I’m bearish on Tesla (NASDAQ:TSLA), and I can’t help but think that Elon Musk’s announcement about unveiling a Robotaxi on August 8 is a bit of a distraction. So why should Musk distract us? Well, car sales are slowing, margins are falling, and Tesla’s dominance in the electric vehicle (EV) segment is over. Moreover, the share valuation is high. This is why I’m bearish on TSLA stock, but I don’t expect it to see much movement until we know what Musk has in store for us on August 8.

Tesla’s performance is disappointing

In the first quarter, Tesla reported a 9% decline in quarterly sales – the steepest year-over-year decline since 2012 – and a 48% decline in adjusted profits. The company’s adjusted earnings per share (EPS) came in at 45 cents, compared to the expected 49 cents. In addition, revenue for the quarter fell to $21.3 billion – less than the $22.2 billion the market had expected.

Sales decreased both year-over-year and sequentially. Meanwhile, net income fell 55% to $1.13 billion from $2.51 billion a year ago. On an unadjusted basis, net earnings per share fell to 34 cents in the first quarter of 2024 from 73 cents a year ago. Furthermore, in an increasingly competitive market, Tesla’s price cuts negatively impacted margins, without a clear the end was in sight.

However, Musk also pointed to unforeseen challenges as a reason for the company’s underperformance. “We overcame several unforeseen challenges, as well as the ramp of the redesigned Model 3 in Fremont. As we have all seen, the adoption rate of electric vehicles is under pressure worldwide, and many other order manufacturers are pulling back on electric vehicles and pursuing plug-in hybrids instead. We believe this is not the right strategy and that electric vehicles will ultimately dominate the market,” Musk said in the Q1 earnings call.

Am I underestimating Tesla’s AI potential?

In the first quarter, Tesla’s free cash flow turned negative. The Austin-based company reported a deficit of $2.53 billion, marking a significant change from a year ago, when Tesla had free cash flow of $441 million. In the fourth quarter of 2023, Tesla reported free cash flow of $2.06 billion. Tesla explained that the negative cash flow was due to a $2.7 billion increase in inventory and $1 billion in capital expenditures for artificial intelligence (AI) infrastructure.

AI is certainly the buzzword of investing right now, and I don’t believe it’s overused. However, some analysts argue that investors should value Tesla not as a car company, but as a technology company at the forefront of AI.

I’m a bit skeptical about this, even though I appreciate that Tesla has AI capabilities in areas like manufacturing, the Tesla Bot, and energy trading. However, so far I am not convinced that these are parts of the business with a revenue-generating capacity that is even remotely comparable to car production.

Of course, the AI-enabled Robotaxi might change my opinion. The question is whether Tesla has really succeeded in making a major leap forward in autonomous technology. This would really put Tesla in the driver’s seat and establish its dominance in the autonomous segment.

The growth of the Robotaxi segment would also open up a new revenue-generating segment, which looks very attractive. Self-driving cars require a lot of computing power, but that power is only used when the vehicle is active. This means that these impressive computers will only be used a fraction of the time.

similar to Amazon (NASDAQ:AMZN) Web Services could sell Tesla this spare capacity and create a new and potentially sizable revenue stream. “It seems like kind of a no-brainer to say, okay, if we have millions and tens of millions of vehicles where the computers are sitting idle most of the time, maybe we can get them to do something useful,” Musk said in the Q1 earnings call, adding that Tesla could have 100 gigawatts of “useful computing power.”

Tesla’s valuation and Musk’s promises

Musk has a habit of over-promising and under-delivering. That’s why I remain bearish on Tesla. I’ve seen no evidence yet that Tesla is about to release a fully autonomous vehicle that just happens to have additional computing power that can be used and sold as part of some Tesla cloud.

This wouldn’t be a problem if Tesla’s valuation were in line with its peers. However, Tesla is currently trading around 70x forward earnings. Furthermore, analysts are clearly not convinced that growth will pick up in the medium term, with a price-to-earnings-growth ratio of 5.75x.

For now, the promise of an autonomous vehicle seems to be keeping the stock price high, despite the lack of concrete information. All eyes are therefore focused on August 8. I think the shares can tread water until then.

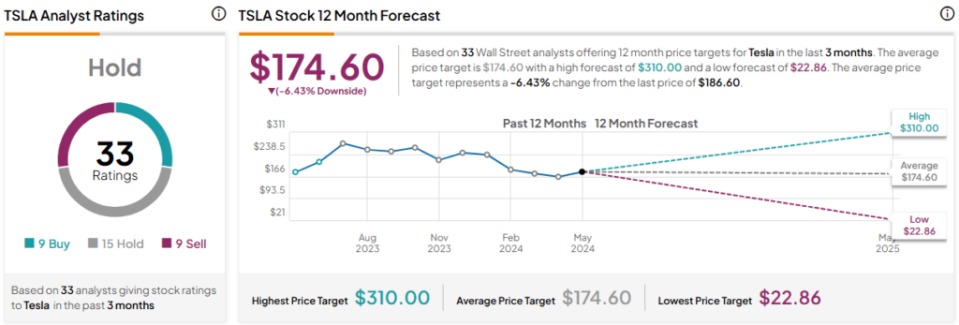

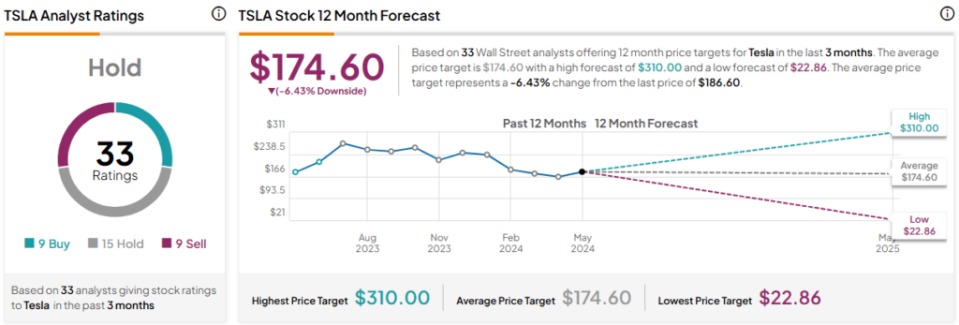

Is Tesla Stock a Buy According to Analysts?

On TipRanks, Tesla comes in as a Hold based on nine Buys, 15 Holds, and nine Sell ratings assigned by analysts over the past three months. Tesla’s average price target is $174.60, implying 6.4% downside potential.

The result of Tesla shares

Personally, I’m skeptical about whether Tesla has really made a breakthrough in autonomous vehicles. Nevertheless, I accept that Robotaxi and fully autonomous vehicles in general have enormous potential. This potential is not limited to road, but also, as Musk discussed, the ability to sell unused computing power to the rest of the market. However, at 70x future earnings, I simply can’t put my money behind Tesla.

Revelation