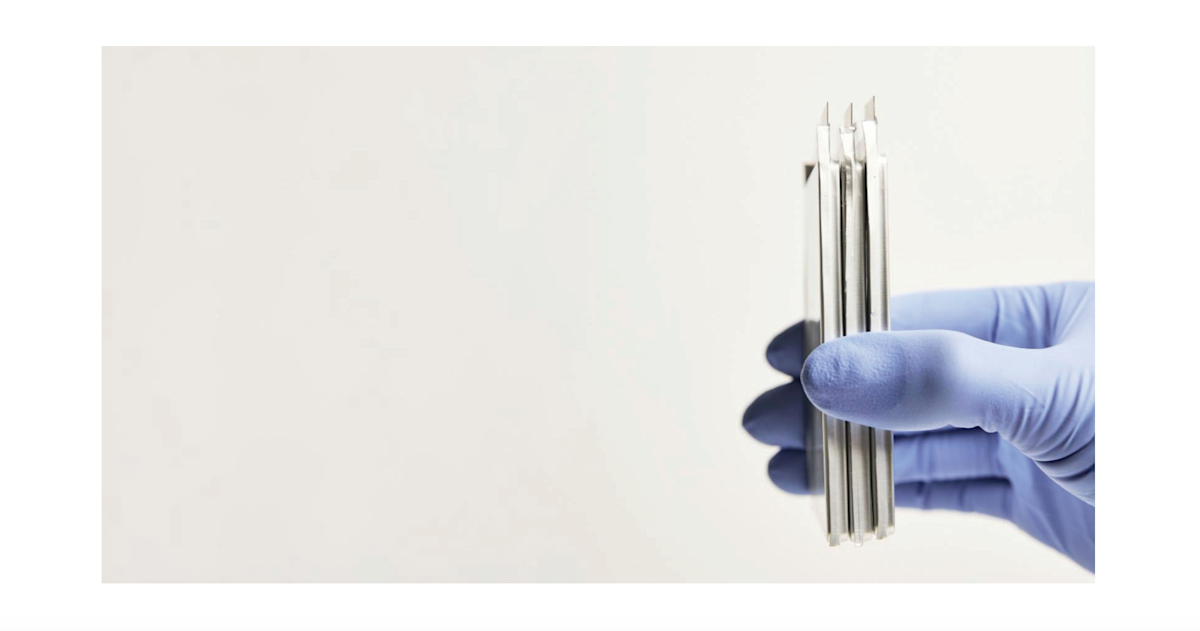

The company announced that the first small B sample battery cells from the Raptor manufacturing process have been shipped for testing with automotive customers. The next phase of production of the “Cobra” will begin in 2025.

The samples of the first commercial product, QSE-5, are designed to meet the demands of automotive applications and provide EV buyers with better battery technology. The samples, made with disconnectors and now tested by car manufacturers, have a high energy density and offer a fast charging option of less than 15 minutes for EV owners. The batteries are safer and designed to operate over the full temperature range of the car.

In its earnings release, the company stated: “[T]To the best of our knowledge, these cells are the first anode-free solid-state lithium-metal cell design ever produced for automotive applications.” While the testing process will take months, it is an important step for QuantumScape.

Investors responded by jumping into the stocks today. However, shares are still down more than 20% over the past six months. For those who can tolerate the risks and believe the company can successfully produce its commercial product at scale, it’s not too late to buy the stock.

Have you ever felt like you missed the boat on buying the most successful stocks? Then you would like to hear this.

On rare occasions, our expert team of analysts provides a “Double Down” Stocks recommendation for companies they think are about to pop. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you had invested $1,000 when we doubled in 2010, then you have $20,803!*

-

Apple: If you had invested $1,000 when we doubled in 2008, you would have $43,654!*

-

Netflix: If you had invested $1,000 when we doubled in 2004, you would have $404,086!*

We’re currently issuing ‘Double Down’ warnings for three incredible companies, and another opportunity like this may not happen anytime soon.

See 3 “Double Down” Stocks »

*Stock Advisor returns October 21, 2024

Howard Smith has positions in QuantumScape. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why QuantumScape Stock Skyrocketed Higher Today was originally published by The Motley Fool