Chipotle Mexican Grill (NYSE:CMG) owns and operates more than 3,400 Mexican restaurants in five different countries. Investors lifted their shares to 67x earnings, praising the company’s growth, drive-throughs, recession-proof demand and balance sheet. However, at current interest rates, Chipotle’s valuation is a market anomaly. Treasury yields far exceed Chipotle’s earnings yield, even far into the future. That’s why I’m bearish on Chipotle stock.

Why Chipotle’s valuation makes no sense

Warren Buffett once said, “Interest rates are to asset prices… as gravity is to the apple. They are the driving force behind everything in the economic universe.”

So what did Buffett mean? Well, in the financial world there is such a thing as the ‘risk-free rate’. The premise is simple: If you can get 5% on a risk-free asset like a U.S. Treasury bond, that should be the minimum required return on a riskier, less certain asset like a stock. In addition, you must have a ‘risk premium’ that compensates for the additional risk.

Over the past 150 years, the 10-year Treasury bond has returned an average of about 5%, which is slightly higher than where we are today. Over the same time frame, the average price-to-earnings ratio of the S&P 500 was 15x, yielding an earnings yield plus growth of 6.66%. This resulted in a compound annual return of about 9.2% for the S&P 500 (over a 150-year period), meaning that the average equity risk premium over that period was about 4.2%.

The problem is that Chipotle has the opposite of a risk premium, which makes it look extremely overvalued. For example, based on analyst earnings estimates, Chipotle has price-to-earnings ratios of 57x in 2024, 48x in 2025, 40x in 2026, 33x in 2027 and 28x in 2028. This translates into earnings yields of 1.75%, 2.08%, 2.50. %, 3.03% and 3.57%. These earnings yields are nowhere near the 5.21% you can get on one-year government bonds, or the 4.59% you can get on five-year government bonds.

Even if Chipotle meets analysts’ high growth expectations (and I don’t believe it will) and then trades at a price-to-earnings ratio of 30x 2028 earnings, you’d earn a total return of less than 2% per year. , which translates into a negative equity risk premium. This is a market anomaly. But as Buffett said, gravity should win out in the end.

If the market decides to revalue Chipotle at a lower price-to-earnings ratio, say 35x current earnings (yielding an earnings yield of 2.86% plus growth), the stock price would fall by almost 50%. A price-to-earnings ratio of 35x may seem low now, but it is still significantly above that of Starbucks (NYSE:SBUX) and McDonald’s (NYSE:MCD) currently trading. Chipotle traded at a price-to-earnings ratio of about 25x between 2008 and 2010, when a much bigger growth opportunity was on the horizon.

Chipotle’s growth will slow

Chipotle’s revenues have grown at a blistering pace over the past five years. From 2018 to 2023, the company’s earnings per share grew at a compound annual rate of 47.7%. This was partly due to the company improving its return on assets. In other words, Chipotle earned too little in 2018, with a return on assets of just 7.79%.

Meanwhile, companies with similar business models, such as McDonald’s and Starbucks, achieved a return on assets of 18% in 2018 (more than double the return at Chipotle). Chipotle’s weak returns between 2016 and 2020 were likely due to foodborne illness and legal issues that tarnished the company’s reputation and hurt its bottom line. However, Chipotle’s customers have returned in droves and the company has improved returns thanks to its loyalty program, expansion and drive-throughs.

Fast forward to 2023, Chipotle doubled its return on assets to 15.41%, in line with other owner-operated chains. For example, Starbucks and McDonald’s also have returns on assets of 14 to 16%, which is high compared to the historical industry average.

All of this means that growth at Chipotle is likely to slow. For example, Chipotle’s average 10-year EPS CAGR was much lower, at 15.5%. I expect that the company’s growth could be even lower than this rate in the future. Last year, Chipotle’s restaurant count grew just 8%. The company also relies on buybacks, which won’t be effective at 67x earnings. In addition, there is a risk that management will fail to deliver results.

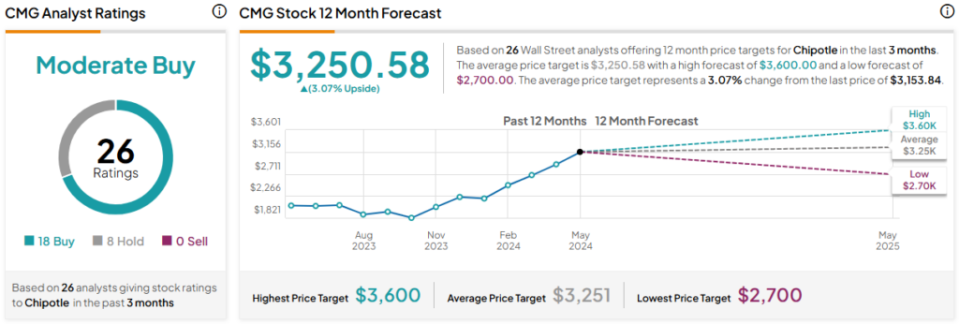

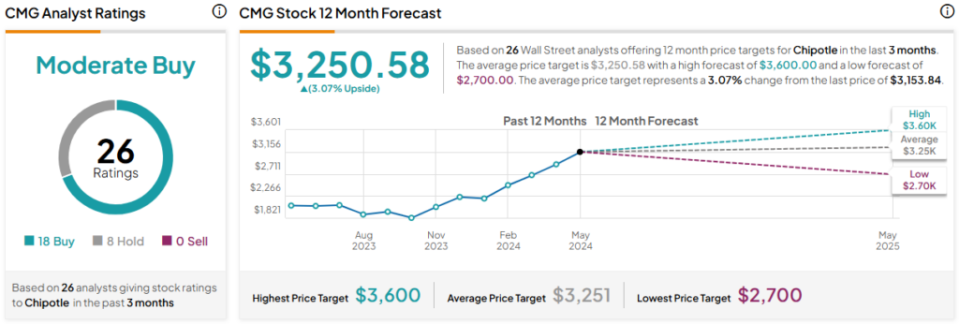

Is CMG Stock a Buy According to Analysts?

Currently, 18 of the 26 analysts covering CMG give it a buy rating; eight rate it a Hold, and zero analysts rate it a Sell, resulting in a consensus rating of Moderate Buy. Chipotle Mexican Grill’s average stock price target is $3,250.58, implying 3.1% upside potential. Analysts’ price targets range from a low of $2,700 per share to a high of $3,600 per share.

The result of CMG shares

Interest rates would probably have to be closer to 0% for Chipotle’s valuation to make sense. The stock appears to have a very negative equity risk premium. Should Chipotle’s price-to-earnings ratio fall from 67x to a more appropriate multiple of 35x based on current earnings, the stock could crash by almost 50%.

Meanwhile, I think Chipotle’s earnings growth will slow to less than the 10-year average of 15.5% in the coming years. It grew at a blistering pace over the past five years, partly because returns on assets doubled. Now that I’m comparable to McDonald’s and Starbucks in this regard (and historically on the high side), I think this tailwind has disappeared. Furthermore, buybacks at this level are unlikely to be effective, and the company’s store count grew just 8% last year.

Revelation