The $1 trillion club is elite. At the time of writing, only six US companies have a market capitalization over $1 trillion: Apple, Microsoft, Nvidia, Alphabet, AmazonAnd Meta Platforms.

But in a few years, other companies will probably join the club.

What about then? Palantir Technologies (NYSE:PLTR)a company at the forefront of the artificial intelligence (AI) revolution? Could it extend the stock market’s recent rally to a $1 trillion valuation?

Let’s dig in and see.

Image source: Getty Images.

What does Palantir do?

First, to understand why Palantir could reach a $1 trillion valuationyou have to to grasp what the company does.

In the simplest terms, Palantir is a problem-solving company. Every day the world produces an innumerable amount of data. This data can be a powerful asset, especially for the organizations that produce it, but its sheer volume often makes it difficult to parse and understand.

Take a hospital for example. On any given day, a hospital may admit hundreds of patients, collect millions of data points, and schedule thousands of work hours for doctors, nurses, and other staff.

Palantir, wants to provide clarity to customers at large organizations such as hospitals through its AI-powered platform. By using Through the company’s platform, employees can identify patterns and develop solutions that deliver better results for all stakeholders.

For example, the UK’s National Health Service (NHS) used Palantir’s technology to help improve its efficiency reduced waiting times for patients for surgery.

Implementing these improvements can save large organizations a lot of money. That’s why Palantir is seeing its customer base explode. In the most recent quarter (the three months ending June 30, 2024), the company’s customer base increased Through 41% compared to a year ago. While Palantir previously focused on government contracts, pressure on the private sector is taking off of Commercial customers in the US are up 83% year over year.

In short, over the next five years (and more), organizations will continue to implement AI-powered solutions to help improve their operations and save money. Palantir will benefit, which is why its shares are up 129% this year and could soar much higher in the next five years.

Can Palantir grow into a $1 trillion company?

Next, let’s see how big Palantir already is. At the time of writing, the company has a market capitalization of $89 billion. So for Palantir to reach a market cap of $1 trillion, its valuation would have to increase about elevenfold. In other words, the shares should increase in value by 1,100%. This amounts to a compound annual growth rate (CAGR) of more than 62%.

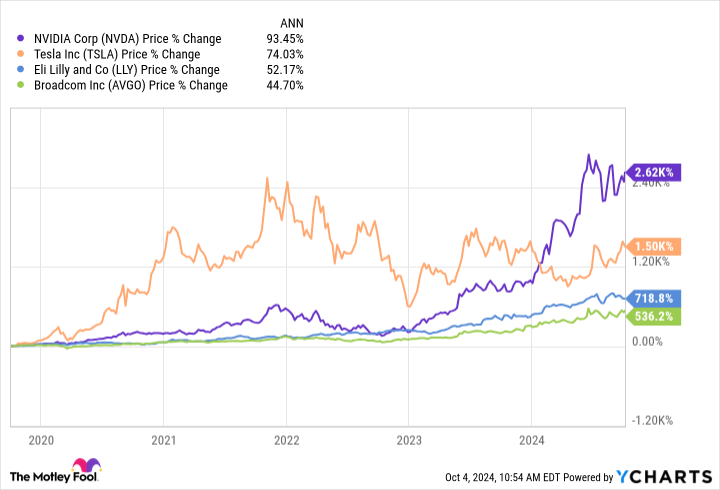

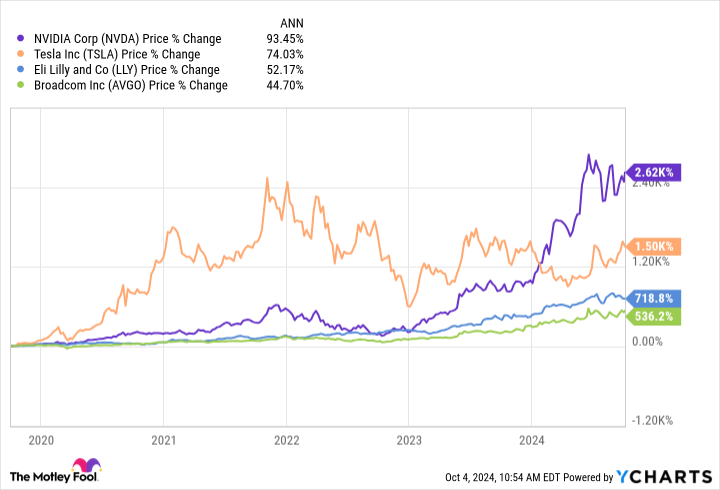

That’s a tough lift, to say the least. Yet it is not impossible. There are even examples of companies meeting or exceeding that level of growth.

Over the past five years, Nvidia and Tesla have both registered CAGRs of over 62%. Nvidia has an incredible CAGR of 93%, while Tesla’s is at 74% – all that growth coming in the years between 2019 and 2022.

And there are others that have come close. Eli Lily‘s five-year CAGR is 52%; Broadcom‘is 45%.

In other words, a CAGR of 63% is surprisingly high, but not unattainable.

That said, Palantir would need a tremendous rally to have any chance of reaching a $1 trillion valuation by 2030 – which in my opinion is unlikely to happen.

Is Palantir a bargain now?

But perhaps the better question to ask is whether Palantir stock is a buy right now.

On that question, I’m much more optimistic.

Palantir is a well-run company with an innovative product that is riding the wave of enthusiasm about AI. Sales growth is 27%, while the number of customers is growing even faster.

In short, the company remains every growth investor’s dream come true. And that’s why I continue to believe it’s a stock worth owning, even though it’s unlikely to reach a $1 trillion valuation by 2030.

Should You Invest $1,000 in Palantir Technologies Now?

Consider the following before purchasing shares in Palantir Technologies:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, Nvidia and Tesla. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Will Palantir Technologies Be a Trillion Dollar Stock by 2030? was originally published by The Motley Fool