Agree Real Estate (NYSE:ADC) is a large net-lease real estate investment trust (REIT) with a dividend yield of 4.9%. For reference, that’s well above the 1.3% you’d get from the S&P500 index and the 4.1% of the average REIT, using the Vanguard Real Estate Index ETF (NYSEMKT: VNQ) as a sector proxy. There’s a good reason for Agree’s high yield, but there’s also a long-term growth story with plenty of room to run.

Agree Realty likes simple black boxes

Agree Realty focuses on single-tenant retail properties located in the United States. These assets are generally quite similar, making them relatively easy to buy and sell. It is also relatively easy to replace a tenant if there are vacancies. And there is a large market for retail real estate in the United States, so the property type is also fairly liquid. While it is true that each location carries a high risk because it is occupied by only one tenant, Agree owns more than 2,100 properties. That’s enough diversification to offset the risk of individual properties.

Adding the net lease structure to the picture makes Agree’s business model even more attractive. That’s because the REIT’s tenants are responsible for most of the operating costs at the property level. While this is a huge simplification, Agree essentially just has to sit back and collect the rent while focusing most of his efforts on finding new properties to buy. Agree, of course, it is not the only company using this model, but it has grown relatively quickly over the past decade.

To put a figure on that: Agree’s dividend has been increased annually for about ten years. That said, funding was cut in 2011, following the Great Recession, due to the bankruptcy of a key tenant. But at the time, Agree owned fewer than 100 properties, making it a very different company. More important on the dividend front is the growth that Agree has achieved, with the annualized dividend increase over the past ten years being almost 6%. That may not sound like a huge number, but for a net lease REIT, it’s quite attractive.

Why are investors gloomy about Agree Realty?

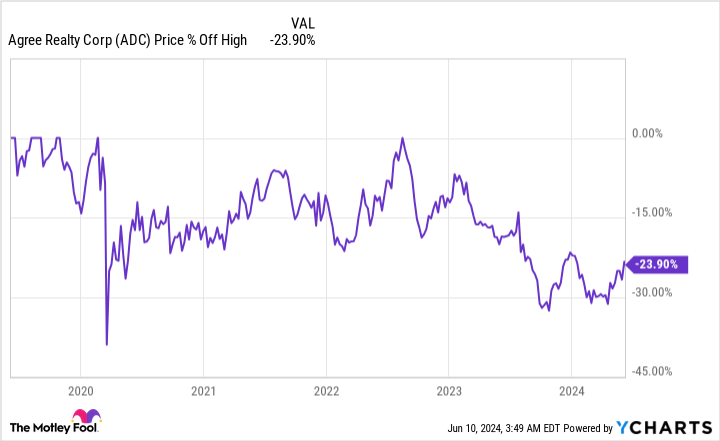

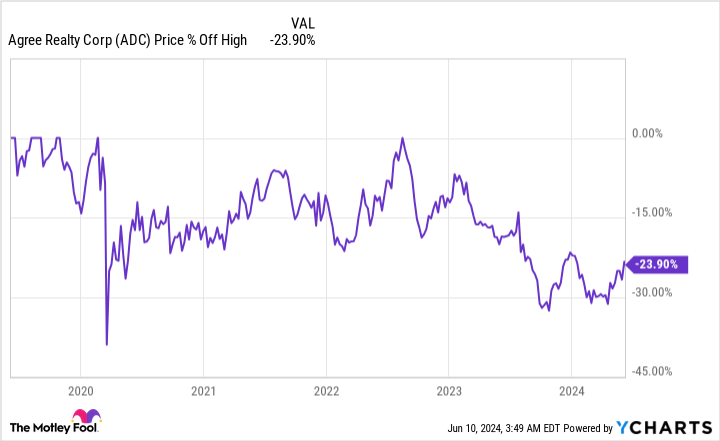

The backstory with Agree is pretty good. So why is the REIT’s share price down about 20% from its 2022 highs? Before we get to an explanation, it’s worth highlighting that the price drop has pushed Agree’s dividend yield up to 4.9%, which is the high end of the yield range over the past decade. It looks like the stocks are on sale.

The good news is that the problem isn’t really with Agree. The problem is that interest rates have risen dramatically. That raises costs for REITs, which typically rely heavily on debt to finance real estate purchases. Don’t follow the crowd on Wall Street or get upset: real estate markets adjust to interest rate changes. It just takes time. If you think in terms of decades and not days or weeks, Agree should probably be on your wish list if dividend growth is your focus.

Agree, it’s not dead money

Although Agree faces a tougher business environment, it still acquired 31 properties and completed two development projects in the first quarter of 2024. There are also 14 development projects in the works. In other words, Agree is still finding ways to grow. So not only are you buying a REIT that appears to be on sale, you’re also receiving an attractive dividend yield from a still emerging net leasing company.

When the real estate market rebalances, Wall Street will likely start to realize what is likely to be a very long runway for growth here. Note that the largest company in the industry owns more than 15,000 properties.

Should You Invest $1,000 in Agree Realty Now?

Consider the following before purchasing shares in Agree Realty:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Agree Realty wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

1 Magnificent Dividend Stock Down 20% to Buy and Hold Forever was originally published by The Motley Fool