There are plenty of ways to generate passive income, from risk-free assets to bonds and rental property income. But one of the easiest and most effective ways to generate income is by investing in dividend stocks, generating passive income without having to sell assets, while also allowing you to participate in the stock market.

Finding a company that can grow in value while paying dividends is a dream come true for long-term investors. And that’s exactly what Microsoft (NASDAQ: MSFT) And Air products and chemicals (NYSE: APD) Are.

Meanwhile, the JP Morgan Equity Premium Income ETF (NYSEMKT: JEPI) yields as much as 7.6% and includes exposure to top companies from Amazon Unpleasant ExxonMobil. Here’s what makes Microsoft, Air Products, and the JP Morgan Equity Premium Income ETF worth buying now.

Microsoft’s dividend is part of an impeccable investment thesis

Daniel Foelber (Microsoft): Microsoft’s dividend yield of just 0.7% is the result of its highly performing share price, not a lack of increases. Over the past five years, the stock is up 223%, but the dividend is up 63%. Zooming out over the past ten years, Microsoft is up a whopping 906%, while its dividend is up 168%.

Given the stock’s strong performance, Microsoft investors certainly don’t mind low interest rates. But investors who don’t own Microsoft and are considering buying the stock may wonder why the 0.7% yield is worth it, let alone a reason for a lifetime of passive income.

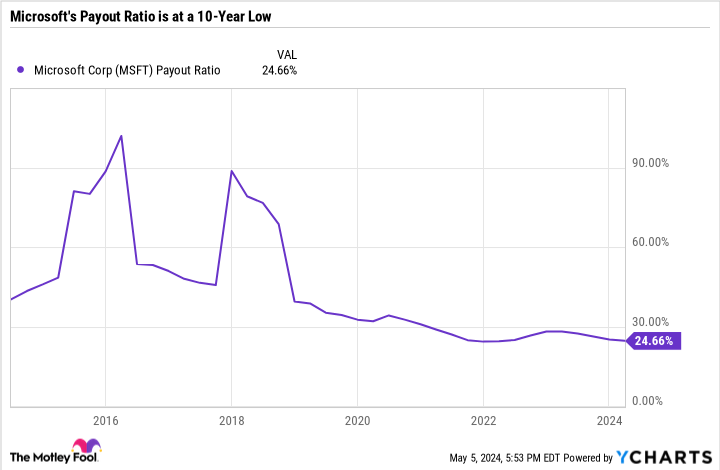

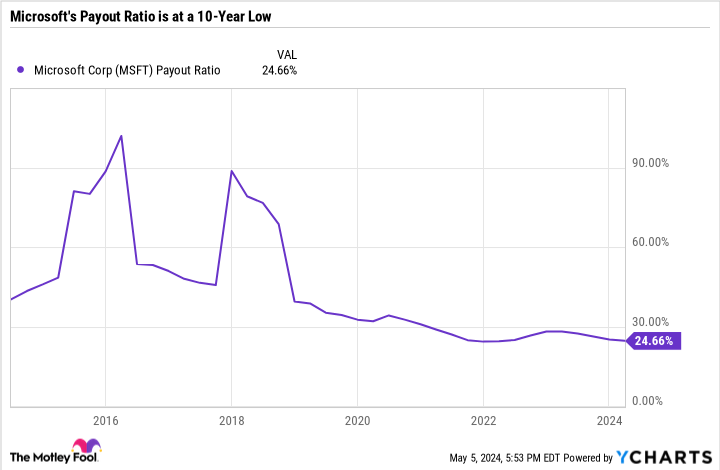

The reason for this is that Microsoft can easily afford to make a significant increase in the dividend every year. Earnings have grown faster than dividend increases. That’s why the payout ratio is now at a ten-year low of less than 25%.

A payout ratio under 75% is good for a reliable company, but under 50% is even better if a company has cyclical profits. Part of the reason for Microsoft’s low payout ratio is that it rewards its shareholders with share buybacks and dividends. Microsoft has reduced its share count despite significant stock-based compensation costs. Buybacks are an important means of preventing dilution, and we can expect the number of buybacks to continue to accelerate in the coming years and the number of shares outstanding to decline significantly.

If Microsoft continues to outperform the S&P500, then the dividend will just be a cherry on top of a winning position. But if Microsoft languishes, expect returns to rise noticeably thanks to strong dividend growth and room to increase the payout ratio if necessary. Either way, Microsoft has what it takes to reward shareholders.

Air Products is a reliable stock that can deliver dividends for decades

Scott Levine (Air Products): It may be impossible to look into the future and see which stocks will provide investors with passive income for years to come, but it’s certainly helpful to turn your attention to the past. With a peak in a company’s past performance, you can gain insight into how strong a candidate is to return capital to shareholders for years to come. Air Products is an excellent option.

Over its 80 years of existence, Air Products has emerged as a leading supplier of industrial gases and related equipment to companies operating in a variety of industries, including energy, aerospace and healthcare, to name a few. to name. For forward-looking investors, now is a good time to take advantage of Air Products stock, which currently has a 2.9% dividend on the market and is hanging on the discount rack.

By growing its dividend for 42 consecutive years, Air Products has demonstrated a steadfast commitment to rewarding shareholders. Turning to the more recent past, it’s worth noting the company’s commitment to payout. From 2014 through 2024, Air Products has increased its dividend at a compound annual growth rate of 9%, while delivering an average payout ratio of 62.3% over the past ten years.

Because the company serves a wide range of industries, it is unlikely that a recession in any of these sectors would wreak havoc on the company’s financials, putting its dividend at risk. Moreover, the company has a strong competitive advantage. With more than 750 manufacturing facilities and more than 2,000 miles of industrial gas pipelines, Air Products has developed a robust infrastructure that can be easily disrupted by early-stage industrial gas companies. Add to this the company’s leading position as a hydrogen supplier, and Air Products’ appeal becomes even clearer.

With Air Products shares valued at around 15.2 times operating cash flow – a discount to their five-year average cash flow of 17.4 – this now looks like a great opportunity to gain a position in this industrial gas power plant.

This ETF’s 7.6% yield is attractive to investors looking for income

Lee Samaha (JP Morgan Equity Premium Income ETF): If you’re looking for a monthly income ETF with equity exposure and a strategy to generate relatively low returns compared to the S&P 500 index, this ETF may be for you. I’ve discussed it in more detail as an ETF to buy elsewhere, but for the sake of brevity I’ll go over the key points here.

In short, the ETF invests a minimum of 80% of its assets in actively managed US equities and a maximum of 20% in a strategy that sells call options on the S&P 500 index. A call option on the index is the right to buy the index at a certain price, the strike price, until a certain expiration date. Investors in call options must pay a premium for that right.

So when this ETF sells a call option, it tries to capture the premium of the index not rise above the strike price, so investors do not realize this option. You could summarize the strategy as follows:

-

When the S&P 500 rises sharply this month, the ETF will lose money from selling call options but make money from its equity exposure.

-

If the S&P 500 falls sharply this month, the ETF will likely lose money on its equity exposure but make money by increasing premiums.

-

In low volatility months, the ETF should make money by collecting premiums and can make or lose money on stocks.

The ETF’s total return (generated by reinvesting dividends) since its launch in 2020 is a whopping 59.2%, and the maximum withdrawal in a month was 6.4% in September 2020. Overall, it has a good record, and the monthly income will suit investors who are looking to live on passive income.

Where you can invest $1,000 now

If our analyst team has a stock tip, it could be worth listening to. The newsletter they have been publishing for twenty years, Motley Fool stock advisorhas more than tripled the market.*

They just revealed what they think are the 10 best stocks for investors to buy now… and Microsoft made the list – but there are nine other stocks you might be overlooking.

View the 10 stocks

*Stock Advisor returns May 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

3 Dividend Stocks That Are Coil Springs for a Lifetime of Passive Income, originally published by The Motley Fool