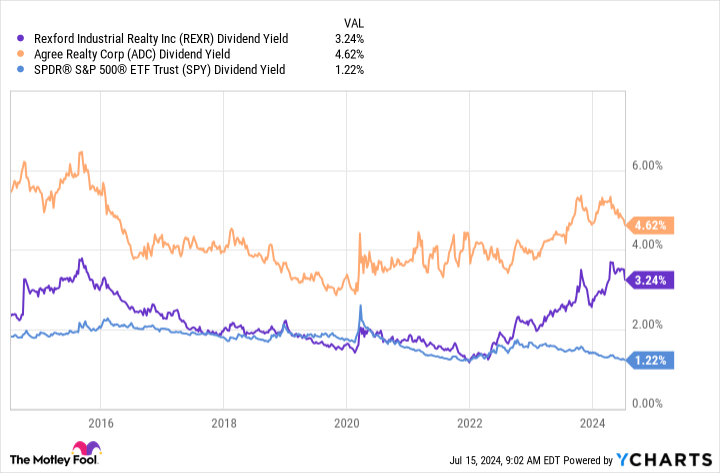

The problem with dividend growth stocks is that investors often give them a premium valuation. Given the dividend yield equation, that essentially translates into a lower yield. However, the stock market is near record highs right now, so the yield on the S&P 500 is disappointingly hovering at just under 1.3%. You can do much better with dividend growers like Agreement Realty (NYSE: ADC) And Rexford Industrial (NYSE: REXR)Here’s what you need to know about these high-yielding dividend growth stocks.

Agree Realty is expanding rapidly

The past decade or so has been one of big changes for Agree Realty. The net-lease real estate investment trust (REIT) cut its dividend in 2011. At the time, the company was small, with fewer than 100 properties, and the bankruptcy of a single major tenant left the company with no choice but to cut the payout. Agree is no longer such a small company.

In just over a decade, it has grown its portfolio to 2,150 properties. Along with that portfolio growth has come dividend growth, averaging nearly 6% annual growth over the past 10 years. That’s about twice the historical rate of inflation and significantly higher than some of the biggest names in the net-lease REIT niche. Now add to that an attractive 4.6% dividend yield.

To be fair, it’s a lot easier to grow a business when it owns 100 properties than when it owns 2,000+. So maybe Agree’s growth slows from here. But it’s focused on the retail sector, leasing single-tenant buildings to occupiers willing to pay most of the operating costs at the property level (which requires a net lease). This is a very liquid and large market to play in, and there’s no reason to think Agree can’t continue to grow, even at a high rate, in the future. And its returns look historically high, too.

Rexford is super focused, but in a very good market

Rexford Industrial is a very different REIT. For starters, as the name suggests, it invests in industrial properties. But there’s another small difference that’s important. Agree has a geographically diversified portfolio, while Rexford focuses exclusively on owning industrial properties in Southern California. From that perspective, it seems like a pretty risky stock.

Southern California, however, is one of the largest industrial markets in the world, let alone the U.S. It’s a major shipping hub for products from Asia. It also suffers from chronic supply constraints, with older properties often being converted to residential. And there are strict regulations that make it difficult to build new industrial properties, even if someone wanted to. If you had to pick just one region to invest in industrial properties, it would probably be the one Rexford chose.

That has led to very rapid expansion, with the best indication being the massive annual dividend growth of nearly 17% over the past decade. The yield is about 3.2%, but that’s still more than twice the level of the S&P 500 index. And given the shockingly rapid dividend growth, a premium valuation relative to other REITs seems justified.

What about future earnings? Rexford has several levers to pull. First, it has been able to significantly increase rents as leases expire. Second, it has acquired assets. Third, it has a long history of redevelopment, which increases the rent it can charge for a property. Management believes it can increase its net operating income by 47% by 2027 with just the assets it currently has in its portfolio. If it can get anywhere near that figure, it is highly likely that dividend growth will continue to be impressive.

Act now while the opportunity still exists

So why would strong dividend growth stocks like Agree and Rexford have historically high yields? The answer is that investors rushed to exit REITs as interest rates rose, a change that increases costs for property owners. But real estate markets have historically adjusted to higher rates over time and will likely do so again. That means long-term dividend growth investors appear to have a unique opportunity to add higher-yielding dividend growth stocks to their portfolios if they act quickly with Agree and Rexford.

Should You Invest $1,000 In Agree Realty Now?

Before you buy Agree Realty stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Agree Realty wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $787,026!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 15, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Rexford Industrial Realty. The Motley Fool has a disclosure policy.

2 Incredibly Cheap, High Yield Dividend Growth Stocks You Can Buy Now was originally published by The Motley Fool