Palantir Technologies (NYSE:PLTR) gets its share of hype, and for good reason. The software, artificial intelligence and analytics platform for businesses and governments has grown rapidly since its IPO in 2020. There is also a growing legion of enthusiastic shareholders. Part of that enthusiasm has to do with the eccentric CEO, who has done things his own way to disrupt a once faltering industry (the government’s defense spending).

It’s said that Palantir is poised to become one of the next big tech stocks. Can the AI upstart join the ‘Magnificient Seven’ in 2030? Let’s take a closer look and find out.

AI software for commercial and government customers

Palantir was founded in 2004 as a big data and analytics software platform. The goal was to sell innovative and modern software solutions to government agencies and the Ministry of Defense. At the time, many Silicon Valley companies were hesitant to get involved in certain government-related work because some saw it as politically charged. Palantir’s willingness to work with the government at the time has proven beneficial. There was a huge opportunity to modernize the software and analytics platforms for the United States and its allies. Palantir’s government segment now generates $1.27 billion in annualized revenue.

After entering government agencies, Palantir began selling its analytics programs to large commercial customers. It has 427 commercial customers today, up from just 49 at the end of 2020. In recent years, the company has invested heavily in its artificial intelligence platform (AIP) to further develop its platform for its large customers.

I’m not going to pretend to understand how these AI tools work, but the technology departments of all these companies and government agencies seem to like them. Palantir now has a total of 554 customers, up from 139 at the end of 2020. These customers like Palantir’s software platform, which should lead to more customer wins around the world. This, in turn, could drive revenue growth in the coming years.

Even more strong growth, finally a profit

Speaking of revenue: Palantir posted strong revenue results last quarter. Revenue grew 21% year-over-year to $634 million, driven by US commercial revenue growth of 40% year-over-year. The company also grew its customer base by 40% year over year, which is a good indicator of future revenue growth.

Another positive aspect of Palantir is the fact that it is growing and generating profits at the same time. A few years ago, Palantir had a negative 100% operating margin. Over the past twelve months, the company has achieved a positive margin of 8%, which continues to increase. With extremely high gross margins, I would expect Palantir’s profitability to be quite healthy once it matures.

Could this be a great tech stock?

There’s a lot to like about Palantir. However, optimistic investors should be realistic about whether this company will become a tech giant anytime soon. It is simply not big enough financially.

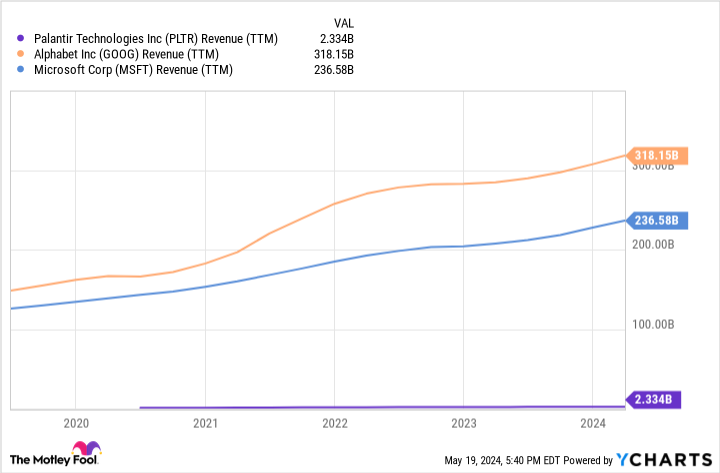

Palantir has generated $2.3 billion in revenue over the past twelve months. Turnover has grown by 30% since 2018. Let’s say the company can grow 30% from now until 2030. With these estimates, Palantir will likely generate $18 billion in annual revenue by 2030. Not bad. However, many of these big tech companies generate annual revenues of more than $200 billion Today. Alphabet has generated sales of $318 billion in the past twelve months Microsoft did $237 billion, all with strong gross margins like Palantir. That’s more than ten times what Palantir could generate if its revenue continued to grow at 30% for seven years.

Could Palantir be a good stock to own in the long term? Of course that is possible, as long as turnover continues to grow quickly and healthy profits are generated. But this is not a major technology stock.

Should You Invest $1,000 in Palantir Technologies Now?

Consider the following before purchasing shares in Palantir Technologies:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $580,722!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions at Alphabet. The Motley Fool holds positions in and recommends Alphabet, Microsoft, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Will Palantir Stock Join the ‘Magnificent Seven’ in 2030? was originally published by The Motley Fool