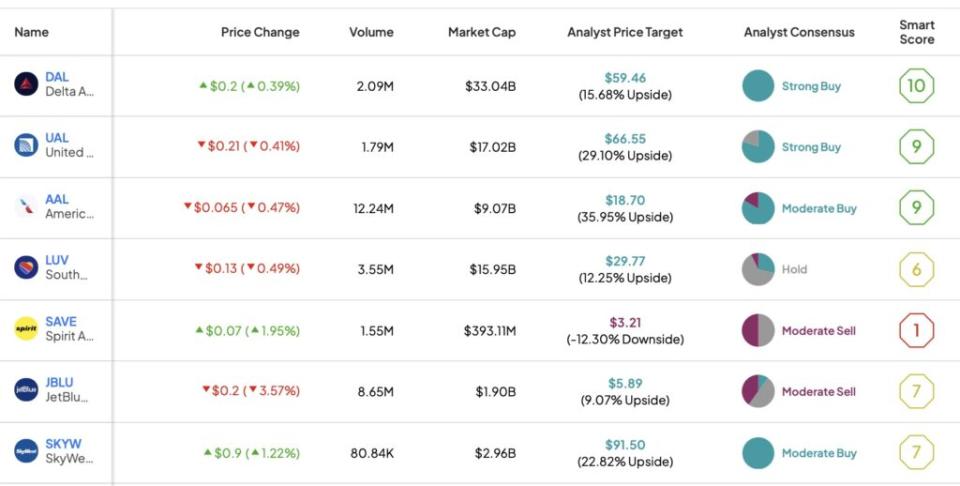

Investing in the volatile aviation industry takes courage. Airlines are highly sensitive to economic cycles and fuel prices, while fierce competition continually puts pressure on margins. However, in this challenging landscape, two names stand out: Delta Air Lines (NYSE:DAL) and United Airlines (NASDAQ: UAL). Using TipRanks’ stock comparison tool below, these two companies stand out for their Strong Buy ratings on Wall Street and strong Smart Scores.

Given their best unit margins among U.S. legacy carriers and trading at low-risk valuations, I believe both airlines deserve their Strong Buy ratings. That is why I am optimistic about DAL and UAL.

Delta Airlines (NYSE:DAL)

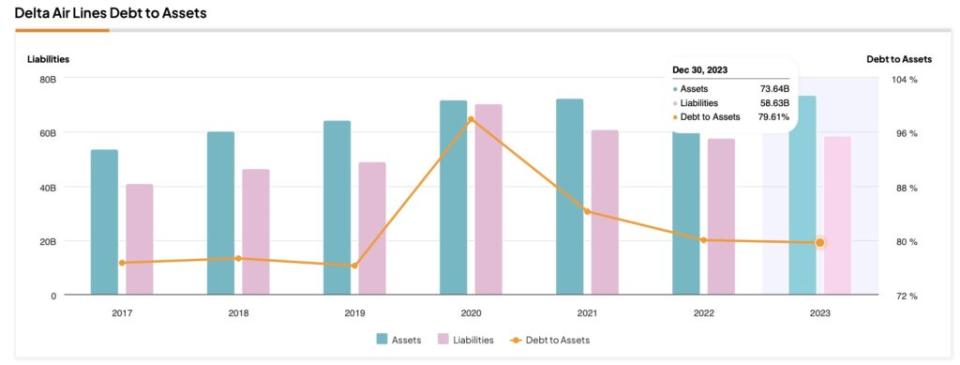

Delta Airlines distinguishes itself in the sector mainly by the high quality of its balance sheet, given the company’s relatively low debt burden. In addition to its competitive position in the lucrative domestic and international markets, the Atlanta-based company had a debt-to-asset ratio of 97% in 2020 at the height of the pandemic, which it has managed to stabilize at around 80% in recent years. last two years.

Delta’s high-quality margins are also notable. In 2023, Delta reported passenger revenue per available seat mile (PRASM) of $17.98. After deducting the cost per available seat mile, excluding fuel and one-time costs (CASM-ex) of $13.17, the result was a per unit margin of $4.81. In other words, for every available seat mile, the airline generated an operating profit of nearly $4.81 after covering its operating costs – on par with UAL as the highest among all U.S. airlines.

Furthermore, Delta’s shares have risen sharply in value over the past six months due to a sharp earnings turnaround despite costly fuel and labor, especially since October last year. Over the past twelve months, DAL shares are up 44%.

More recently, in the quarter ending in March, Delta flew 54.2 billion seat miles, a 9% increase compared to the same period last year. The company attributed this performance to best-in-class operations, with the company leading the industry in on-time performance and operating 26 days without cancellations during the quarter.

In addition, strong demand for domestic business travel, continued international travel and diversified revenue streams from Loyalty, Premium, Cargo and MRO (maintenance, repair and overhaul) enabled Delta to close its latest quarter with record revenues in the March quarter. The company reported revenue of $11.3 billion and reversed a net loss of $277 million from last year to a net profit of $614 million.

These strong results in the most recent quarter demonstrate Delta’s excellent performance in addressing rising demand post-pandemic despite a challenging global economic scenario. The company has effectively seized the opportunity at the right time.

To further support the bullish thesis, Delta trades at a price-to-earnings ratio of just 6.6x (compared to an industry average of almost 20x). This valuation looks even more attractive given the company’s earnings per share guidance of $6-7 for 2024, implying 6% net growth.

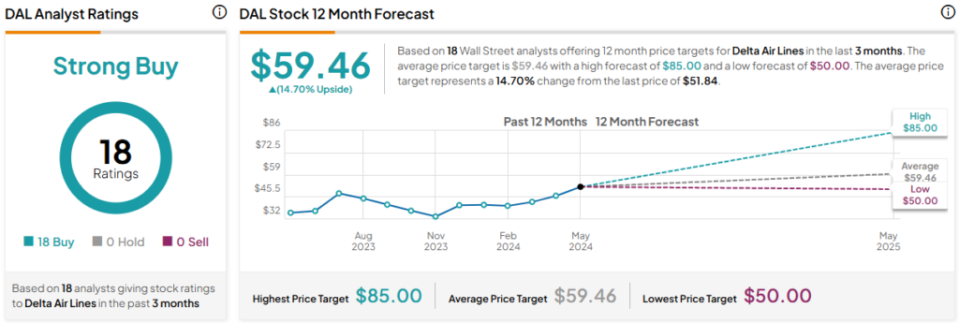

What is the price target for DAL shares?

Considering the above points, it’s understandable why analysts consider DAL stock a strong buy, with eighteen unanimous buy ratings assigned in the last three months. The average DAL stock price target of $59.46 implies 14.7% upside potential.

United Airlines (NASDAQ:UAL)

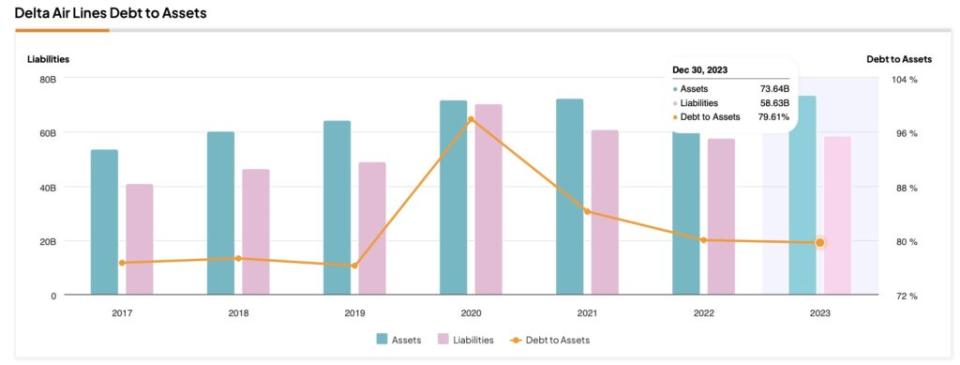

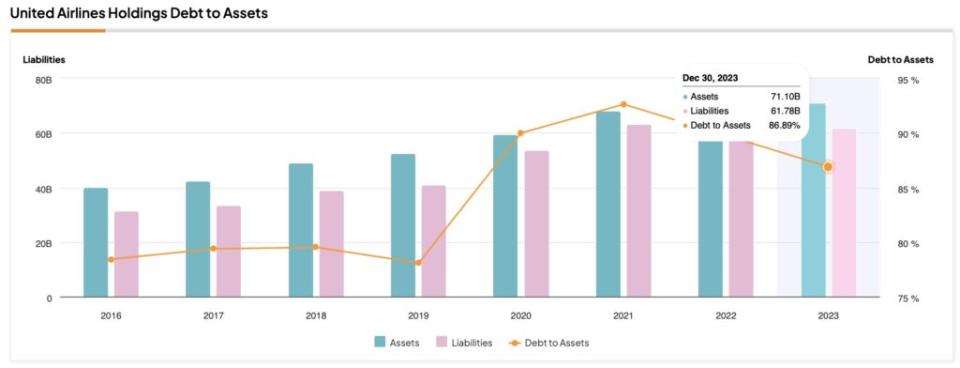

In recent years, United has transitioned from a growth-oriented company among U.S. airlines to a focus on improving margins and strengthening its balance sheet. Like Delta, United currently stands out as one of the top U.S. airline stocks in terms of quality. Examining the balance sheet, the company has managed its debt effectively, currently at 87% debt-to-assets, as you can see below.

Notably, United avoided issuing additional debt, thanks to a cash infusion from a 2020 stock sale, a strategically sound move that contributed to this performance.

United’s robust balance sheet is a testament to its stellar operating performance through 2023. During this period, United has become the world’s largest airline by available seat miles, with a total of 73.7 billion.

In addition, United maintained the highest unit margin of any U.S. airline, alongside Delta. This was demonstrated by passenger revenue per available seat mile (PRASM) of $16.84, minus operating costs per unit excluding fuel (CASM-ex) of $12.03, resulting in a margin of $4.81 per unit. Notably, United’s margins exceed those of its American competitor, American Airlines.NASDAQ:AAL), which reported a unit margin of just $4.32 last year.

In the first quarter of 2024, United increased capacity by 9.1% compared to the same period in 2023, resulting in total operating revenues of $12.5 billion, up 9.7% year over year. United’s business fundamentals appear to be developing well, and the valuation ratios at which the company trades are attractive, similar to DAL.

United trades at a price-to-earnings ratio of 6.4x. Furthermore, with expected net growth of around 16% by the end of 2025, the company trades at an attractive PEG ratio of 0.6x (1.0x and below is generally considered undervalued).

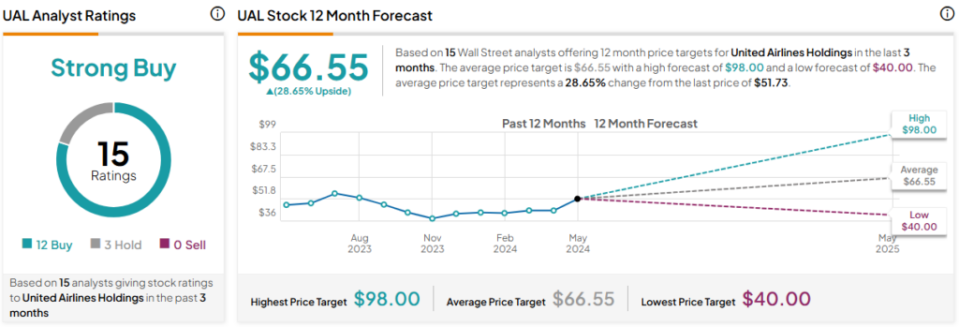

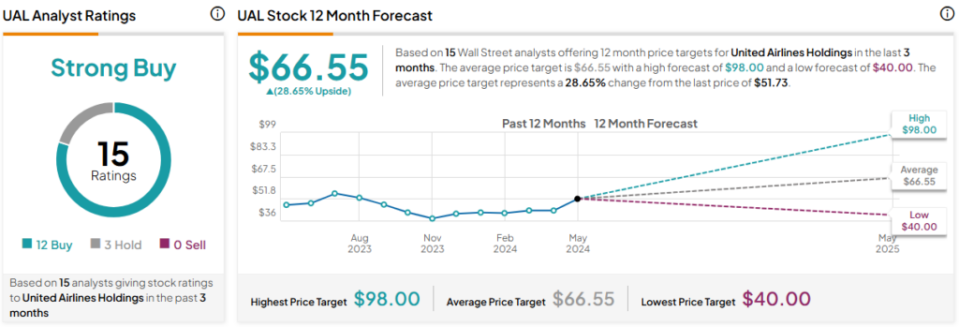

What is the price target for UAL shares?

Like Delta, UAL is also seen as a strong buy by Wall Street analysts. Of the fifteen analysts who have covered the stock over the past three months, twelve are bullish. The average price target for UAL stock is $66.55 per share, implying 28.65% upside potential.

It comes down to

The bullish thesis for Delta and United rests on the balance sheet and margin quality of these two US airlines, which operate in a high-risk, high-cyclical industry that is particularly sensitive to oil price swings.

Given the characteristics of the industry, I don’t consider Delta and United to be ideal long-term investments, given the intense volatility typically seen in airline stocks. However, among their peers, I think both stocks emerge as winners today as they combine robust fundamentals with less risky valuations.

Revelation