There’s a battle underway in an under-explored part of the artificial intelligence (AI) industry: chip design software. Several merger and acquisition deals have been announced and a mega-merger is in the pipeline between the leader in electronic design automation (EDA). Synopsis (NASDAQ: SNPS) And Ansys (NASDAQ: ANSS). Shortly afterwards it was announced that the second EDA software suite, Cadence Design Systems (NASDAQ: CDNS)unveiled its new supercomputer platform for simulating electronic systems.

I don’t want to be left behind, the Japanese chip manufacturer Renesas (OTC: RNECY) announced its intention to acquire a smaller EDA software vendor Altium (OTC: ALMF.F). Is something big about to happen in the AI market?

Renesas is looking for a software boost

Renesas is an integrated device manufacturer, a company that designs and manufactures semiconductors. It is a hybrid business model that has been making a comeback in recent years. In addition to Japan emerging as a top manufacturing destination in the East, Renesas can thank the electric vehicle (EV) revolution for its resurgence, as well as a host of other, more mature manufacturing processes (no advanced chips for things like data center AI) for chips in industrial and energy applications.

In addition to some other smaller acquisitions to strengthen its power chip portfolio, I wrote about the deal with Renesas last year Wolf speed (NYSE: WOLF) to purchase silicon carbide (SiC) wafers for use in next-generation applications such as EV motors.

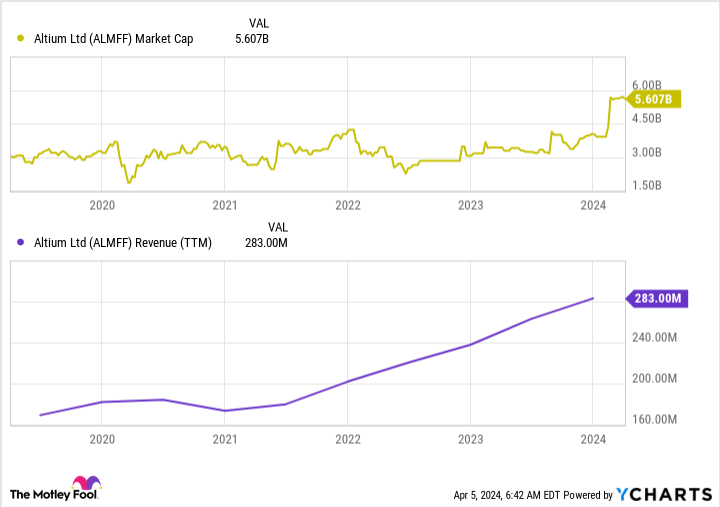

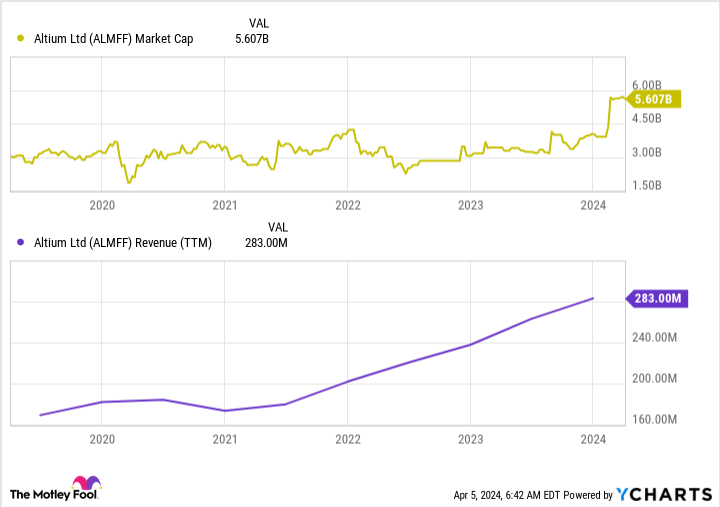

But the purchase of Altium, a small competitor to EDA software giants Synopsys and Cadence, is something else entirely. Australia-based Altium (which Wolfspeed notably counts as a chip design customer) generated revenue of just $139 million in U.S. dollars in the first half of the current fiscal year 2024. And yet Renesas will pay out $9.1 billion ($6 billion in U.S. dollars, based on April 5, 2024 exchange rates). That is a significant price premium.

Renesas’ rationale is to increase the software and digital tool capabilities it offers its customers, as many of those customers (automakers, for example) are non-techies who may need help implementing next-generation electronics.

Will there be a big wave of AI?

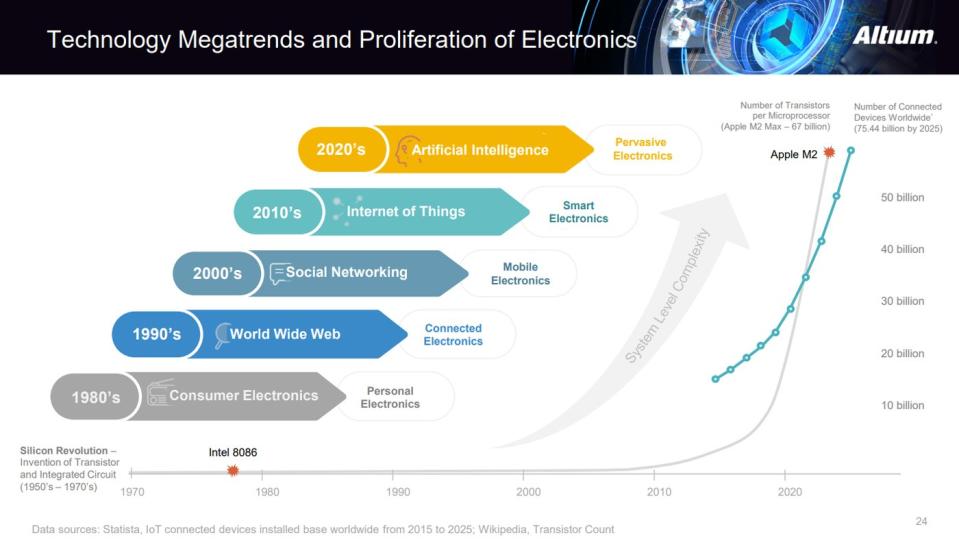

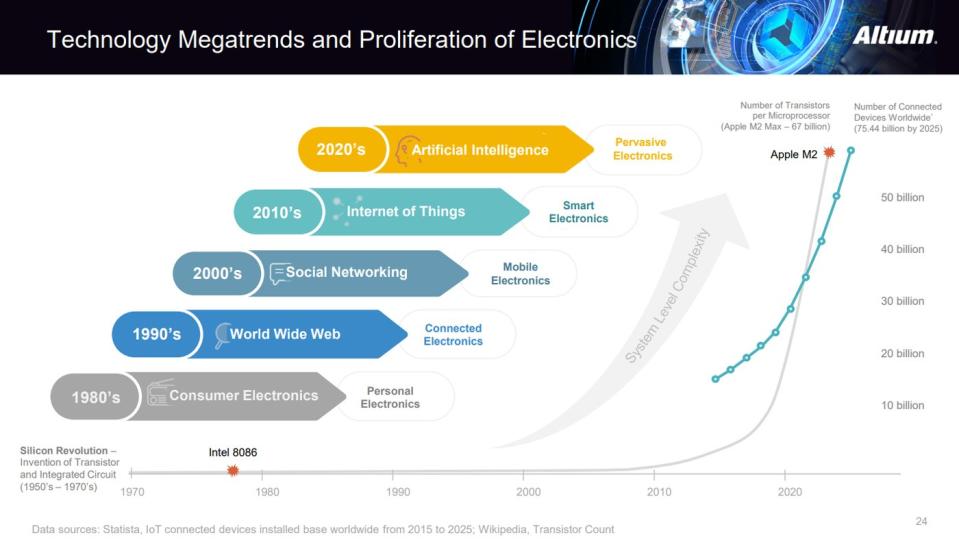

From now, Nvidia‘S (NASDAQ: NVDA) AI systems in data centers are extremely popular because companies want to use their data to ‘train’ new AI systems. But in the next decade, all these AI systems will have to disappear somewhere so users can benefit from their creation.

That’s likely where Renesas sees huge opportunity by buying Altium and competing with Synopsys and Cadence in electronic systems design. Semiconductor manufacturers have a path to sustainable growth thanks to customer interest in embedding intelligent computing systems into a broad ecosystem of devices, from automobiles to automated factory equipment to smart home devices.

All that new AI embedded in the devices themselves, rather than in data centers, will require much more advanced hardware. It will also need more power-efficient hardware, like the type Renesas has been working on (again, with the Wolfspeed deal). Renesas could secure a seat at the table for years to come by combining not just the chips, but also the software, to make those AI devices a reality.

Renesas could be a hidden growth stock in the AI race. The shares trade around 13 times trailing trailing 12-month earnings and free cash flow, a potential buy if the company can continue to build an edge in its manufacturing and design businesses for automotive semiconductors, industrial equipment and consumer electronics.

Should You Invest $1,000 in Renesas Electronics Now?

Please consider the following before purchasing shares in Renesas Electronics:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Renesas Electronics wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 4, 2024

Nicholas Rossolillo and his clients have positions at Cadence Design Systems, Nvidia and Synopsys. The Motley Fool holds positions in and recommends Altium, Cadence Design Systems, Nvidia, Synopsys, and Wolfspeed. The Motley Fool recommends Ansys. The Motley Fool has a disclosure policy.

1 Chip Manufacturing Stock Making a Big Bet on AI was originally published by The Motley Fool