When a dividend stock’s yield is exceptionally high, there is usually a worrying reason behind the increase. If a dividend were considered safe, investors would buy up the high-yield stocks, causing the stock price to rise and yields to fall. When that is not When this happens, it can often be a sign that investors are not optimistic about the company’s ability to continue paying such a high dividend.

Reliance on medical properties (NYSE: MPW) currently pays its investors a dividend that yields almost 15%. That is much higher than the S&P500 average 1.4%. And that’s even after the Real Estate Investment Trust (REIT) cut its dividend payments last year.

Given the REIT’s high yield and the fact that it continues to experience issues with select tenants, should investors brace for the prospect of another dividend cut this year?

Steward Health’s bankruptcy creates a lot of uncertainty for the company

Investing in a healthcare-focused REIT may seem like a safe option for dividend seekers, but that hasn’t been the case at all for investors in the Medical Properties Trust (MPT). The company has been plagued by rent collection issues, especially at one of its largest tenants, Steward Health.

Earlier this month, Steward Health filed for bankruptcy and announced it would sell all 31 hospitals. While Steward’s move may ultimately be a positive development for MPT, there is no guarantee that the buyers will be in a solid financial position and that MPT will not continue to have problems with these hospitals. And if the process takes longer than expected, MPT may need to provide Steward with more financial assistance; it has already provided a $75 million bankruptcy loan to help its troubled tenant, and Steward may need another $225 million later.

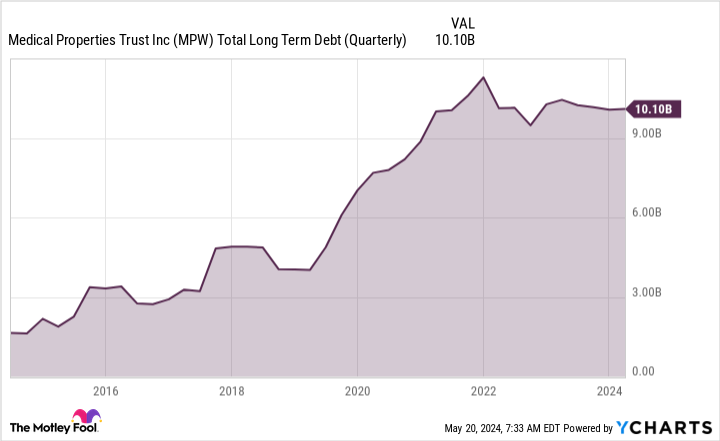

As of March 31, MPT already has a significant debt burden of $10.1 billion, which has increased over the past decade.

Is the dividend sustainable?

During the first three months of the year, MPT suffered a loss per share of $1.23 due to impairment charges, mainly due to Steward. When excluding these factors, the company’s normalized operating funds (FFO) was $0.24 per share, which is higher than the current quarterly dividend of $0.15. But that normalized FFO also fell from $0.37 in the same period last year. MPT says the decline is mainly due to a decline in Steward-related revenues.

Steward’s name is all over MPT’s financials, highlighting how important the current situation is for the healthcare company and the impact it could have on MPT.

If MPT could maintain the status quo, the dividend could likely be sustainable. But the problem is that MPT’s situation is currently uncertain and far from stable. While it’s tempting to assume that things will get better in the long term, there’s still a lot of risk for investors.

Should investors expect a dividend cut?

MPT’s high debt load and near-term uncertainty indicate that another dividend change may occur. But without knowing the outcome of the sale of Steward’s hospitals and what the future will look like, it may be difficult for MPT to estimate what payout size is manageable. There could indeed be a cut, but in the short term I suspect a dividend suspension may make more sense to give MPT more time to reassess its financial position, while freeing up some important resources.

Investors primarily look to the REIT for its dividend, but without much stability in recent years due to tenant issues, people haven’t been eager to buy the stock. Over the past three years, MPT shares have fallen 76%. And until the Steward issue is resolved, investors are probably still better off holding off on this stock, as it remains a very risky investment.

Should You Invest $1,000 in Medical Properties Trust Now?

Consider the following before purchasing shares in Medical Properties Trust:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $581,764!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Will there be another dividend cut for the medical property trust? was originally published by The Motley Fool