2024 was a testament to the resilience of stocks. Despite concerns about persistent inflation, rising Treasury yields and the Federal Reserve’s rate-cutting plans, the S&P500 has achieved a commendable 7.4% this year. However, this situation has created a kind of cognitive dissonance. On balance, shares have become expensive in relation to corporate profits.

For example, the S&P 500 is currently trading at 24 times earnings, well above its 10-year average of around 20. The key takeaway is that stocks may be primed for a pullback due to the combination of high valuations against a backdrop of cooling economic activity and persistent inflation.

While this remains speculative, smart investors know that being prepared is critical to taking advantage of market opportunities when they arise. If the market does indeed slump in response to these headwinds, one supercharged Vanguard exchange-traded fund (ETF) stands out as the go-to play: the Vanguard S&P 500 Growth Index Fund ETF Shares (NYSEMKT: VOOG). Read on for more information.

GUARDIAN: A lot better than the rest

The VOOG distinguishes itself with the following standards:

-

Expense ratio: 0.10%

-

Dividend yield: 0.87%

-

Average return over 10 years: 14.4%

-

Number of shares held: 228

-

Average annual profit growth: 18.6%

-

Price-earnings ratio: 35

These figures demonstrate not only VOOG’s cost-effectiveness and growth potential, but also its ability to provide a stable revenue stream.

Compared to its main counterpart, the Vanguard S&P 500 ETF (NYSEMKT: VOO)De VOOG distinguishes itself for two important reasons:

-

Targeted growth: VOOG focuses specifically on the growth segment of the S&P 500. It is poised to capitalize on key trends such as artificial intelligence, weight loss drugs, and next-generation software innovations. The VOO, on the other hand, offers exposure to the entire S&P 500, a broad index that includes companies with varying levels of earnings growth.

-

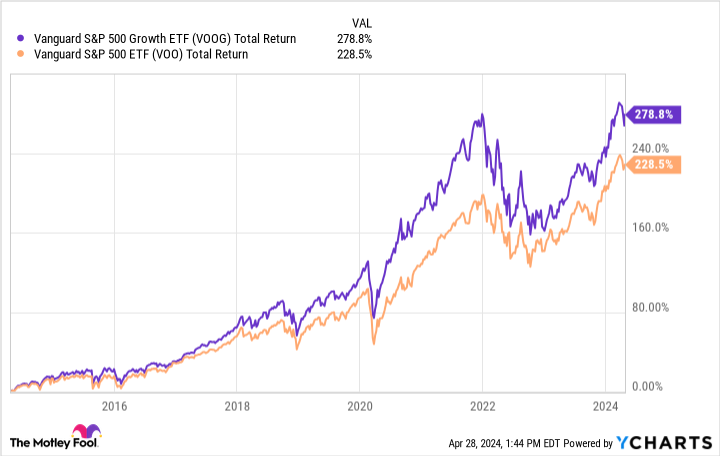

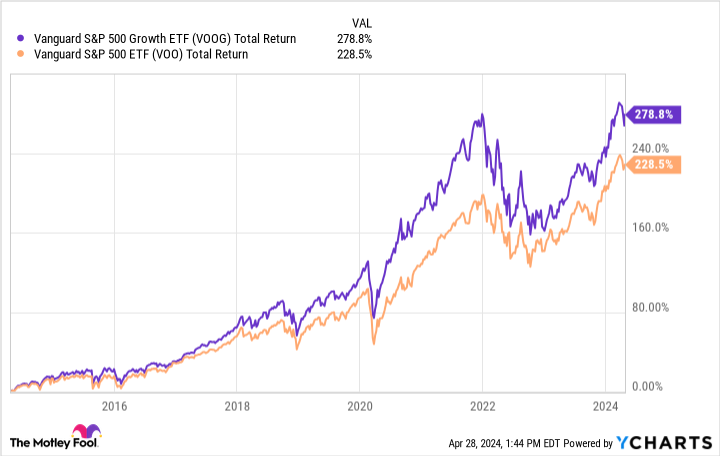

Appreciation and performance: VOOG’s strong price-to-earnings ratio reflects a premium to growth, justified by the robust earnings growth of the holding companies. Over the past decade, VOOG has significantly outperformed VOO, making it an attractive option for investors looking for unusual levels of growth over long periods of time.

Key learning points

When we look at the investment landscape of 2024, two important things become clear:

-

Preparing for Volatility: Current market conditions underscore the need for investors to be prepared for volatility. VOOG’s strong performance history and focus on growth-oriented stocks make it an attractive option for those looking to benefit from a sharp decline in the coming months.

-

Strategic investment choiceVOOG’s competitive expense ratio, solid dividend yield and impressive growth rates position it as a top strategic choice for price-conscious investors who demand top performance. The focus on the growth segment of the S&P 500 makes it a more attractive buy than many comparable passively managed large-cap growth funds such as VOO.

In conclusion, VOOG offers a unique combination of earnings growth, low costs, decent returns and excellent long-term performance, making it a top watchlist candidate ahead of a potential market correction. In other words, this Vanguard ETF should be at the top of your “to buy” list when the market reverts to the mean later this year.

Should You Invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF Now?

Consider the following before buying shares in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 22, 2024

George Budwell holds positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

1 No-Brainer Vanguard Growth Fund to Buy Into a Market Correction was originally published by The Motley Fool