Artificial intelligence (AI) is by no means a new technology. The term was first coined by mathematician and computer scientist Alan Turing in 1950. Since then, the generative technology has been around in one form or another for decades. However, it is only recently that technological advancements have made it possible for companies to bring the true concept of AI into reality.

The launch of OpenAI’s ChatGPT in November 2022 breathed new life into the industry and forced many to rethink what they thought was currently possible with AI. As a result, interest has surged as tech companies have rushed to get in on the ground floor. Nasdaq Composite The index has risen 68% since the start of 2023, largely due to enthusiasm for AI.

However, macroeconomic concerns have led to a decline in the market over the past month, sending the same index down by around 4%. However, recent declines are likely temporary, as many tech giants are still generating solid financial gains from their respective AI offerings. As a result, this could be an excellent time to invest in the market before it’s too late.

Here are two AI stocks to buy after a tech market sell-off.

1. Advanced micro devices

Advanced micro devices (NASDAQ: AMD) Shares have fallen about 1% since the start of 2024, driven by a challenging start to the year as it faced stiff competition from Nvidia and a general retreat from tech investors. However, recent declines have boosted the stock’s value, making it a no-brainer investment for those in it for the long haul.

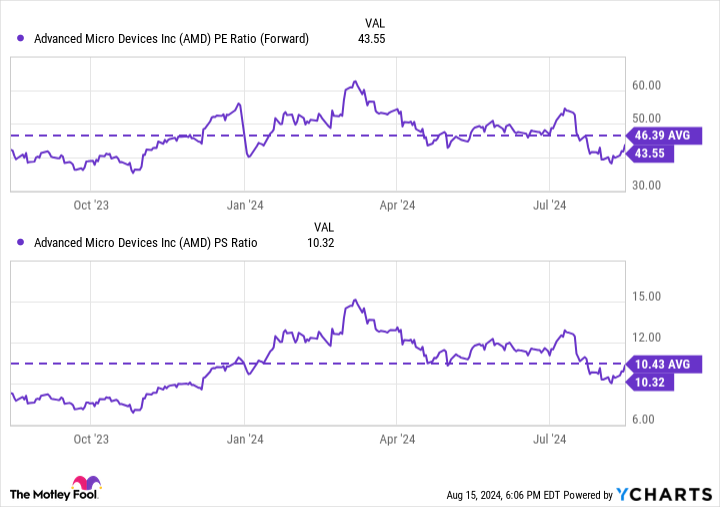

This chart shows that AMD’s forward price-to-earnings (P/E) and price-to-sales ratios are below their 12-month averages. The numbers indicate that AMD is trading at one of its best values in months, making this an excellent time to invest in its AI potential.

Since the beginning of last year, AMD has unveiled a series of new AI products as it attempts to catch up with market leader Nvidia. On June 3, CEO Lisa Su said of the company’s ambitions: “AI is our highest priority, and we’re at the beginning of an incredibly exciting time.”

During the same keynote at the Computex conference in Taipei, the company debuted its Ryzen AI 300 series of central processing units (CPUs) for laptops and its Ryzen 9000 CPUs for desktops. AMD also revealed its datacenter chip roadmap, announcing its Instinct MI325X AI accelerators, due in the first quarter of 2024, the MI350 series for 2025, and the MI400 for 2026.

Meanwhile, AMD is already making promising progress in the AI space, illustrated by 115% revenue growth in its data center segment in Q2 2024. The company has attracted prominent names to its roster of AI chip customers, including Amazon, MicrosoftAnd Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)which strengthens its position in the sector.

AMD is on track for promising growth, making the stock a logical choice after a sell-off.

2. Alphabet

Alphabet shares are up 23% year-over-year but have fallen 13% in the past month. The company has been mired in a market downturn that has hit dozens of tech stocks. Still, Alphabet remains an industry giant with a growing role in AI, making its stock an attractive investment.

The tech giant has its hands full with the job, holding the third-largest market share in cloud computing behind Amazon Web Services and Microsoft’s Azure. But Alphabet has made impressive strides in the past year, adding a raft of new AI tools to Google Cloud that has helped it outpace its peers in terms of growth.

In Q2 2024, Alphabet posted 13% year-over-year revenue growth, driven largely by a 29% spike in Google Cloud sales. Meanwhile, Google Cloud’s operating profit nearly tripled to more than $1 billion for the first time. For reference, AWS and Azure revenue both rose 19% year-over-year in the same quarter.

In addition to cloud computing, Alphabet is leveraging its Pixel smartphone brand to bolster its position in AI. The company unveiled the Pixel 9 on August 13, debuting it alongside a new Gemini-powered AI smart assistant. Gemini AI uses Alphabet’s large language model (LLM) to bring new generative image, text and speech features to Pixel 9 users. The announcement came ahead of Apple‘s iPhone event in September, where a slew of new AI features are also expected to be announced for the 2024 smartphone lineup.

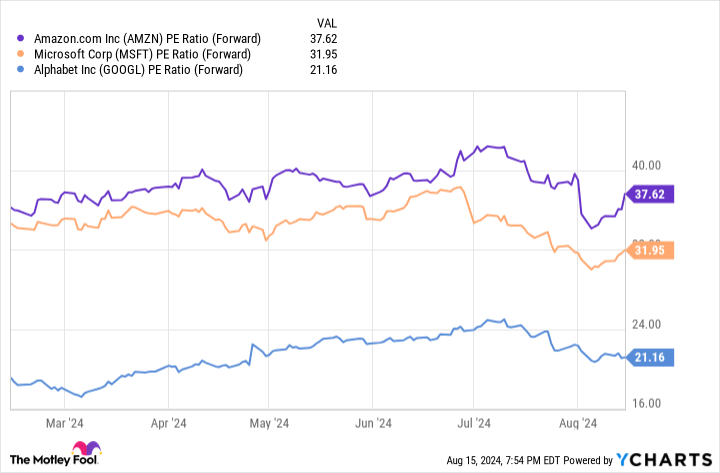

Alphabet’s stock is trading at a bargain price after a sell-off. The chart above shows that its forward price-to-earnings ratio is significantly lower than Microsoft or Amazon, indicating that Alphabet is one of the best-valued AI cloud stocks on the market.

Besides impressive growth in AI and a powerful brand, Alphabet’s stock price is too good to ignore right now.

Should You Invest $1,000 in Advanced Micro Devices Now?

Before you buy Advanced Micro Devices stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $796,586!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks to Buy After Tech Market Sell-Off was originally published by The Motley Fool